Swiss Franc The Euro has risen by 0.35% to 1.1433 CHF. FX Rates The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that...

Read More »FX Daily, September 06: Wake Me up when September Ends

Swiss Franc The Euro has risen by 0.17% to 1.1396 CHF. EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank’s decision. We are concerned that given the strong performance and market positioning, a rate...

Read More »Great Graphic: Young American Adults Living at Home

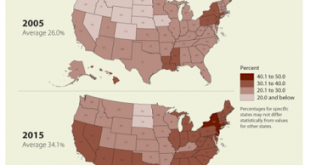

This Great Graphic caught our eye (h/t to Gregor Samsa @macromon). It comes from the US Census Department, and shows, by state, the percentage of young American adults (18-34 year-olds). The top map is a snap shot of from 2005. A little more than a quarter of this cohort lived at home. A decade later, and on the other side of the Great Financial Crisis, the percentage has risen to a little more than a third. The deeper...

Read More »FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Swiss Franc The Euro has risen by 0.07% to 1.1406 CHF. EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new...

Read More »Weekly Speculative Positions (as of August 29): Speculators Make Minor Position Adjustments, but Like that Aussie

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Summary: Following strong Q2 GDP figures, risk is that Bank of Canada’s rate hike anticipated for October is brought forward. ECB’s guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley’s comments are the most important. Four central banks from high income countries hold policy is making...

Read More »FX Weekly Review, August 28 – September 02: The end of big euro rise?

EUR/CHF Let us remember why the euro has risen from 1.08 to 1.14 between June and August: Hopes that the French president Macron will help the French economy, similarly to the Trump reflation trade. Hopes that the ECB will finish their bond buying program earlier combined with quite good economic data. We are of the opinion that both points may be illusionary. The euro should not rise further. Politicians cannot...

Read More »Cool Video: CNBC Clip Tactical and Strategic Dollar Outlook

- Click to enlarge I appeared on CNBC earlier today to talk about the dollar. I was given the time to briefly sketch out my view of the dollar. Near-term, I am concerned about the political and economic events in September, but I am looking for a better Q4 for the greenback. I have not given up the idea that the dollar’s pullback this year is a correction to the bull move that began in mid-2014. The euro...

Read More »Cool Video: Bloomberg Discussion of Opioid Epidemic and US Labor

I had the distinct of honor of being on Bloomberg television today with David Gura and Francine Lacqua. Dino Kos, formerly of the NY Fed and now at CLS, joined this segment as well. The broad topic was the Jackson Hole Symposium, and the challenge is fostering more dynamic growth. While short-term market participants are hoping for some clues into the Fed and ECB thinking, We are not convinced that our information set...

Read More »FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

Swiss Franc The Euro has risen by 0.04% to 1.1418 CHF. EUR/CHF and USD/CHF, September 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback’s gains yesterday. Manufacturing PMIs from China, EMU,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org