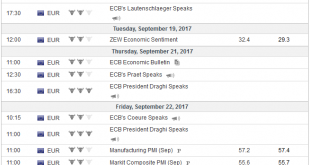

Swiss Franc The Euro has risen by 0.36% to 1.153 CHF. EUR/CHF and USD/CHF, September 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Politics seems to dominate the talking points today. Boris Johnson’s weekend op-ed has been rejected by May, and there is talk that Johnson may resign or fired. Sterling is consolidating after pulling back yesterday. Carney said that if the...

Read More »FX Daily, September 18: More Thoughts from Berlin

Swiss Franc The Euro has risen by 0.03% to 1.1468 CHF. EUR/CHF and USD/CHF, September 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The unexpected weakness in US retail sales and industrial production reported before the weekend did not prevent US yields and stocks from rising. Asia followed suit, and with Japanese markets closed, the MSCI Asia Pacific Index rallied a...

Read More »FX Weekly Preview: FOMC Highlights Big Week

New Zealand holds elections at end the of next week as well. While the German contest does not appear close and the odds on the most likely scenario are a return of the Grand Coalition, in New Zealand, the center-right’s decade-long rule is being seriously challenged by a resurgent Labour Party. The New Zealand dollar fell by around 5.7% in August. The pullback was twice as deep and lasted twice as long the as the...

Read More »FX Daily, September 15: Short Note Ahead of the Weekend

(Sporadic updates continue as the first of two-week business trip winds down) Swiss Franc The Euro has risen by 0.03% to 1.1481 CHF. EUR/CHF and USD/CHF, September 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit...

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

Read More »FX Daily, September 13: Sterling Shines While Euro Stalls in Front of $1.20

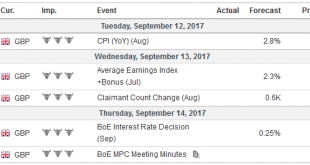

(The next leg of the business trip takes me to Frankfurt. Sporadic updates will continue) Swiss Franc The Euro has fallen by 0.14% to 1.147 CHF. EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We have been identifying the $1.3430 area is a reasonable technical target for sterling. It represents the 50% retracement of sterling’s losses...

Read More »FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

(The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe) Several developments have attracted our attention, but the key take away is that the global capital markets have stabilized after appearing downright frightful at the end of last week, as stocks, yields, and the dollar plummeted. Equities rallied om Monday and there was follow through buying in...

Read More »FX Weekly Preview: Forces of Movement in FX: The Week Ahead

Summary: The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again. The US dollar’s sell-off accelerated. It has been selling off since the start of the year. The first phase of the decline at...

Read More »FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

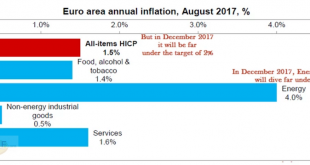

EUR/CHF The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach. Strangely the EUR/CHF reacted with losses only on Friday. Where will Euro...

Read More »FX Daily, September 08: US Dollar Tracks Yields Lower

Swiss Franc The Euro has fallen by 0.28% to 1.1393 CHF. EUR/CHF and USD/CHF, September 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org