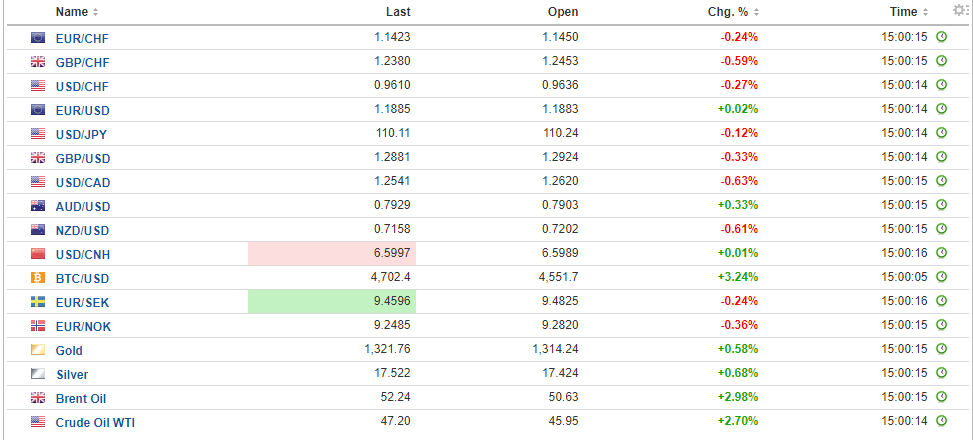

Swiss Franc The Euro has fallen by 0.05% to 1.1441 CHF. EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed’s target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year. Bloomberg currently calculates the odds of a hike by the end of the year to be near 33%, while the CME model puts the odds at closer to 40%. We

Topics:

Marc Chandler considers the following as important: AUD, CAD, Canada Gross Domestic Product, China Manufacturing Purchasing Managers Index, China Non-Manufacturing Purchasing Managers Index, EUR, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Eurozone Unemployment Rate, Featured, FX Trends, GBP, Germany Retail Sales, Germany Unemployment Change, Germany Unemployment Rate, JPY, newslettersent, Spain Current Account, U.K. GfK Consumer Confidence, U.S. Chicago Purchasing Managers Index, U.S. Initial Jobless Claims, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.05% to 1.1441 CHF. |

EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

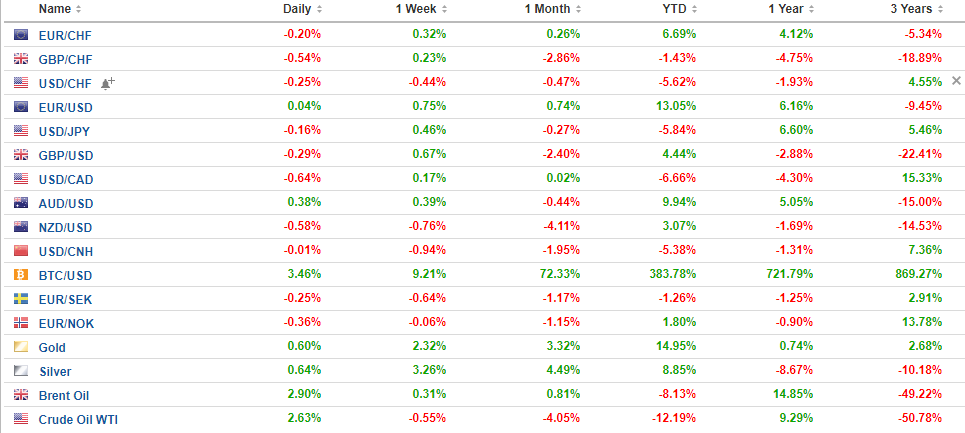

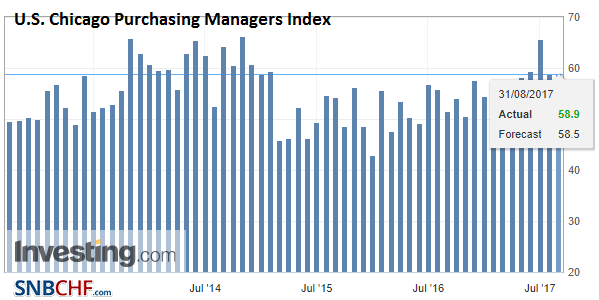

FX RatesThe US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed’s target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year. Bloomberg currently calculates the odds of a hike by the end of the year to be near 33%, while the CME model puts the odds at closer to 40%. We think the odds are somewhat greater, not because of any special insight into the path of core inflation. Rather, we put more emphasis on the Fed’s third mandate, financial stability, which in the all the market talk of a dual mandate does not appreciate sufficiently. Specifically, we underscored the July FOMC minutes that showed that official concern about asset prices had been ratcheted up. We have noted that in several speeches, the Fed’s leadership and some regional presidents have made references to financial conditions. The Fed judges that the economy requires less accommodation, and so it removes some through three increases in the Fed funds target in the past year. The market has countered this, and financial conditions remain, by some measures, more accommodative than before the Fed’s recent hikes. We do not think the Fed is simply going to capitulate to market forces. |

FX Daily Rates, August 31 |

| Previously, the Fed had been concerned about the global headwinds. The pendulum of market sentiment has swung from “How can the Fed be the only one normalizing policy?” to “Other countries are moving away from unorthodox policies, while the Fed may be too hawkish.” The world’s second largest economy has also surprised many observers in its resilience, though we did not expect anything else in this important year for China’s politics.

The euro is in less than a half cent range. It extended its pullback for the third day but has stabilized around little-changed levels. The euro has not recorded a three-day fall since early July. There are two option strikes that are in play today. There are 726 mln euros struck at $1.1875, and another 642 mln euros struck at $1.19 that expire today. The $1.1865 area represents the 50% retracement of the latest leg up in the euro that we see beginning on August 17.near$1.1660. The 61.8% retracement is near $1.1820. The dollar is trading higher against the yen. It had reached almost JPY110.65 after posting a key reversal on Tuesday when the JPY108 level held. The JPY110.65 area is the 38.2% retracement objective of the dollar’s drop since testing JPY114.50 on July 11. In the middle of this month, the JPY111 level held back the dollar’s recovery attempt. The Aussie was turned back from $0.8000 yesterday, and it posted a potential key reversal by making new 3-4 week highs and then selling off and closed a smidgen below the previous day’s low. There has been a little more following through selling today. A break off $0.7850 signals a return to the $0.7800 area seen in the middle of the month and mid-July. |

FX Performance, August 31 |

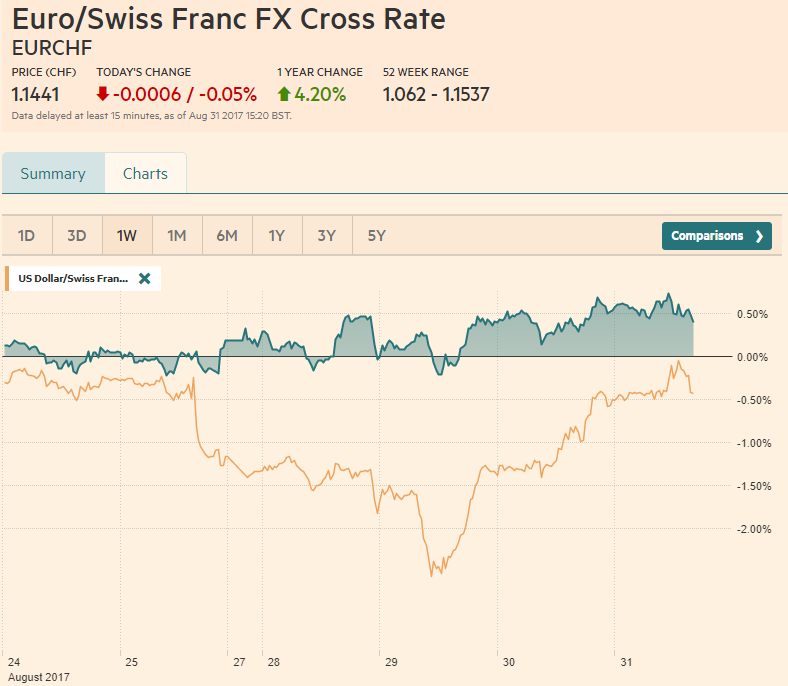

United StatesIndeed the Fed’s confidence in the US economy may be bolstered by yesterday’s news that included the upward revision to Q2 growth, led by consumption and business investment. |

U.S. Chicago Purchasing Managers Index (PMI), Aug 2017(see more posts on U.S. Chicago Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

| The 3% annualized pace is the fastest in two years. The ADP jobs estimate was the best in five months |

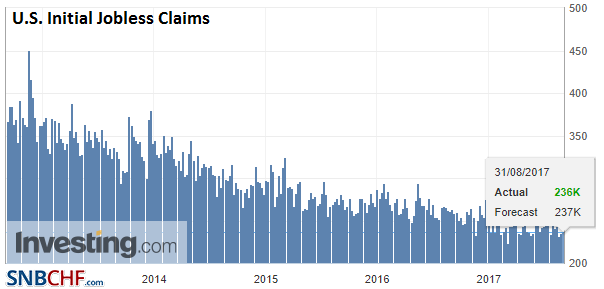

U.S. Initial Jobless Claims, 31 August 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

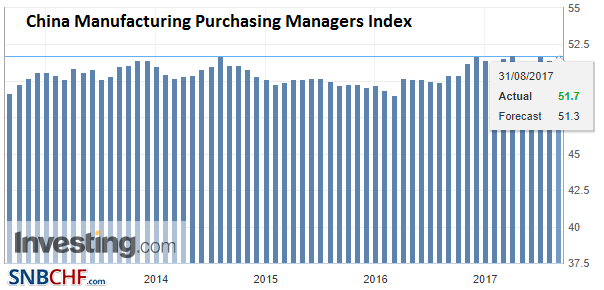

ChinaChina’s August manufacturing PMI rose to 51.7 from 51.4. This is the second highest this year. Gains were recorded in production, new orders, and imports. |

China Manufacturing Purchasing Managers Index (PMI), Aug 2017(see more posts on China Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

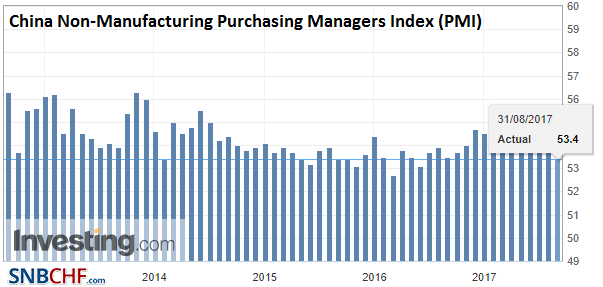

| On the other hand, the expansion in the non-manufacturing sector slowed to 53.4 from 54.5. It is the lowest since May 2016. This is something that needs to be watched, though it may prove to weather-related, according to some reports. |

China Non-Manufacturing Purchasing Managers Index (PMI), Aug 2017(see more posts on China Non-Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

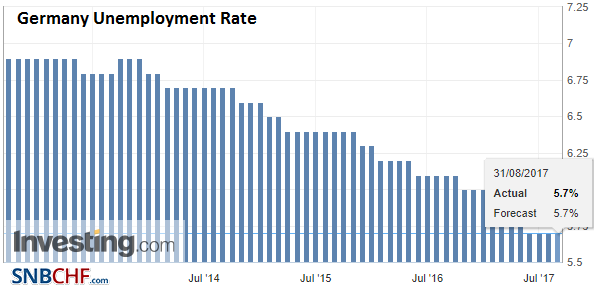

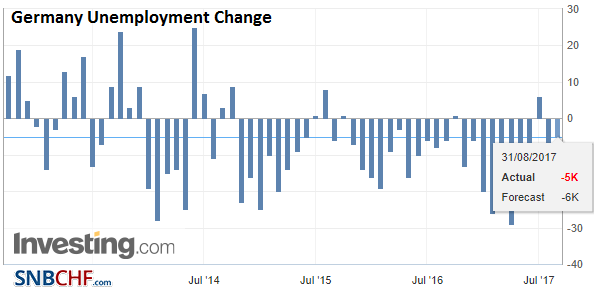

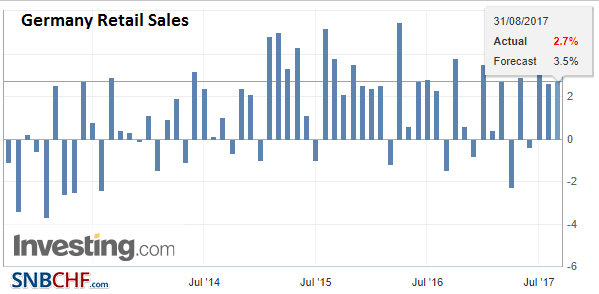

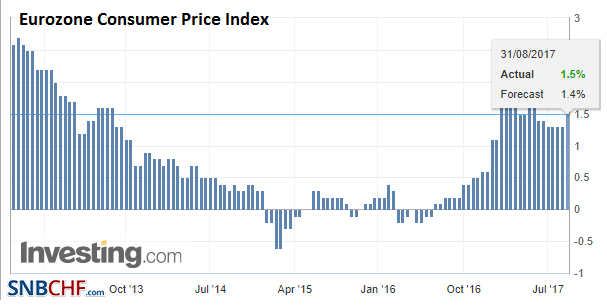

GermanyYesterday, Germany and Spain reported somewhat higher than expected preliminary August CPI. |

Germany Unemployment Rate, Aug 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

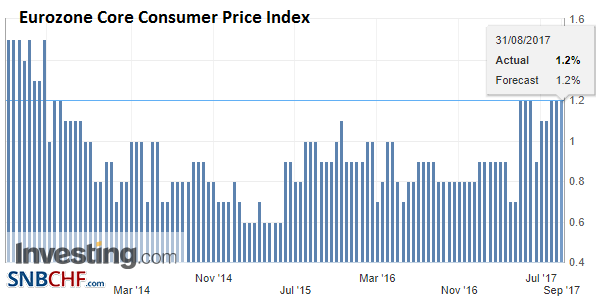

| This warned over a higher regional reading today, and sure enough, EMU CPI rose to 1.5% from 1.3% in July. |

Germany Unemployment Change, Aug 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

| The median forecast was for 1.4%. The core rate remained unchanged at 1.2% for the second month. |

Germany Retail Sales YoY, Jul 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

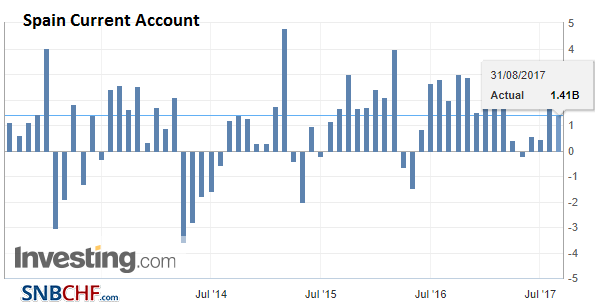

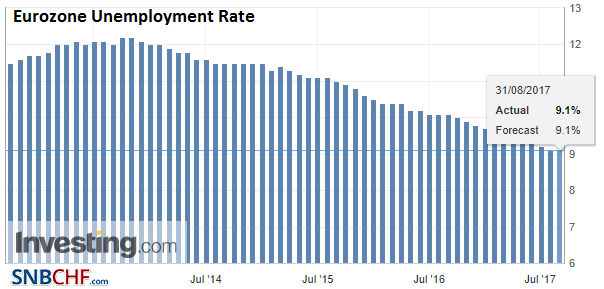

SpainIt matches the high from earlier this year and the highest level since early 2013. Separately, Eurostat reported that the unemployment rate was unchanged in July at 9.1%. The last cyclical trough (2007) it was at 7.3%. |

Spain Current Account, Jun 2017(see more posts on Spain Current Account, ) Source: Investing.com - Click to enlarge |

EurozoneThe ECB meeting next week important. The ECB is expected to announce an extension of its asset purchases but at a slower rate (tapering). |

Eurozone Core Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Many expect that Draghi may seek to put a dovish spin on it to prevent the markets from prematurely taking away the proverbial punch bowl. |

Eurozone Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| We do not think that today’s inflation report changes the ECB’s assessment of the underlying path of inflation, which they find wanting. |

Eurozone Unemployment Rate, Jul 2017(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

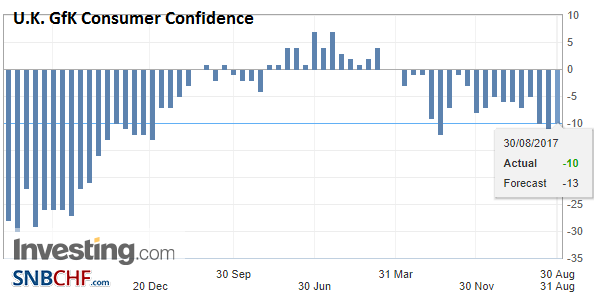

United KingdomSterling is trading heavily, after closing the North American session near its session highs. It has slipped through yesterday’s lows, which corresponded to a 50% retracement of sterling’s bounce from $1.2775 last week to nearly $1.2980 this week. The next retracement level is seen near $1.2850. As we recently suggested, the EU negotiators are not satisfied with the UK’s effort on Brexit to date, and this makes the EU unlikely to signal that it is ready to discuss the post-Brexit relationship. The UK government’s reported hope to pull an end run and appeal directly to Merkel and Macron is unlikely to prove successful. It is far too early for the heads of state to overrule the EU’s negotiating team. |

U.K. GfK Consumer Confidence, Aug 2017(see more posts on U.K. GfK Consumer Confidence, ) Source: Investing.com - Click to enlarge |

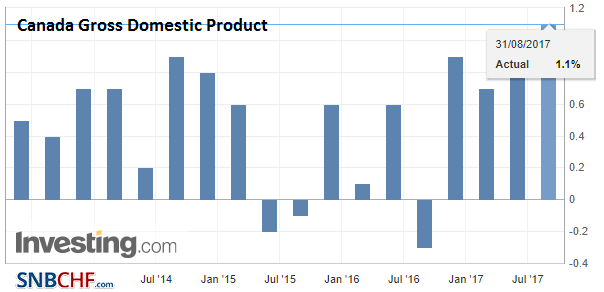

Canada |

Canada Gross Domestic Product (GDP) QoQ, Q2 2017(see more posts on Canada Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

At the start of the month, the weakness of the dollar-bloc currencies and sterling gave hints that the US dollar’s downtrend was moderating and consolidative forces took hold. The Australian and Canadian dollar’s price action warned of a new set back from the US dollar. The US dollar is bouncing off support seen near CAD1.24, the low set in late July. Today will likely provide a test of it. The US dollar pushed a little through CAD!.2650 earlier today, which is a 61.8% retracement of its decline since mid-August. Canada reports Q2 GDP today. A strong showing, which is what is expected (3.7% annualized, unchanged from Q1 and the second consecutive quarter that the year-over-year pace is above 4%) could see the Canadian dollar strengthen on what would be seen as additional confirmation of a follow-up rate hike in October.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Canada Gross Domestic Product,China Manufacturing Purchasing Managers Index,China Non-Manufacturing Purchasing Managers Index,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Unemployment Rate,Featured,Germany Retail Sales,Germany Unemployment Change,Germany Unemployment Rate,newslettersent,Spain Current Account,U.K. GfK Consumer Confidence,U.S. Chicago Purchasing Managers Index,U.S. Initial Jobless Claims,USD/CHF