Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn’t throw in the towel in a whimpering surrender to superior force. Instead, he used...

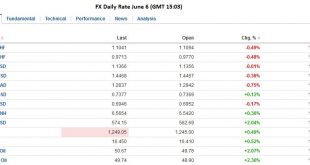

Read More »FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery...

Read More »Economy “Improves”, Americans Get Poorer

Cartoon by Bob Rich No Surprises BALTIMORE – We were not surprised by the big news last week. We saw it coming. Figures from the Conference Board research group revealed productivity sinking for the first time in three decades. We promised to explain why it was such a big deal. Rate hike fantasies have been a recurring theme since 2009. Given that the market for federal funds is dead as a doornail (banks continue to hold huge excess reserves with the Fed and therefore have no need to...

Read More »FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday’s ranges while sterling and the Canadian dollar pushing through yesterday’s lows. Source Dukascopy Asian shares were mostly higher, though Chinese markets closed with slight losses. The MSCI Asia-Pacific Index rose (~0.7%) for a third session and secured a 2% gain for the week. European bourses are seeing some profit-taking...

Read More »FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step...

Read More »FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

The US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable that it begins recovering first. Its recent resilience was noted, but that has evaporated today, but a 0.8% drop by early European activity. We had noted the divergence between what...

Read More »Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted confidence that the US economy is rebounding in Q2 after a six-month slow patch. The average of the Atlanta Fed (2.8%) and NY Fed GDP trackers (1.2%) is...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More »Risks to Global Economy Abound in 2016

The global economy struggled through a difficult year in 2015, leaving a range of challenges for policymakers hoping to avoid a third leg of the financial crisis, panelists at the Credit Suisse 2016 Asian Investment Conference (AIC) said. The Federal Reserve’s moderation in monetary tightening is crucial to sustaining fragile global economic growth in 2016, while structural reforms in China, India, and other countries are essential if struggling emerging economies are to regain their...

Read More »Japan Stocks Plunge; Europe, U.S. Futures, Oil Lower Ahead Of Payrolls

For Japan, the post "Shanghai Summit" world is turning ugly, fast, because as a result of the sliding dollar, a key demand of China which has been delighted by the recent dovish words and actions of Janet Yellen, both Japan's and Europe's stock markets have been sacrificed at the whims of their suddenly soaring currencies. Which is why when Japanese stocks tumbled the most in 7 weeks, sinking 3.5%, to a one month low of 16,164 (after the Yen continued strengthening and the Tankan confidence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org