Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual bonds, all of which would be bought by the BOJ. There may be a very big problem with what the market is pricing in, however. As Reuters reports, citing government and central bank officials directly involved in policymaking, “there is no chance Japan will resort to helicopter money.” The problem: it is prohibited by law to directly underwrite government debt, which means parliament needs to revise the law for the central bank to start directly bank-rolling debt. “Adopting helicopter money in the strict sense is impossible as it’s prohibited by law,” said one of the officials. “If it’s about the BOJ buying huge amounts of bonds and the government deploying fiscal stimulus, we’re already doing that.

Topics:

Tyler Durden considers the following as important: Abenomics, Bank of Japan, Ben Bernanke, Borrowing Costs, Central Banks, Debt and the Fallacies of Paper Money, Featured, Federal Reserve, Global Economy, Great Depression, Haruhiko Kuroda, Helicopter Money, Hyperinflation, Japan, Korekiyo Takahashi, Masahiko Shibayama, Monetization, newslettersent, Newspaper, Nikkei, Reality, Reuters, Shinzo Abe, Switzerland, Wall Street Journal, Yen

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual bonds, all of which would be bought by the BOJ.

There may be a very big problem with what the market is pricing in, however. As Reuters reports, citing government and central bank officials directly involved in policymaking, “there is no chance Japan will resort to helicopter money.” The problem: it is prohibited by law to directly underwrite government debt, which means parliament needs to revise the law for the central bank to start directly bank-rolling debt.

“Adopting helicopter money in the strict sense is impossible as it’s prohibited by law,” said one of the officials. “If it’s about the BOJ buying huge amounts of bonds and the government deploying fiscal stimulus, we’re already doing that.”

With the BOJ already keeping borrowing costs near zero with aggressive money printing, as the central bank already gobbles up more government bonds than is sold to the market each month under its massive monetary stimulus program, there is no strong push from premier Shinzo Abe’s administration to revise the law and force the central bank to resort to helicopter money, said the officials, who declined to be named due to the sensitivity of the matter.

While hardly a hurdle to Bernanke, the reality is that for Japan to adopt helicopter money, Abe would need to change the fundamental laws of central bank independence, and many are already rising up against this prospect. “It’s an illusion to think that a country can spend as much money as it wants, without having to pay it back,” said another official on condition of anonymity.

“I haven’t heard of any such discussions taking place in the Ministry of Finance,” a third source said, adding that adopting helicopter money was “unthinkable.”

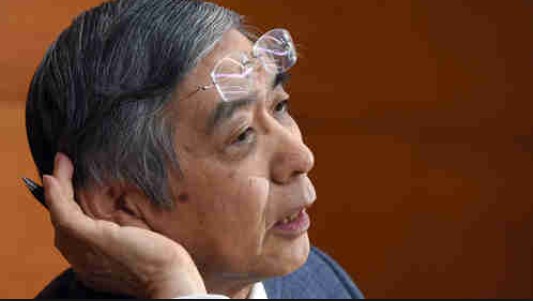

One can probably discount what BOJ Governor Haruhiko Kuroda said when he dismissed the idea of helicopter money, stressing the central bank is buying bonds not to finance debt but to hit its 2 percent inflation target: recall that Kuroda said just one week before Japan unveiled NIRP that no NIRP would come to Japan, which certainly dilutes any credibility he may have.

However, the dissent to Bernanke’s plan has spread far and wide, spreading as far as Abe’s cabinet.

Masahiko Shibayama, an influential aide to Abe, voiced caution over helicopter money involving the issuance of perpetual bonds.

Koichi Hamada, another key economic adviser to Abe, told Reuters on Thursday Japan should not resort to helicopter money as it could lose control of inflation. “Resorting to such a step would be sending a grave message to the international community” on Japan’s fiscal management, he told Reuters on Thursday. “We need to think carefully about how markets will react if we even signal it as an option.”

Worse, quoted by the WSJ, Hamada hinted at what we have said all along: helicopter money would be the precursor to hyperinflation.

Japan shouldn’t make its central bank directly underwrite government borrowing, or it could suffer the kind of runaway spending and inflation that followed a similar move in the 1930s, said Hamada.

“It would be too tempting for politicians. They wouldn’t give it up once you made it possible for them to print and spend as much money as they please, either for political purposes or for their own ambitions,” said Koichi Hamada in an interview with The Wall Street Journal recently.

The stern warning from the Yale University professor comes as economists increasingly speculate that Mr. Abe may resort to the radical step to save his campaign to escape deflation, a negative cycle of price falls. Mr. Abe’s recent pledge to bolster spending and his meeting earlier this week with former Federal Reserve Chairman Ben Bernanke, an advocate of monetization, has fueled such speculation.

Which is not to say that helicopter money is impossible. Supporters of the measure, known as “helicopter money,” view it as the quickest, surest way to stimulate demand and create the 2% inflation wanted by Mr. Abe. But the problem is that politicians may not have the self-discipline to withdraw the policy before it destabilizes the economy, Mr. Hamada said, playing down a recent local newspaper report that portrayed him as supportive of helicopter money.

“There is a huge risk that fiscal expansion would get out of control” if the Bank of Japan started underwriting government borrowing, Mr. Hamada said.

The adviser called attention to the consequences of debt monetization in the 1930s by finance minister Korekiyo Takahashi. Mr. Takahashi’s powerful stimulus helped the nation escape the Great Depression, but Mr. Hamada said it opened the door to aggressive military spending that later caused sky high inflation.

Mr. Takahashi was assassinated by rebel officers in 1936.

Other aides to Mr. Abe, including Japan’s ambassador to Switzerland Etsuro Honda, see Mr. Takahashi as a national hero and put the blame for spiraling spending and inflation squarely on the military and capacity shortages in a war-torn economy.

For now, the reality is that with a political gate to helicopter money, the best Japan can hope for is to jawbone the Yen and markets higher; however for Abe to actually change the law a far more drastic deterioration in Japan’s inflationary picture will have to emerge.

Renewed debate over helicopter money underlines the continued radicalization of discussions over how to remedy Japan’s lost two decades. It also reflects frustrations over the limited effects so far of Abenomics.

Hamada agreed that expanding fiscal and monetary policies at the same time is likely to produce stronger stimulus effects than implementing them in isolation. But Mr. Hamada said that if the BOJ continues to buy debt from the markets, not directly from the government, the policy coordination wouldn’t amount to monetization by strict definition.

Speaking of the BOJ’s coming policy decision on July 29, Mr. Hamada said he “can’t say with absolute certainty for now” whether the central bank should undertake additional easing. “It depends on how much stock prices will have recovered and how much the yen’s upward momentum will have weakened by then,” he said.

However, that goes back to problem #1 for Japan: it has insufficient bonds to monetize, forcing the BOJ to increasingly soak up ETFs and other non-debt instruments. As such, continuing with merely more QE will lead to even lower record JGB rates, sending even more acut deflationary signals to the local and global economy, and forcing Japanese investors to buy even more record amounts of offshore debt.

Mr. Hamada said policy decisions are up to Mr. Kuroda to make, but added that Japan’s tightening labor market means that officials don’t need to debate the need for action at every meeting. He also urged Japanese companies to stop expecting too much from the BOJ and instead to put their savings to better use, by investing more or offering sharper pay raises.

“I am wondering if those corporate managers…understand that they are a drag on the Japanese economy,” Mr. Hamada said.

They do, however with the help of such “experts” as Kuroda and Bernanke, they have every reason to believe that the punch bowl will not only not be taken away but will be spiked even more. This time, however, that may not happen.