Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of time and excuses. That is very likely why earlier this week Federal Reserve Chairman Janet Yellen admitted that economists like her and her fellow policymakers might not really understand inflation. The larger, more important implication is that if they don’t comprehend inflation they can’t really

Topics:

Jeffrey P. Snider considers the following as important: Alan Greenspan, Consumer Prices, core inflation, CPI, currencies, dallas fed trimmed mean pce deflator, disposable personal income, economy, EuroDollar, eurodollar system, Featured, Federal Reserve/Monetary Policy, inflation, Janet Yellen, Markets, missing money, Money, MW, newslettersent, oil prices, pce deflator, Price Index, The United States, U.S. Retail Sales, wireless telephone services

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

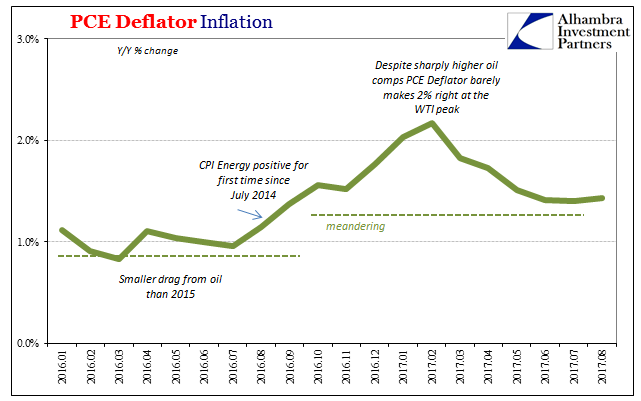

| Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of time and excuses.

That is very likely why earlier this week Federal Reserve Chairman Janet Yellen admitted that economists like her and her fellow policymakers might not really understand inflation. The larger, more important implication is that if they don’t comprehend inflation they can’t really comprehend money, either. It has taken seventeen years, but we are finally getting closer to reconciling with what Alan Greenspan was talking about in June 2000:

|

PCE Deflator Inflation, Jan 2016 - Aug 2017(see more posts on inflation, ) |

| If you can’t “locate” money, you can’t locate inflation. Not for lack of trying, of course, but officials have been forced to increasingly ridiculous means to distract from the only real possibility. They started with the oil price crash being “transitory” and have kept up the use of the same word, only shifting it from one excuse to the next. The last has been unlimited wireless data plans, a huge deflationary positive for consumers (like oil prices) that suggests maybe things aren’t so well for consumers (like oil prices).

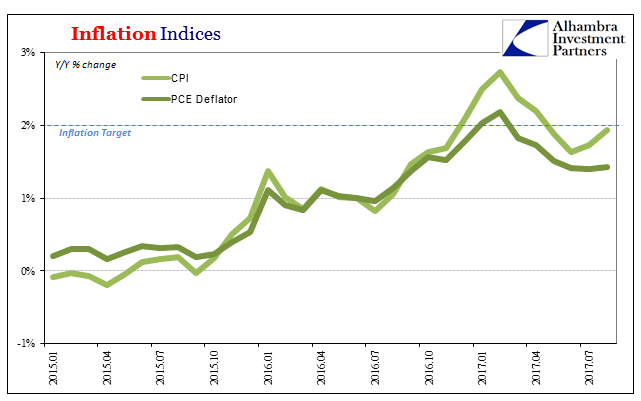

The updated estimate for the PCE Deflator in August 2017 was 1.43%. Despite a large contribution from gas and energy prices that boosted the CPI, indicated consumer price inflation here was basically unchanged from the last two months. In fact, the rate of growth has settled down right about where we thought it would going back to last autumn; the predictable contribution, and then withdrawal, of oil price base effects largely concluded. |

Inflation Indices, Jan 2015 - Jul 2017(see more posts on inflation, ) |

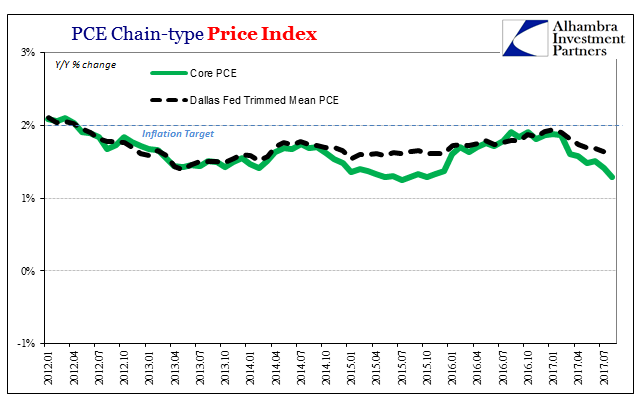

| To further check the FOMC’s hypothesis about transitory one-off factors explaining the continuing miss, the BEA estimates a “core” inflation rate for the deflator, stripped of energy and food prices that often prove to be more volatile on a short-term basis. And if that isn’t enough, the Dallas Fed calculates a trimmed-mean for the index to try to separate some of the noise from what might be considered the more important basis for any price momentum one way or the other. |

PCE Chain-type Price Index, Jan 2012 - Jul 2017(see more posts on Price Index, ) |

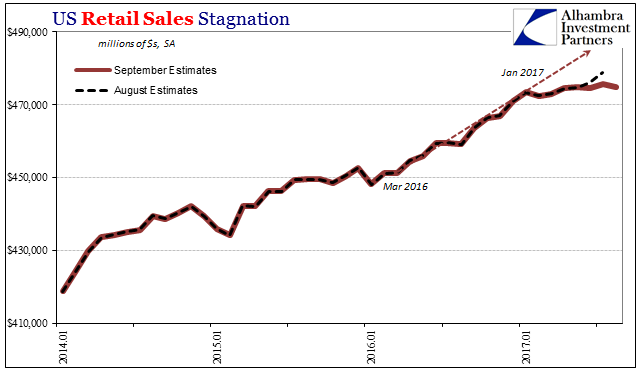

| Unfortunately for Janet Yellen, both of these suggest the wrong thing is taking place this year. In each “core” version, they are once more falling and rather significantly. Since the price data shown here matches up well with economic statistics describing the same slowing economic momentum, it doesn’t look good for the mainstream view. |

US Retail Sales, Jan 2014 - 2017(see more posts on U.S. Retail Sales, ) |

| The trimmed mean deflator throws out any components that are outliers, which means they stack every component on a monthly basis and eliminate the highs and lows so that what is left is the non-volatile middle/majority. The benefit of such a calculation is that unlike the other which always eliminates food and energy prices, the trimmed mean approach can be more flexible in narrowing down what might be skewing the index in either direction.

That would include wireless data and telephone services. In other words, the trimmed mean doesn’t consider the most recent commonly cited justification for the misbehaved performance of the inflation indexes – and it is still moving downward anyway. Not only that, they are doing so in a way that is entirely too familiar, reminiscent of just a few years ago when we were treated to much the same spectacle (though, admittedly, it isn’t nearly as dramatic now as during the oil crash). |

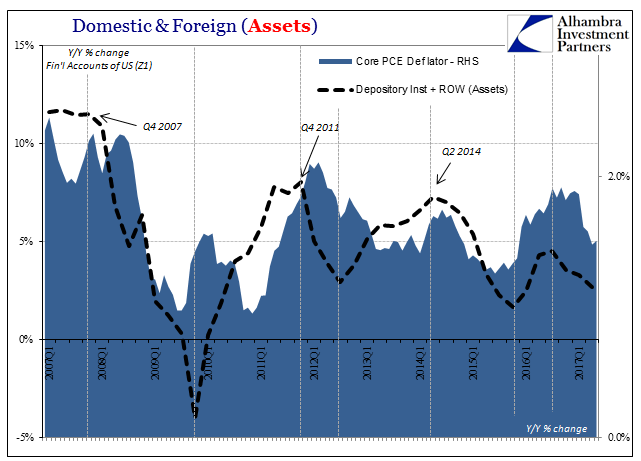

Domestic and Foreign (Assets), Q1 2007 - 2017 |

| Again, you can begin to appreciate just why Janet Yellen’s adherence to orthodox inflation dogma has loosened to some degree of late. There just isn’t any indication that the unemployment rate matters even a little, and that instead all the things Alan Greenspan wondered about seventeen years ago really do. The Fed may still hike rates and runoff or even selloff its balance sheet, but so what? None of that matters, as if we needed any more evidence. |

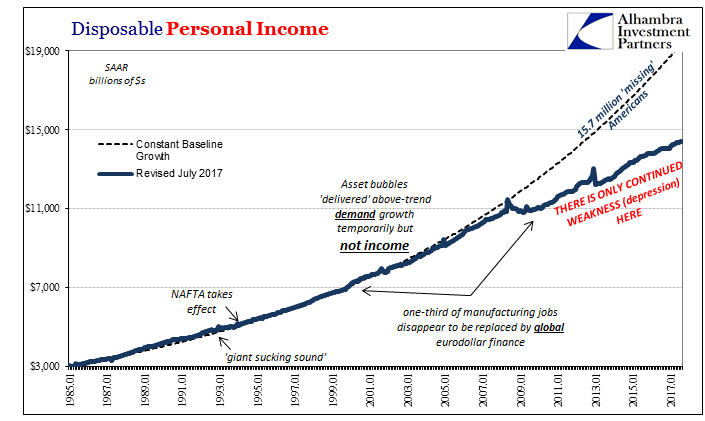

Disposable Personal Income, Jan 1985 - 2017(see more posts on disposable personal income, ) |

To try to explain it better, I’ll reprint here the analogy I used earlier today in the context of a more thorough and historical analysis (the significance of 1923) as to why that is:

|

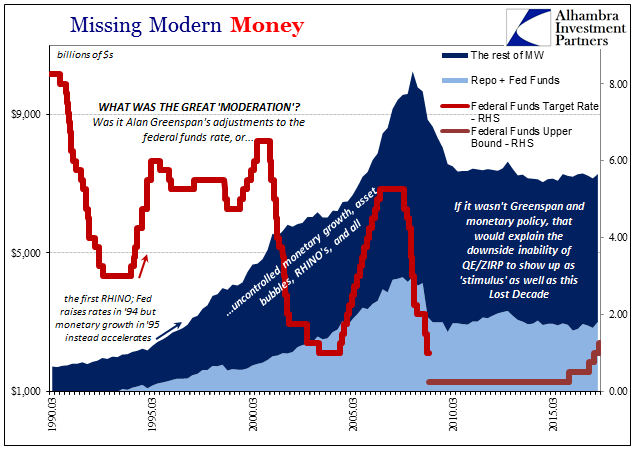

Missing Modern Money, March 1990 - 2015(see more posts on missing money, ) |

Tags: Alan Greenspan,Consumer Prices,Core Inflation,CPI,currencies,dallas fed trimmed mean pce deflator,disposable personal income,economy,EuroDollar,eurodollar system,Featured,Federal Reserve/Monetary Policy,inflation,Janet Yellen,Markets,missing money,money,MW,newslettersent,oil prices,pce deflator,Price Index,U.S. Retail Sales,wireless telephone services