Swiss Franc The Euro has fallen by 0.05% to 1.1441 CHF. EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed’s target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in...

Read More »FX Daily, August 30: US Dollar Recovery Extended

Swiss Franc The Euro has fallen by 0.09% to 1.1427 CHF. EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea’s missile over Japan subsided. The US response was seen as measured and tempered. North Korea...

Read More »Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding. Many investors were looking for policy clues, but these were not forthcoming. The December Fed funds futures contract was unchanged,...

Read More »FX Daily, August 29: Dollar Losses Accelerate After North Korea Sends Missile over Japan

Swiss Franc The Euro has fallen by 0.57% to 1.1374 CHF. EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A brief period of quiet, which some may have confused with a change in posture, North Korea followed up the weekend’s test of three ballistic missiles with what appears to have been an intermediate missile that flew over Japan. South Korea...

Read More »FX Daily, August 28: Monday’s Dollar Blues

Swiss Franc The Euro has risen by 0.08% to 1.1415 CHF. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we...

Read More »FX Weekly Preview: Three Drivers in the Week Ahead

Summary: EMU preliminary August CPI headline rise may not translate into core. US jobs growth is fine; earnings growth is key. Trump’s coalition is fraying, and the weekend pardon will not help mend fences. The US dollar’s consolidation ended with an exclamation point last week. The downtrend since the beginning of the year is resuming, and there is a reasonable risk that the pace accelerates. In addition to...

Read More »Weekly Speculative Positions (as of August 22): Sterling Bears Press, but Too Much?

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

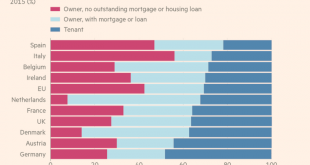

Read More »Great Graphic: Home Ownership and Measuring Inflation

Summary Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not. This Great Graphic was in the Financial Times recently. It shows home ownership rates several EU countries. The useful chart also shows those who own (red bar) and those...

Read More »FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

USD/CHF The dollar had some gains versus the franc during the last month, but it lost all during the last days. EUR/CHF The euro is still around 1.14, this is up 2.5% against one month ago. The rising momentum for EUR/CHF, however, seems to be fading. EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

Read More »Great Graphic: Small Caps and the Trump Trade

The Russell 2000, which tracks the 2000 smallest companies in the Russell 3000, is threatening to turn positive for the year. It had turned negative in the second half of last week. Many pundits saw its decline and the penetration of the 200-day moving average for the first time in over a year as a sign of an impending down move in the broader equity market. Given valuation, and the number of big name asset managers and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org