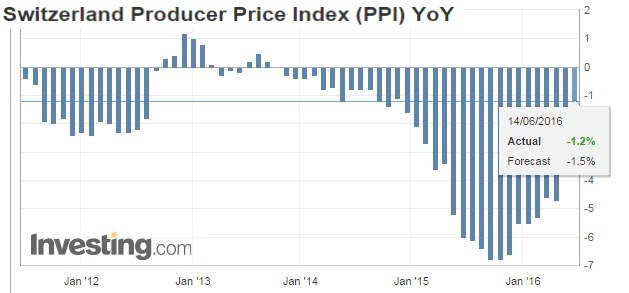

Swiss Franc The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. FOMC The FOMC meeting later today, with updated economic projections and a press conference, is the key event of the day, even though three other central banks meet over the next 24 hours. There are four things investors should know before the FOMC meeting. Calendar CET Time click to enlarge First, MSCI has chosen not to include China’s A shares in its emerging market indices. Several large banks had played up the chances, and emphasized the reforms that have been announced since last August. Of the 23 participants surveyed by Bloomberg 10 expected the A shares to be included and another eight thought it was too close to call. We were less sanguine and MSCI spoke to our concerns. Essentially the MSCI decision, which did not seem particularly close, was based on two main considerations. First, more reforms are needed. Second, more time is needed to evaluate the effectiveness of recently announced measures.

Topics:

Marc Chandler considers the following as important: Featured, Federal Reserve, FX Daily, FX Trends, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. |

|

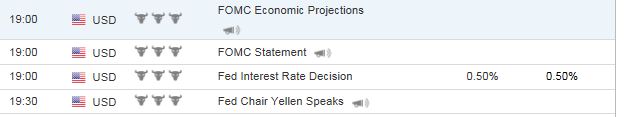

FOMCThe FOMC meeting later today, with updated economic projections and a press conference, is the key event of the day, even though three other central banks meet over the next 24 hours. There are four things investors should know before the FOMC meeting. |

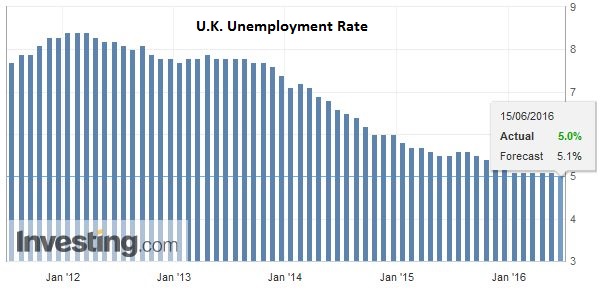

United KingdomSecond, there is no fresh developments on the UK referendum, and this is allowing sterling to bounce. It is gaining for the only the third session in the past eight. Sterling is the strongest of the major currencies today , gaining a little more than 0.5% against the US dollar to edge ahead of the Australian and New Zealand dollars. Some who favor the UK to remain in the EU may have overstated their case by blaming the economic slowdown to Brexit fears. The economy has been slowing gradually for a year or more and the most recent economic data has surprised on the upside.

The better than expected industrial and manufacturing data has been followed by a favorable employment report today. The ILO unemployment measure unexpectedly edged down to 5.0% from 5.1%. The claimant count fell by four hundred, though the April figure was revised higher (to 6.4k form -2.4k). The number of employed rose by 55k to 31.6 mln and the number of unemployed fell by 20k to 1.67 mln.

|

|

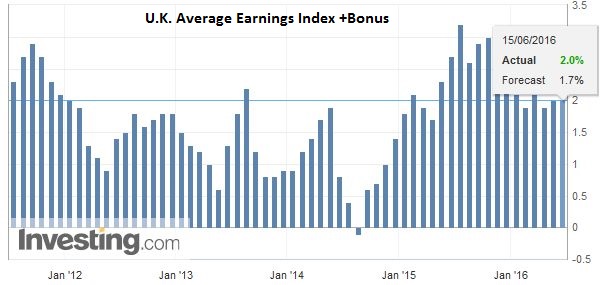

| Earnings are reported with an extra month lag, but were stronger than expected. In April, average weekly earnings were flat at 2.0%. Many expected the pace to fall to 1.7%. Excluding bonus payments, average weekly earnings rose 2.3% from a revised 2.2% (initially 2.1%). The median expectations was for a 2.0% rate. The 2.3% increase is the strongest since last September. | |

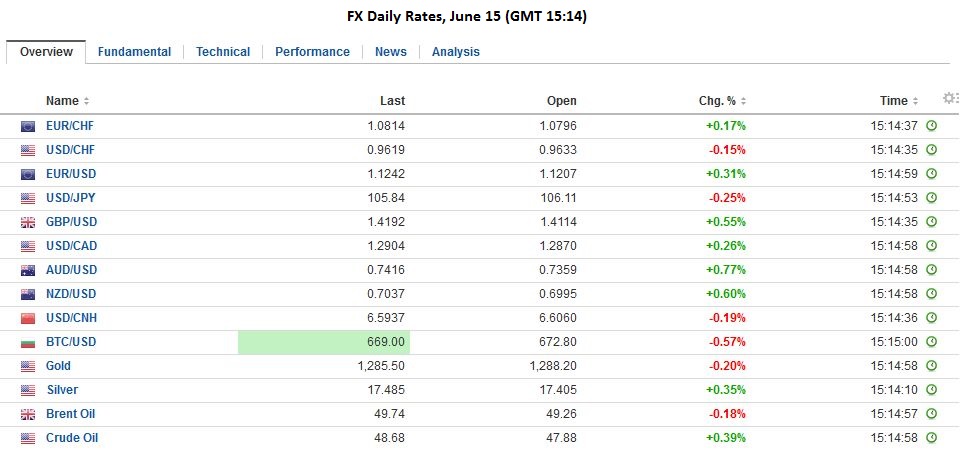

FX RatesThird, global capital markets are in a correction mode. The MSCI Asia-Pacific Index posted a minor gain to snap a four-session decline. The Dow Jones Stoxx 600 is up 1.4% near midday in London to break a six-session 7.5% drop. It is a broad advance today, with all sectors up more than 1% except energy. Core bond yields are slightly firmer, while peripheral European bonds are seeing 2-3 bp decline in 10-year benchmarks. In the foreign exchange market, the greenback is seeing yesterday’s gains against most of the majors trimmed. The yen and Swiss franc are marginally lower on the day. Still the dollar is holding below the previous days high (~JPY106.42) for the third consecutive session. However, thus far, the dollar is holding above the previous day’s low (~JPY105.63) for also the first time this week. |

|

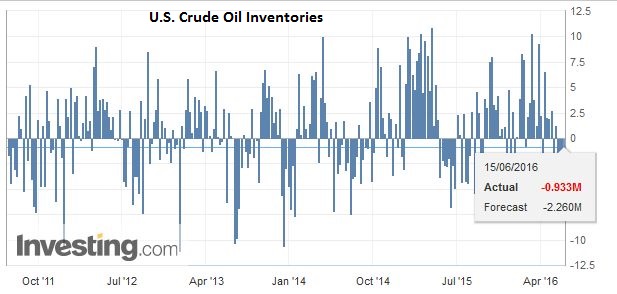

Oil PricesFourth, oil prices are softer following news of an unexpected US inventory build as estimated by API. The official DOE estimate will be reported later today. The July light sweet futures contract continues to flirt with the four-month uptrend. After closing last week below the 20-day moving average, the contract has sent the first half of the week below it. |

|

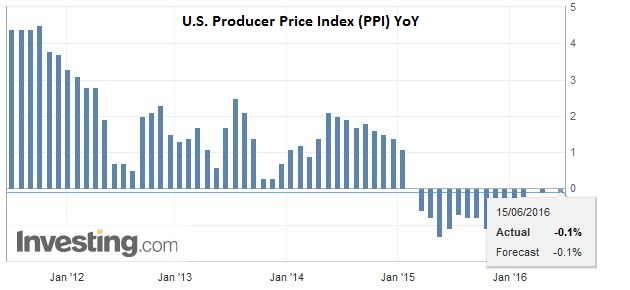

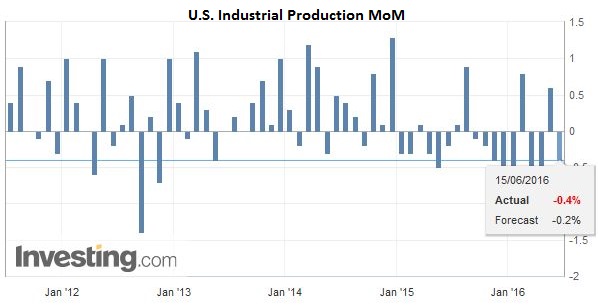

United StatesAhead of the FOMC meeting, the US reports producer prices, Empire State manufacturing survey (June) and industrial output. After yesterday’s import price surprise, the risk on PPI is on the upside. Industrial and manufacturing output may be softer after a 0.7 and 0.3% respective gains in April. The Empire survey is expected to show modest improvement. |

|

| Note that the Atlanta Fed’s GDP tracker now shows Q2 GDP growing by 2.8% after yesterday’s day, up from 2.5%. |

Graphs and additional information on Swiss Franc by the snbchf team.