I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his administration, the Wall Street Journal reports yesterday she is a top contender to remain at her post for a second term. The President reportedly believes she is doing a “good job” and “has a lot of respect for her.” Maybe he does and maybe he doesn’t, but he’s not any longer going to say publicly

Topics:

Jeffrey P. Snider considers the following as important: Ben Bernanke, CPI, currencies, economy, Eurozone Gross Domestic Product, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, Inflation target, interest rate targeting, Janet Yellen, Markets, missing money, Monetary Policy, Money Supply, newsletter, pce deflator, stephen goldfeld, The United States, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook.

On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his administration, the Wall Street Journal reports yesterday she is a top contender to remain at her post for a second term. The President reportedly believes she is doing a “good job” and “has a lot of respect for her.” Maybe he does and maybe he doesn’t, but he’s not any longer going to say publicly anything else. It’s a violation, though, of the spirit of “reflation” that started on the premise of different. Markets, I believe, want Trump to trash Yellen and everything she stands for; because what she stands for is more of the same appalling economic conditions. Ben Bernanke accused the President a few weeks ago of holding a dystopian view of the economy, an economy that Bernanke handed to Yellen under what he called a recovery. Who is actually dystopian? |

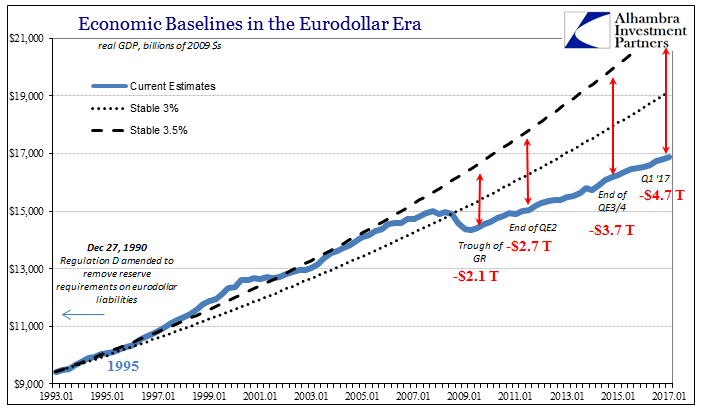

Eurozone Gross Domestic Product, 1993 - 2017(see more posts on Eurozone Gross Domestic Product, ) |

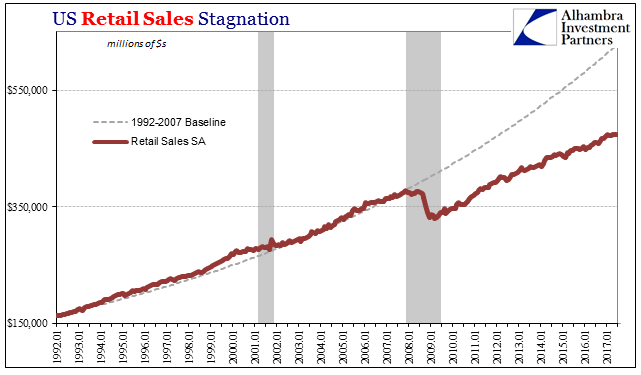

U.S. Retail Sales, 1992 - 2017(see more posts on U.S. Retail Sales, ) |

|

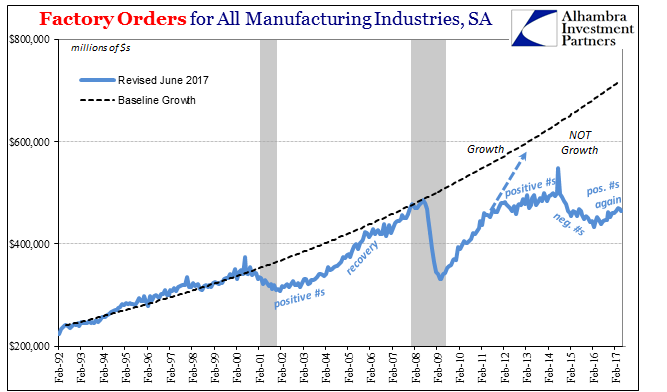

U.S. Factory Orders, Feb 1992 - 2017 |

|

| The bond and eurodollar markets in particular have crawled back down into pessimism again in 2017 on the growing realization that even bland platitudes expressed about Janet Yellen are in many important ways holding to the same old paradigm. The world wants radical; truly desperate for it.

One reason is inflation. The concentration on the CPI or the PCE Deflator seems overly obsessive considering. After all, nobody really wants inflation apart from economists who think always like it could be 1929. Even at 2%, that’s enough to rob a slow, insufficient trend of enough to make it that much more painful especially for workers. The issue, however, isn’t truly inflation as consumer prices, as even CNBC has finally come round to understand:

|

|

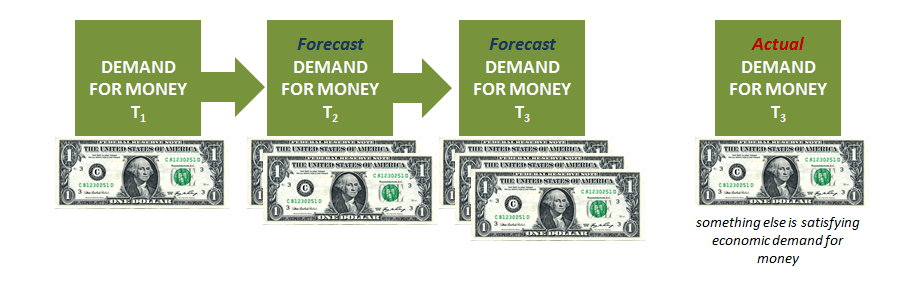

| It is instead about monetary effectiveness. In a lot of ways it’s a strange path to take from one to the other, especially for something like the 21st century central bank. If there is one thing settled in the popular imagination, it is that. Money isn’t supposed to be a point for debate, nor, then, is monetary policy.

But how do we know when monetary policy is effective? You can claim that the fact the economy is growing is proof enough, but every economy’s default setting by virtue of nothing more than the increasing population is growth. Stuck in stagnation, by contrast, this evaluation is all the more important. There must be some reason for it. |

|

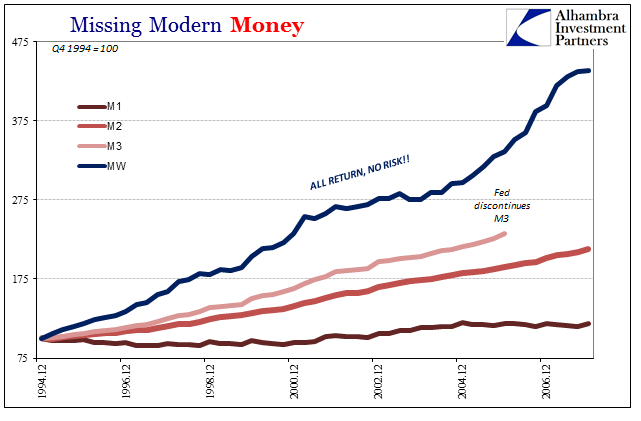

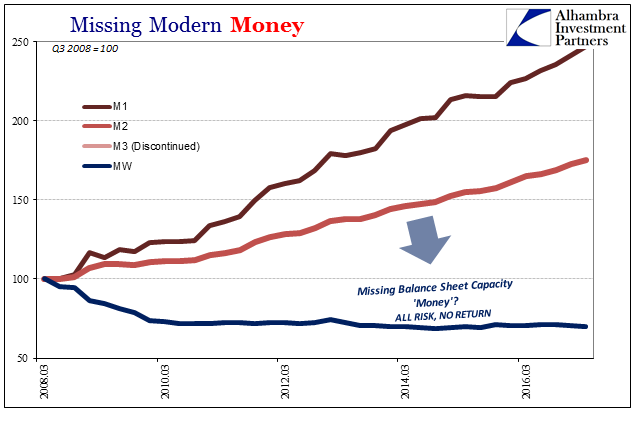

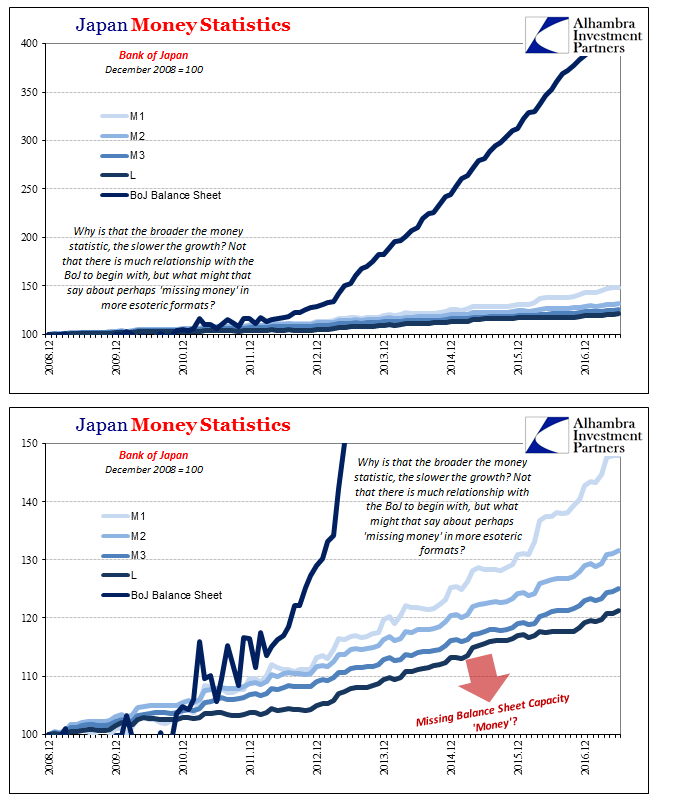

| The truth is that central bankers a very long time ago stopped using actual money indications for evaluation. In the 1970’s, it was called the age of “missing money” because financial institutions in particular had already been using new forms of it that didn’t fit traditional definitions. As such, policymakers couldn’t find money, and after enough time no longer bothered to try. | |

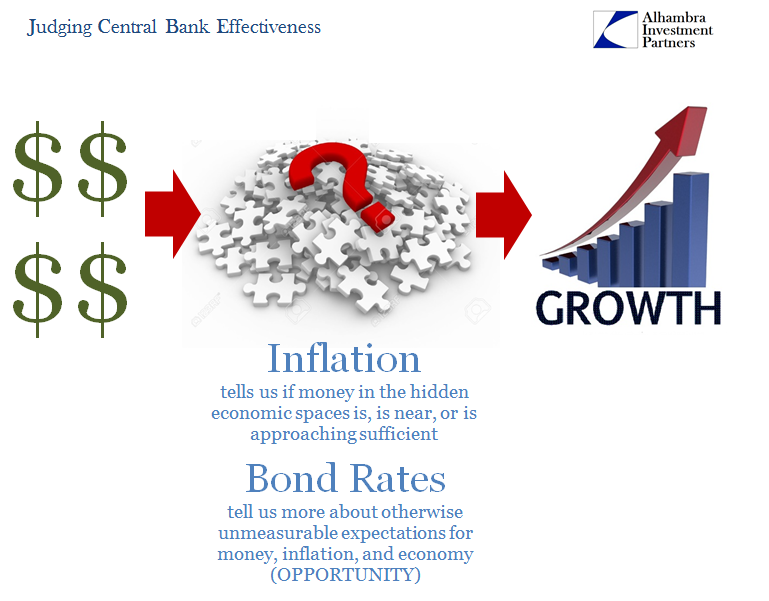

| But in switching to discretionary policy (interest rate targeting), there is still required some feedback in how money is functioning inside the rest of the economy. The way in which it actually does is never known, as many economic factors in actuality always will be beyond all observation. To gauge the appropriateness of money conditions under discretionary policy, central bankers use inflation and its relationship to their target. | |

| Inflation is not the only monetary indicator, along with bond rates (and more esoteric instruments like eurodollar futures) we can get a better sense if monetary conditions are sufficient. For a central bank with an explicit inflation target, such as the Federal Reserve since 2012, the combination of current inflation measures along with longer-term interest rates as compared to that target propose effective (or ineffective) policy aiding in effective money for efficient, sustainable economic growth. | |

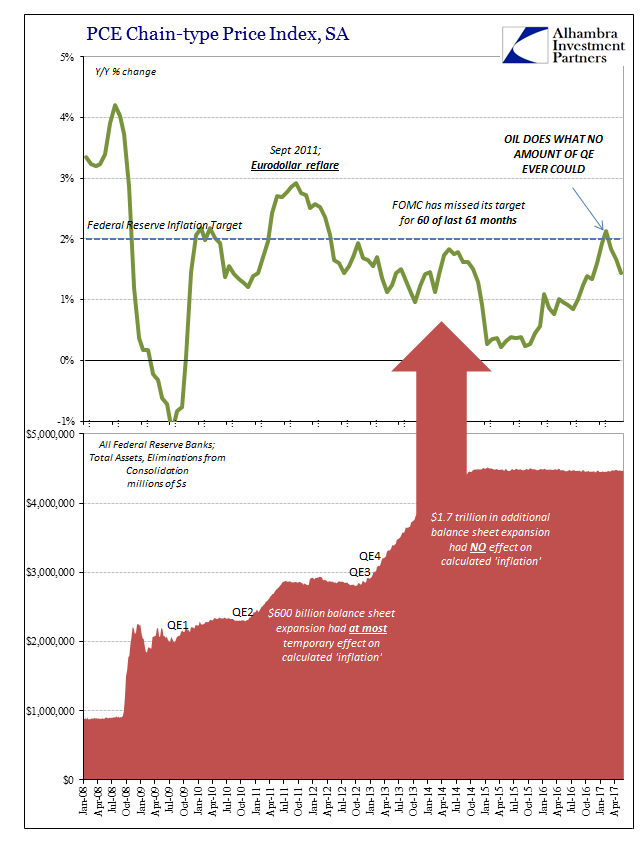

| Thus, the focus on 2% inflation is important for these reasons rather than inflation itself. The failure to achieve that target in a sustainable fashion cries out that “something” isn’t right – especially after expending considerable effort, as many central banks have and still are, to ensure these outcomes money to inflation to growth (or money to growth to inflation).

Convention tries to assign these deviations to either the “hawkish” or “dovish” column; the latest FOMC policy statement today being chosen for the latter by virtue of several words in that document recognizing that inflation is not coming any closer to behaving (in relation to the target) despite the passage of appropriate time. This is the wrong way of thinking about both policy and prices. The Fed, as the ECB or Bank of Japan, is neither of those. Instead, it is expressing varying degrees of confusion and angst. Policymakers around the world don’t have the slightest idea why after so much LSAP (QE’s and other programs) inflation persists underneath. They introduced what was supposed to be a powerful monetary input into that swirling, hidden economic world without success in output. Instead of considering the possibility that there is something wrong with money and therefore monetary policy, as would be common sense, officials like Janet Yellen increasingly prefer to believe that the hidden economy must be itself screwed up (opioids and Baby Boomers). Markets know better; or at least some markets. The simplest, most logical explanation is that each central bank having no special insight into monetary mechanisms doesn’t know what it is doing. They are flying blind, as they have been for decades. The difference is that in the 1990’s everything was moving in the “right” direction regardless. It is certainly far more plausible than an epidemic of drug abusers that didn’t make the news until years into an economic recovery that never was a recovery. |

U.S. Fed Balance Sheet, Jan 2008 - Apr 2017 |

| Disavowing Yellen could upset markets alright, but in a good way. It would say that this awful and dangerous condition is both unacceptable and, more importantly, just might not be as permanent as it today appears. There could be a solution, a real solution, by more closely examining and scrutinizing the fog of money interactions, starting with the 21st century version of missing money. |

U.S. Missing Modern Money, Dec 1994 - Jul 2017 |

U.S. Missing Modern Money, Mar 2008 - 2017 |

|

| The Fed years ago set a 2% target for the PCE Deflator. It has achieved it once in the past five years, and that was oil prices not QE. The Federal Reserve as it is currently construed doesn’t matter; it has proven beyond any doubt that is the case. Janet Yellen, however, does because she represents that perilous monetary status quo. |

Japan Money Statistics, Dec 2008 - Jul 2017 |

Tags: Ben Bernanke,CPI,currencies,economy,Eurozone Gross Domestic Product,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,inflation target,interest rate targeting,Janet Yellen,Markets,missing money,Monetary Policy,Money Supply,newsletter,pce deflator,stephen goldfeld,U.S. Retail Sales