Mainstream thinking considers the central bank a key factor in the determination of interest rates. By setting short-term interest rates, the central bank, it is argued, can influence the entire interest rate structure by creating expectations about the future course of its interest rate policy. In this way of thinking, the long-term rate is an average of current and expected short-term interest rates. If today’s one-year rate is 4 percent and the next year’s...

Read More »FX Daily, December 12: Enguard Lagarde

Swiss Franc The Euro has risen by 0.08% to 1.0946 EUR/CHF and USD/CHF, December 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.comeur - Click to enlarge FX Rates Overview: With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading...

Read More »Monetary policy assessment of 12 December 2019

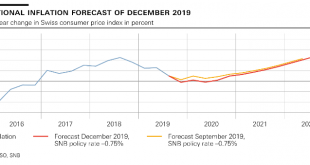

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The expansionary monetary policy continues to be necessary given the inflation outlook in Switzerland. The trade-weighted exchange rate of the Swiss franc...

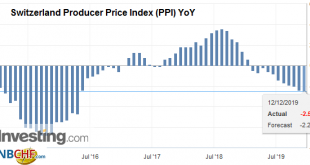

Read More »Swiss Producer and Import Price Index in November 2019: -2.5 percent YoY, -0.4 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Money for nothing – Swiss government gets paid to borrow

© Radomír Režný | Dreamstime.com Imagine borrowing CHF 105,500 but only having to repay CHF 100,000 in 20 years time, including interest. You’d get an interest free loan plus an extra CHF 5,500 to keep. This is what the Swiss federal government will do on 20 December 2019, except it will borrow CHF 196.6 million by issuing zero interest bonds at a price of 105.5%. The government will generate a CHF 10.25 million windfall. In addition, investors interested in this...

Read More »Nestlé identifies over 18,000 child labourers in cocoa supply chain

23% of monitored children were found to be engaged in “unacceptable” tasks. (Keystone / Christine Nesbitt) As part of its monitoring programme, Swiss multinational Nestlé has identified 18,283 children performing “unacceptable” tasks at cocoa farms that supply beans to the company. Over half have been rehabilitated following company intervention. In 2012, Nestlé established a Child Labor Monitoring and Remediation System (CLMRS) in partnership with the International...

Read More »Why “This Sucker Is Going Down”

Once the contagion starts spreading, loose money won’t put the fires out. As the nation’s political and economic leaders struggled to contain the 2008 financial meltdown, President George W. Bush famously summed the situation up: “If money doesn’t loosen up, this sucker will go down.” Eleven years into the loose money recovery, this sucker is finally going down for reasons that have little to do with tight money and everything to do with the inconvenient fact...

Read More »If Trade Wars Couldn’t, Might Pig Wars Change Xi’s Mind?

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is usually a thick...

Read More »Central Banks May Be Driving Us Toward More Waste, More Carbon Emissions

Christine Lagarde, the new president of the European Central Bank (ECB), has added a new green dimension to monetary policymaking. The charming Frenchwoman signaled that the ECB could buy green bonds, possibly as part of the reanimated bond purchase program (a form of QE). This could reduce the financing costs of green investment projects. If interest rates were negative, the green bond purchases would even amount to a subsidy for climate-friendly investment. This...

Read More »FX Daily, December 11: Sterling Holds Firm Despite Tighter Poll

Swiss Franc The Euro has risen by 0.12% to 1.093 EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets continue to tread water as investors await this week’s key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde’s first ECB meeting at the helm. Global equities continue...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org