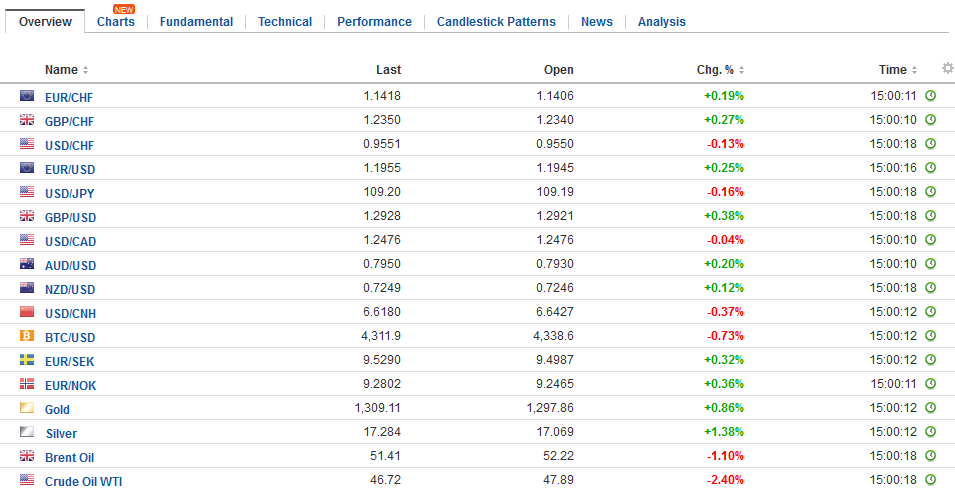

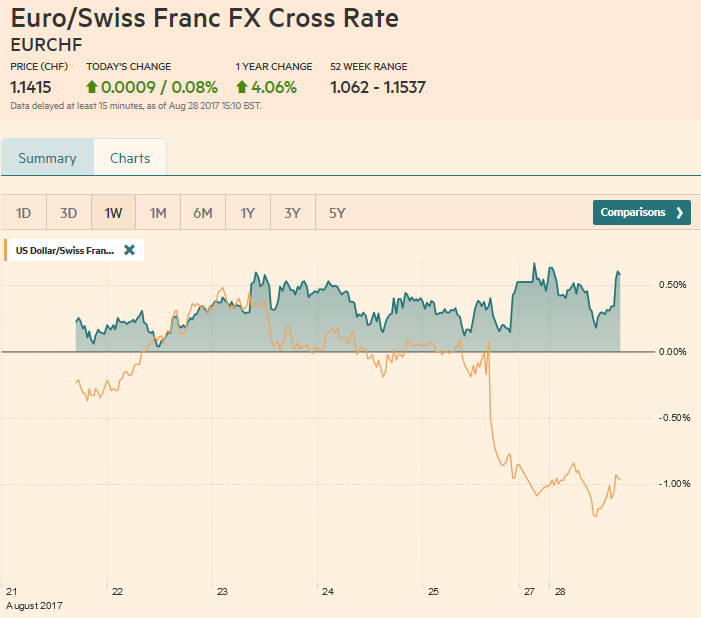

Swiss Franc The Euro has risen by 0.08% to 1.1415 CHF. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we see it, was simply fanned by both Yellen and Draghi did not alter the status quo in their Jackson Hole speeches. BOJ Governor Kuroda spoke at Jackson Hole following the release of Japan’s July CPOI figures before the weekend. He did talk about policy. He suggests that although the BOJ’s IGB buying was

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, FX Trends, GBP, JPY, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.08% to 1.1415 CHF. |

EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar’s pre-weekend losses were extended initially in Asia before it recovered sufficiently to give European participant a better selling level. The dollar selling into the shallow bounce reflects the bearish sentiment, which as we see it, was simply fanned by both Yellen and Draghi did not alter the status quo in their Jackson Hole speeches. BOJ Governor Kuroda spoke at Jackson Hole following the release of Japan’s July CPOI figures before the weekend. He did talk about policy. He suggests that although the BOJ’s IGB buying was having some impact on liquidity, the market was still functioning fine. Kuroda also underscored the need to continued efforts, meaning the talk of central bank exits did not include the central bank for the world’s third largest economy. Since poking briefly through 0.10% in July, the yield on the 10-year JGB has been trending lower. Today it reached 0.5 bp, the lowest since April when it reached 0.1 bp. The yield has not been negative since last November. Japan reports July jobs and retail sales tomorrow and Wednesday, followed by industrial production on Thursday. The Japanese economy led the G7 with 1% growth in Q2. The growth appears to be slowing to a more sustainable pace in Q3. |

FX Daily Rates, August 28 |

| Storm Harvey is leaving a path of destruction in its wake, with an ongoing deluge of rain and wind. In addition to the human tragedy and physical damage, about 10% of US refining capacity has been shuttered according to reports. As one would expect, gasoline prices are jumping 4-5%. Brent prices are steady, while the front month light sweet crude oil futures contract is off around 1%. Although it traded on both sides of the pre-weekend range, the October contract is well within the range set the day before (August 24) of roughly $47-$48.40.

Equities are mixed. The MSCI Asia Pacific Index eked out a small gain. Of note, Hong Kong’s Hang Seng rose to new two year highs. However, the market lost momentum and closed below the open, suggesting a heavier technical tone than the bullish impulse of a new high. That said, it is up 36.6% year-to-date. In Europe, the Dow Jones Stoxx 600 gapped lower and has not been able to enter the gap in the first half the day. The gap is found between the pre-weekend low (~374) and today’s open and high (~373.2). So far, it has held above the low from earlier this month (~371.5), which was also the lowest since March. We are concerned that a sharp fall in European equities may see the euro-positive inflows unwind and could act as one of the headwinds to the euro’s advance. After surging through $1.19 before the weekend, the euro reached $1.1965 before pulling back a bit. The $1.1900 area should now offer initial support. The dollar is holding just above JPY109. Resistance is pegged near JPY109.40 now. Sterling initially gapped higher in Asia after a strong showing before the weekend. It reached nearly $1.2950, its highest level since the middle of the month. It stalled in front of the 20-day moving average (~$1.2960), which it has not closed above since August 3. The Canadian and Australian dollars remain firm near their pre-weekend highs and look poised to post additional near-term gains. |

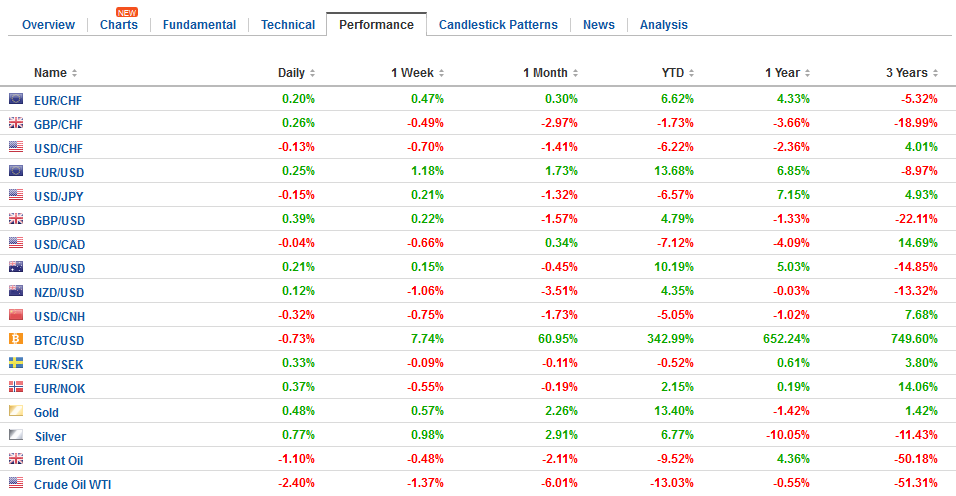

FX Performance, August 28 |

The eurozone reported an unexpected slowing of M3 money supply, but lending to business strengthened. M3 rose 4.5% from a year ago in July. This matches two-year lows. The decline was broad based, but lending fared well. Loans to households were steady at 2.6%, while lending to nonfinancial businesses rose to a 2.4% from a year ago, accelerating from a 2.0% clip. These gains were not particularly widespread and instead were concentrated in Germany and France.

The North American session features US wholesale and retail inventories, and good trade balance. They are components of Q3 GDP. Midweek the US will revise Q2 GDP. It is expected to be tweaked higher to 2.7% from 2.6%. The Bloomberg survey picked up a median guesstimate that US growth in Q3 matched Q2 growth, but the GDP trackers at the Atlanta and NY Fed’s don’t see it that way. The Atlanta Fed sees the economy tracking 3.4% growth presently, while the NY Fed see 1.9%. Note that the US is selling $132 bln of debt today, including four-week T-bills that may come due before the debt ceiling is raised.

There have been two geopolitical developments to note. First, North Korea did launch three short-range ballistic missiles that apparently fell into the Japanese Sea. Recall that the US and South Korea are engaged in annual military exercises that seek to intimidate North Korea. Last year, in protest, during the exercises, North Korea launched a ballistic missile from a submarine. Foreigner sold a small amount of South Korean shares today (~$25 mln) after buying about $240 mln last week, but the Korean won is the strongest currency in the world today, gaining 0.7% against the US dollar. Over the past five sessions, only two currencies have performed better than the Korean won: The Colombian peso (+2.35%) and the Norwegian krone (+~1.9%).

Second, after several months of border tensions between China and India, a successful resolution appears at hand. India said that both sides agreed to disengage, but China claimed that India withdrew (people and equipment) to its side of the border. Indian Prime Minister Modi and Chinese President Xi will meet at the weekend BRICS summit that China is hosting. The Indian rupee and equities firmed on the news. It seems like a temporary solution, but a resolution served both sides immediate political needs.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,newsletter,USD/CHF