With interest rates in many countries close to zero or even negative, some commentators are of the view that monetary policy of the central banks are likely to become less effective in navigating the economy. In fact it is held that we have most likely reached a situation that the economy is approaching a liquidity trap. But what does this mean? In the popular framework of thinking that originates from the writings of John Maynard Keynes, economic activity is...

Read More »Dollar Stabilizes as Markets Await Fresh Drivers

Press reports suggest that the mood in Beijing is pessimistic after President Trump pushed back against tariff rollbacks Fed Chair Powell met with President Trump and Treasury Secretary Mnuchin yesterday Hungary is expected to keep rates steady; the deadline to form a government in Israel is fast approaching RBA released dovish minutes from its November policy meeting The dollar is mostly firmer against the majors as markets await fresh drivers. Kiwi and Stockie are...

Read More »FX Daily, November 19: Hong Kong Stocks Rally as Stand-Off Continues

Swiss Franc The Euro has risen by 0.25% to 1.0981 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The run-up in equities continues to be the dominant development in the capital markets. Although the Japanese and South Korean bourses fell, the rise in Australia, China, Hong Kong, and Taiwan underpin the MSCI Asia Pacific Index. The Hang Seng’s gains (1.5% on top of yesterday’s...

Read More »Things the UN does (that you might not know about)

The ITU has identified the ‘digital gender gap’ as a problem in poorer countries, where men are getting online faster than women. What did the United Nations ever do for us? At the risk of a bit of cliched riffing on that famous scene in Monty Python’s Life of Brian, this month’s column is going to take a look at things the UN does that you may not know about. And one thing in particular: promoting fair and equitable access to the internet. Don’t click away! This is...

Read More »Swiss Trade Balance October 2019: exports fall but remain stable

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »Most Swiss prefer home grown eggs, meat and dairy

© Swisshippo | Dreamstime.com Recently published statistics suggest most Swiss prefer home grown animal products. Three quarters (75%) of those surveyed said they preferred Swiss eggs and more than half preferred Swiss meat (51%) and dairy products (59%). Reasons for preferring local animal products were to support local farmers (nearly 25%), low food miles (15%) and product quality (15%). 40% considered Swiss agriculture to be trustworthy and 33% thought it was...

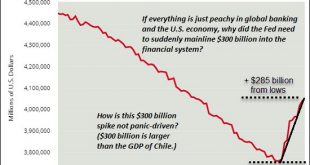

Read More »If Not-QE Is QE, then is Not-a-Blowoff-Top a Blowoff Top?

Can $300 billion, or $600 billion, or even $1 trillion continue to prop up an increasingly risk-riddled, fragile $330 trillion global bubble in overvalued assets? When is “Not-QE” QE? When Federal Reserve Chairperson Jerome Powell declares QE is not QE. We can constructively recall the story that Abraham Lincoln famously recounted in 1862: ‘If I should call a sheep’s tail a leg, how many legs would it have?’ ‘No, only four; for my calling the tail a leg would not...

Read More »True US Economy About To Be ‘Revealed’ – Stockman Interview

David Stockman is the former budget director for President Ronald Reagan and author of “Peak Trump: The Undrainable Swamp and the Fantasy of MAGA” He believes that the market “can’t digest” all the money flooding into Wall Street and that the Federal Reserve responded with panic. Click Here to Watch the Full Interview David Stockman Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World ◆ GOLDNOMICS PODCAST – Episode 13 – Lucky for some ! ◆ Why is nobody...

Read More »The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is radically different)....

Read More »Globalist-Endorsed War on Cash May Be China’s Next Terrifying Weapon

Recent protests in Hong Kong, along with the resulting fall out from international corporations questioned for their relationships with mainland China, has placed a renewed focus on the authoritarianism of the Chinese Communist Party. This has led to several articles identifying ways in which Western countries have learned from the CCP, including Europe’s growing embrace of web censorship and growing interest in the social credit system rolled out in 2018. Given that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org