Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More »Next Up for Central Banks: Infrastructure Investments?

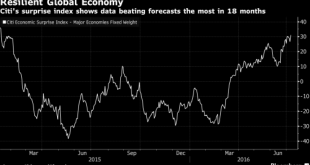

In the years following the global financial crisis, the world’s leading economies have found relief through aggressive monetary policy. But with interest rates slashed to historic lows and central bank balance sheets significantly larger as a percent of GDP than they were before the financial crisis, policymakers will need alternatives to interest rate cuts and conventional quantitative easing when the next recession comes along. U.S. central bankers have cut real interest rates between...

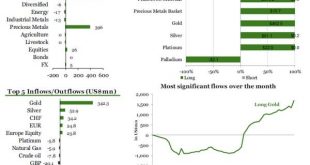

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

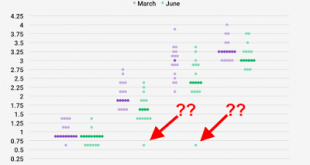

Read More »Bullard’s New Paradigm and the Federal Reserve

Summary There is much to like in Bullard’s new paradigm. The problem is that it does not reflect the Federal Reserve’s view or approach. Policy emanates from the Fed’s leadership, but be confused by the noise. The dot plot the recent FOMC meeting was curious. We noted right away that inexplicably there was one official that apparently anticipated one hike this year and then no hikes in 2017 or 2018. There was...

Read More »US Negative Interest Rate Bets Surge To Record Highs

As the “deflationary supernova” sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the ‘cheapness’ of Treasury bonds lures the world’s yield-hunters dragging it ever closer to the negative rate realities of Switzerland, Japan, and Germany. As rate-hike odds collapse, along with The Fed’s credibility, so investors are...

Read More »Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely appropriateness of a rate hike this summer. Although the Fed did not rule out a...

Read More »FX Daily, June 15: Key Data and FOMC

Swiss Franc The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. FOMC The FOMC meeting later today,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org