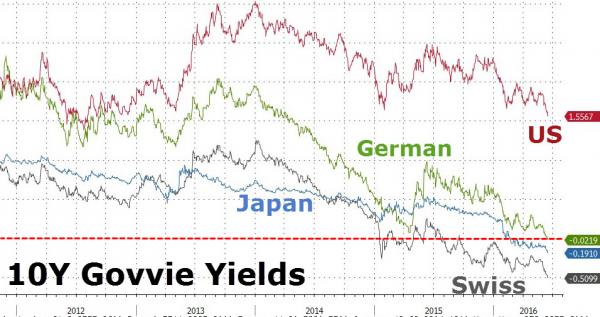

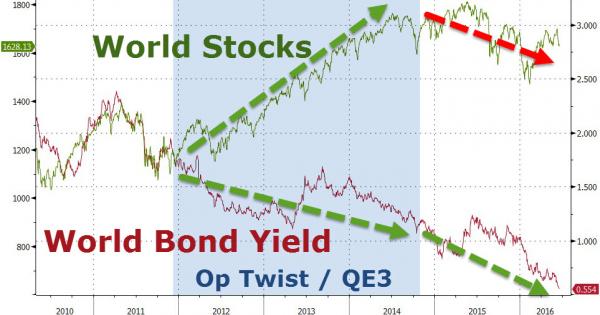

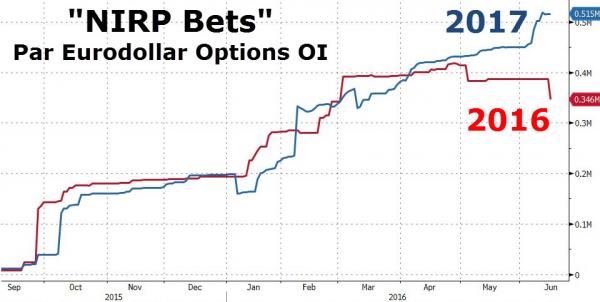

As the “deflationary supernova” sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the ‘cheapness’ of Treasury bonds lures the world’s yield-hunters dragging it ever closer to the negative rate realities of Switzerland, Japan, and Germany. As rate-hike odds collapse, along with The Fed’s credibility, so investors are increasingly betting on the chance that the inevitable negative interest rate washes ashore in a US money-market-crushing manner. While bets on ‘NIRP’ in 2016 have faded modestly, expectations for a ‘below-zero’ rate in 2017 (and implictly a stock market crash) have never been higher… Govvie Yield Curve We suspect the words “it could never happen here” were uttered numerous times in Switzerland, Japanese, and German halls of officialdom over the past few years… click to enlarge Rate-Hike Odds And with The Fed rapidly losing faith… click to enlarge 10Y Govvie Yields It appears not only are Treasury yields attractively ‘cheap’ (and “safe”) to the rest of the world’s bonds… click to enlarge World Bond Yield But their relative moves to stocks also suggest something is amiss in equity land around the world… click to enlarge NIRP Bets And so, traders are increasingly positioning for negative rates

Topics:

Tyler Durden considers the following as important: 10Y Govvie Yields, Bear Market, deflationary supernova, EuroDollar, Featured, Federal Reserve, Germany, Govvie Yield Curve, Japan, Market Crash, negative rates, newsletter, NIRP Bets, Rate-Hike Odds, Switzerland

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

As the “deflationary supernova” sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the ‘cheapness’ of Treasury bonds lures the world’s yield-hunters dragging it ever closer to the negative rate realities of Switzerland, Japan, and Germany. As rate-hike odds collapse, along with The Fed’s credibility, so investors are increasingly betting on the chance that the inevitable negative interest rate washes ashore in a US money-market-crushing manner. While bets on ‘NIRP’ in 2016 have faded modestly, expectations for a ‘below-zero’ rate in 2017 (and implictly a stock market crash) have never been higher…

Govvie Yield CurveWe suspect the words “it could never happen here” were uttered numerous times in Switzerland, Japanese, and German halls of officialdom over the past few years… | |

Rate-Hike OddsAnd with The Fed rapidly losing faith… | |

10Y Govvie YieldsIt appears not only are Treasury yields attractively ‘cheap’ (and “safe”) to the rest of the world’s bonds… | |

World Bond YieldBut their relative moves to stocks also suggest something is amiss in equity land around the world… | |

NIRP BetsAnd so, traders are increasingly positioning for negative rates in 2017… or, as we explain below, positioning cheaply for a stock market crash… |

[the chart shows the cumulative open interest in par calls on eurodollar futures contracts that expire in 2016 and 2017 – basically options on short-term interest rates with a strike price of zero, such that they pay out if the Fed takes rates negative]

As we explained previously, when queried whether this is indeed a trade to bet on a market drop, Michael Green responded as follows:

[A reader] thought this might be an attempt by hedge funds to hedge out their exposure to rising interest rates very cheaply.

My initial idea was that it actually could be a bet on negative rates (if for some reason the Fed had to come back into the picture with QE4).

The bottom line:

“Deep OTM puts on the S&P are very expensive while par ED calls are relatively cheap.

In my view, we are that inflection point where the Fed is going to start to waffle…the bear market beckons and they will not be able to stick with their interest rate guidance. Of course, markets tend to frown on Central Bankers revealed as less than omniscient…“

Loking at the chart above, one wonders if The Fed tries QE in 2016 first, and/or increases its war on cash before negative rates are forced upon Americans.