Why Krugman, Roubini, Rogoff And Buffett Dislike Gold By Jan Skoyles Edited by Mark O’Byrne A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. As with...

Read More »The Dying Middle Class

Largest Theft in History As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset...

Read More »Is The US Dollar Set To Soar?

Which blocs/nations are most likely to face banking/liquidity crises in the next year? Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it’s generally unwise to let that enthusiasm become the basis of one’s bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or...

Read More »FX Weekly Preview: Next Week’s Two Bookends

Germany The start of next week will likely be driven by Deutsche Bank’s travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy. Deutsche Bank is faced with two challenges: its business and several...

Read More »FX Daily, September 23: It is Friday and the Dollar is Firmer Again

Swiss Franc EUR/CHF, September 23, 2016Click to enlarge. FX Rates As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged. Today has the making of the sixth consecutive Friday that the dollar gains against the euro...

Read More »Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. Simply, with an economy failing to gain traction there is little ability for the Fed to...

Read More »FX Daily, September 22: Swiss Franc Strongest Currency Again

Swiss Franc Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance. Click to enlarge. FX Rates The US dollar has lost another 0.5% against most of the major currencies today, as Asia and Europe respond to the Fed’s decision. There are few exceptions to this generalization. The Norwegian krone has gained nearly...

Read More »Why the Coming Wave of Defaults Will Be Devastating

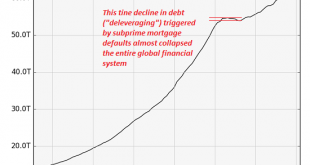

Without the stimulus of ever-rising credit, the global economy craters in a self-reinforcing cycle of defaults, deleveraging and collapsing debt-based consumption. In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by...

Read More »FX Weekly Preview: Punctuated Equilibrium and the Forces of Movement

[unable to retrieve full-text content]Shifting intermarket relationships pose challenge for investors. The market is convinced the Fed will not raise rates. Greater uncertainty surrounds the BOJ; there seems less willingness to shock and awe.

Read More »Yellow Lights are Flashing

Summary: Bonds are not rallying despite poor US data. Greater chance that Trump gets elected than the Fed hikes next week. Berlin may be more important than Bratislava. (Two week business trip is winding down, leaving London tomorrow and will be in Canada for the first couple days of next week, then back to NY. Sporadic posts to continue. Thanks for your patience) Yellow lights are flashing. Bonds remain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org