Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed of reach, eyes and ears against any and all nefarious souls who dare defy and attempt an escape into thick, ancient forests under dark cover of night. Today we use the very descriptive and accurate idiom with little thought as to how it came to be a part of our modern language. The credit should go to Charles Dickens for bringing that borrowed but altered expression forward in time. It was he who first coined and made use of the phrase, “the strong arm of the law,” in his debut novel, 1836’s The Pickwick Papers. This satire opens a window onto life as lived in mid-nineteenth century England. It is through humor rather than judgement that Dickens appeals to and gives readers a glimpse of their true characters as they stand on the precipice of the Victorian Age.

Topics:

Danielle DiMartino Booth considers the following as important: Bank of England, BOE, Brent Donnelly, Central Banks, Citigroup, Corruption, Deutsche Bank, European Central Bank, Featured, Federal Reserve, Italy, Japan, Mark Carney, Matteo Renzi, Meltdown, Monetary Policy, newsletter, Norway, Reality, Recession, Stress Test, Switzerland

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com,

“Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed of reach, eyes and ears against any and all nefarious souls who dare defy and attempt an escape into thick, ancient forests under dark cover of night.

Today we use the very descriptive and accurate idiom with little thought as to how it came to be a part of our modern language. The credit should go to Charles Dickens for bringing that borrowed but altered expression forward in time. It was he who first coined and made use of the phrase, “the strong arm of the law,” in his debut novel, 1836’s The Pickwick Papers. This satire opens a window onto life as lived in mid-nineteenth century England. It is through humor rather than judgement that Dickens appeals to and gives readers a glimpse of their true characters as they stand on the precipice of the Victorian Age.

Suffice it to say that many Britons today yearn for a time when hopefully fair and just monarchs, or later, elected officials, were the only lawmakers with whom they need comply. That bygone world starkly contrasts with the Britain of today, where the electorate finds itself being rigorously governed by the Bank of England (BoE), a deeply intrusive institution whose strictures may as well be law.

As is the case with the United States, those tasked with leading the BoE are unelected officials who have nevertheless risen to a power rivaling that of the duly elected. And, in the absence of any real fiscal courage, the words of central bankers are now being received as gospel rendering their ‘arms,’ and thus their reach, longer than was ever intended by those who envisioned at their inception bodies that were to be apolitical rather than the in-fact compromised institutions of today.

In early May, Mark Carney, the head of the BoE warned that a Brexit vote would not only cause job losses and trigger inflation, but that the risks “could possibly include a technical recession.” In response, Lord Norman Lamont, the former UK Chancellor, chided Carney for yelling the equivalent of fire in a crowded theatre, cautioning that a recession could prove to be a self-fulfilling prophesy brought on by the indiscreet lack of confidence voiced: “A prudent governor would simply have said, ‘We’re prepared for all eventualities.” Can we get a “Hear! Hear!”?

Adding what hopefully appeared to be gravitas to Carney’s alarmist statements, the world’s central banks have joined in the chorus, pledging with fanfare their readiness to step into the breach in the event of a Lehman-like credit market disruption. Can you imagine a more inflammatory way to incite fear? At the front of the line is, of course, the European Central Bank followed by the Federal Reserve and the central banks of Japan, Switzerland, Sweden and, not to be left out, Carney’s native Canada.

It is, no doubt, admirable that central banks are prepared for every contingency in the event of a Brexit, but the public pronouncements, with their accompanying publicity, smack of political complicity on the part of purportedly objective central bankers.

Several weeks ago, Carney answered the criticism with utter pretense, insisting, “We have not supported one side. We have supported low and stable inflation.”

To the credit of the Financial Times, the paper ran the appreciably less affected observations of Richard Sharp, a member of the BoE’s Financial Policy Committee: “The UK is a thoroughly investable economy; it would remain a thoroughly investable economy, whichever way the vote goes.” Sharp went on to add that he was, “very comfortable, from the financial stability issues associated, if there were to be a Brexit vote.”

The true fear lies with those who stand to lose the most, in this case the countries who hold the Euro currency together with the thinnest of threads. European banks are in a much more fragile state than their British and American counterparts, a point alluded to by Sharp. Look no further than the biggest winner as word spread that the ‘Leave’ vote had died the weekend preceding the Brexit vote; that would be Deutsche Bank.

More to the point, a Brexit would cast an immediate and harsh light on the next EU calendar event, an Italian referendum scheduled to come up for a vote in October. Italian Prime Minister Matteo Renzi has vowed to leave office if the referendum, aimed at reforming the constitution, fails to pass. Though his aims may be noble, the corruption that continues to emanate from Italy’s banking sector looks likely to catalyze the fall of Renzi’s government well before the autumn leaves turn.

The sickly Italian banking system can also be partially credited with the rise of the anti-establishment 5-Star Movement, which swept 19 of 20 mayoral elections this past weekend, including that of Rome. The party is a right-wing establishment whose lifeblood is an enraged populace who have screeched “Basta!” as in “Enough!” with the graft and the Italian economy’s other economic burden, nonstop immigration from North Africa.

To news novices, the migrant crisis and its price tag may appear to be a relatively new phenomena driven by the devolution of Syria. To the Italians, the saga has stretched on for a generation. By way of geography and proximity and little more, Italian taxpayers are obliged to bear the brunt of the cost of the immigrant crisis.

Consider that the population of foreign born residents has quadrupled since 2002 to over five million. With that as a starting point for calculating the tab, is it any wonder taxpayers are affronted by the $15,000 per annum, per capita effective tax hike to cover the cost of the hundreds of thousands of migrants who continue to flood Italy’s shores?

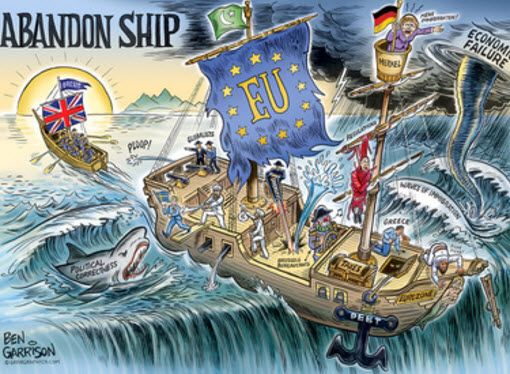

Now, extend this anger to countries who have been invited to share the bill as the ranks of migrants have exploded over the past two years. It’s easy enough to begin to understand the rise of the extreme right across Europe. Which brings us full circle to Brexit. The stakes of a Brexit rise appreciably when you consider that given the opportunity, many Euro members stand poised to join exiting Brits at their own polls.

How would this impact central banks’ grand experiment, even as the $10 trillion line in the sand of negative interest bearing instruments is crossed? Let’s just say it wouldn’t be pretty or containable An unravelling of the Euro would represent a sufficiently strong political stress test of the entire era of unconventional monetary policy.

Step back from the edge, though, and consider that a Brexit would herald a softer pathway to an inevitable dissolution of the Euro, which appears to be increasingly likely as the world economy flirts with recession. Not that this advice will be heeded, but why not treat a Brexit as a dress rehearsal for the real Euro un-deal when the time comes?

As for the financial markets, it’s convenient to have a novel reason to explain day-to-day market moves. The reality is we’ve probably seen the worst of it as stock market trading reflects the fear of an event coming to pass well ahead of its possible fruition.

“I personally think the drama is overdone,” said Citigroup FX trader Brent Donnelly who’s had a bird’s eye view on the action from his perch overlooking the currency markets. “Life would go on under a modified set of rules. The biggest impacts will be psychological and not real driven by the fear and uncertainty that could trigger a temporary dip in investment and spending.”

‘Temporary’ is the key word in Donnelly’s sober assessment. Seriously, who believes that French vintners and Italian prosciutto curers, to say nothing of the Mercedes of the world, would stand still for too long before saying, “Uncle!” Exporters to the UK need well-heeled British consumers much more than the UK needs them. And that’s just the way it is.

“There are plenty of countries outside the EU, such as Norway and Switzerland, who trade seamlessly with the EU,” offered Donnelly, sagely observing as any market veteran would, “And besides, when was the last time a scheduled event that the market was prepared for caused a major meltdown?” His rhetorical answer to his own question: “Never. There could be a panic for a few days, but there’s no systemic issue of concern.”

Given the opportunity, yours truly would indeed vote to Leave the EU. Alas, the roots of this writer are Italian and empathize with her relatives further south who’ve shouldered the economic burden of the ongoing immigrant crisis and corrupt politicians for far too long.

As Britons head to the polling booths, they should hold their heads high, rightly insulted at the feigned notion that the UK cannot stand on its own. After all, much of the civilized world we take for granted today is rooted in the British rule of law.

With that, it might be best to part ways for the week with the following words, care of the Bank of England’s sworn Code:

“We recognise that impartiality and objectivity are crucial to the decisive behaviours that form a core part of our Bank values. We know that our reputation for impartiality and independence is vital to our effectiveness, and, if lost, would be hard to recover.

Like other colleagues in the public sector, we know we must be seen to be apolitical and must never allow ourselves to become open to the perception that our decisions have been inappropriately influenced.”

If only that was the case, the vote to Leave might have passed on its own strong merits. And meanwhile, back at the Castle, the long arm of central bankers might have been retracted to its rightful, detached place. Remember that it was never intended that they be political beings invested with the omnipotent powers of long ago monarchs. Isn’t it time the once-long fiscal arm of our duly elected lawmakers reach out and rein in?