Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is radically different). Perverse Inventives Second, negative interest perversely incentivizes some very perverse behaviors. For example, suppose you could borrow at -1% and just hold the cash. Your asset stays the same, while your liability is going down. You are making a positive return for doing nothing productive! It should

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, bubble, capital consumption, Featured, newsletter, perverse behavior, perverse incentive, perverse outcome, speculation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is radically different).

Perverse Inventives

Second, negative interest perversely incentivizes some very perverse behaviors.

For example, suppose you could borrow at -1% and just hold the cash. Your asset stays the same, while your liability is going down. You are making a positive return for doing nothing productive! It should be obvious to an 8th grader, though perhaps not a PhD economist, that there is something wrong with this. Grossly, monstrously wrong.

Of course this example is an oversimplification. Banks pay negative interest (i.e. charge) on cash deposits in countries with negative borrowing cost. So your asset is going down along with your liability. Withdrawing paper bank notes in large quantity—major institutions have negative unsecured borrowing cost, not individuals—is impractical. We’ve been told that in Switzerland, there are fees both to withdraw large amounts of paper notes and to deposit them. There is no free money to be had this way.

As an aside, the monetary authority has to impose a cost on the holding of paper which is greater than or equal to the cost of negative interest on a deposit. If they don’t, then as the rate of interest falls, they are offering an increasing perverse incentive to withdraw paper notes. This would create a perverse incentive to run on the commercial banks.

OK, it’s not that simple. How can we add a bit of complexity to achieve the goal of the simple example? Instead of holding cash, you must buy an asset. If the asset has a yield, so much the better. But even if—net of all carrying and maintenance costs—the yield is zero, it still works.

At this point, the reader might be thinking to buy gold. Alas, gold incurs the risk of its price dropping. Suppose you borrowed $100,000,000 on September 4 and bought 64,516 ounces of gold. Today, that gold is worth $94,709,677. You would have negative equity of over $5 million.

Perverse Outcomes

You need an asset that is practically guaranteed not to go down. Real estate seems suitable for this purpose. So you borrow that $100,000,000 and build an apartment complex. In a normal world, you would care about occupancy and rent. Whether you are investing your own, or borrowed, money you are trying to make a good return on capital. But this is a negative-interest world. You don’t need to make a profit. You just need an asset without a carrying cost that holds its value. The negative cost of borrowing provides your profit.

In other words, you don’t make a profit by providing something needed by customers in the market, such as a home for rent. You make a profit off the back of the lender, who forfeits 1% of his principal to you every year.

The predictable result of this perverse incentive is that institutions will continue to borrow and build more and more housing, driving down rents and occupancy rates so that the net return on capital for landlords is zero. Note that this happens to all landlords, even those who borrowed during the halcyon days of positive interest rates. Housing is a competitive market, and tenants do not know or care which landlord has higher interest expense. They care only about the location, size, interior finishes, and of course the rental rate.

The return on capital in all other endeavors will also be driven down. It will go down to marginally above the interest rate. In our examples, we are guessing +1% spread above the interest rate as a good first guess, but this is not necessarily the right number.

We leave it as an exercise for the reader to answer what will happen to the return on capital when the interest rate falls another point, to -2%.

Wrong Models

As an aside, consumer advocates and putative defenders of free markets cheer the whole way. Consumer advocacy is based on a fundamental Marxist premise: that there is a class conflict between the class of tenants and the class of landlords (and more generally, the class of consumers vs. the class of producers). They see soft or falling rent (or rising quality of interior finishes with same rent) as occurring despite the greed for exploitation of the class of landlords. The government, in their view, must have found the right ways to nudge the class of landlord exploiters to lower their rents.

Free-marketers have a different premise. They know that whenever the government interferes in markets, it does so by force. And they know that nothing good comes out of the barrel of a gun. But they have an oversimplified view of this as a single scalar, which could be thought of as friction. So in their view, soft or falling rent occurs despite friction. The landlords, in their view, must have found ways to become more efficient, and lower rent.

The former are closer to correct. Not about the absurd materialist idea that everything is class conflict. They are partially right that the government has found a way to nudge landlords. In central bank socialism, that way is: to lower the interest rate. And keep lowering it to zero, to “euthanize the rentier” as Keynes said. And even beyond, to negative rates.

The latter are just wrong. The government can do things that are simply not a kind of friction. Such as lower the interest rate.

And everyone who accepts the Quantity Theory of Money is marveling that rent is falling despite the increase in the quantity of what they think of as money. The drop in rents is occurring because of the drop in interest rates, not despite the increase in M0 or M2 or whatever measure of quantity of dollars.

All three of these groups believe that the fall in rent is occurring despite whatever it is that they are primarily obsessed with. However, the phenomenon is not occurring despite those things. They are simply wrong in obsessing over those things that they obsess over.

By the way, note that we do not use the word bubble. Bubble implies that a price has temporarily spiked. What we are describing is a perverse incentive offered to all market participants to borrow to buy and/or build new real estate. This incentive is durable, and growing with the falling of the interest rate (well, as durable as the regime of irredeemable paper currency itself).

The Strong Economy

Note also that the construction of half-filled apartment buildings—to be rented at a price that barely covers costs—adds to GDP and employment. Those who are inclined to cheer the strong economy can point to employment and GDP numbers that rise despite the tax and regulatory environment.

We can only say that, whatever the word is for an economy where the certain losses of the investors incentive and enable borrowers to build unneeded overcapacity that they rent at no profit, that word is not strong.

Supply and Demand

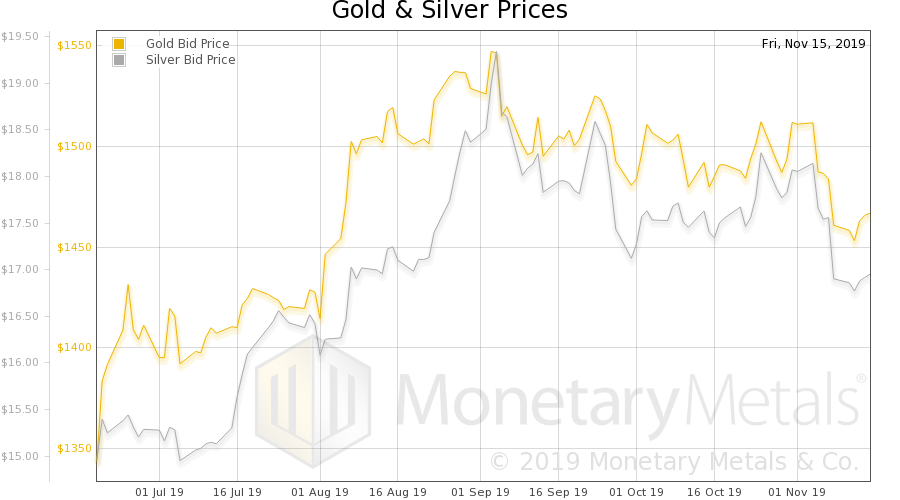

The price of gold was up $9, and the price of silver was up $0.18.

This week, our thought turns to that the cherished old saw. Gold bugs often tell us that the purchasing power of gold is constant. An ounce of gold could have purchased, they say, a fine toga in Roman times. Just as it could buy a fine suit today. We don’t know where they do their shopping, but one can buy a fine suit for a lot less than $1,465 (one could also spend multiples of that for a very fine suit).

In any case, the purchasing power of gold changed this week. Gold can buy 0.62% more fine suitage than it could last week.

The gold bugs also tell us that one reason to hold gold is that gold owners will be rewarded with more purchasing power. How one squares this circle with 2000 alleged years of constant purchasing power, we don’t know. We can only say that there are many forces that push prices up and down. That is, prices are not intrinsic to the money. They are not built-in to the money, but merely expressed in money.

There are not bags of groceries stored inside any asset. But if there were, some more of them leaked out of a bitcoin this week. These groceries poured into US equities. The S&P confirms this strong economy, adding about another quarter grocery to the index. It is at a record high, over 31 groceries per unit of the S&P.

A little-known fact (Keynes smirked that it will not be observed by one in a million people) is that the more groceries are pumped into a yielding asset, the lower the yield is driven. Yield is the inverse of price. This is great for those who sell the asset, as the buyer forks over a greater amount of capital for him to spend. But terrible for savers and pension funds, whom Keynes thought were functionless parasites to be euthanized.

So long as asset prices are rising, most people are happy to cheer the process on. 999,999 out of a million people, at first estimate.

They call it a strong economy. The conversion of one party’s wealth into another’s income, to be spent—while adding jobs and increasing GDP—does not make for a strong economy. Is it a bubble? Is there an everything bubble? We don’t think the concept quite applies.

There are arbitrage mechanisms between the market rate of interest and the yield on all assets. As the interest rate falls—which is not a bubble—then the yield on all other assets drops. If the market interest rate is 2%, then you won’t be able to buy a $100,000 property and make $10,000 a year, which is a yield of 10%. If you could, then someone would borrow $100,000 at 2% to buy that property. This would push up its price. The next investor would do it. Until the price was, say, $333,000, making the yield 3%.

The same is true for stocks. If the S&P has a dividend of $57.22, and its price is $3,115 then its dividend yield is 1.8%. That is actually below LIBOR. It is the yield on the 10-year Treasury. Equities carry a risk that Treasurys do not. So the yield should be higher. On the other hand, people can get excited about equities. They can believe in a strong economy and therefore further gains in equity prices. So they can bid up the price / push down the yield to the level of Treasurys or beyond. Which is where we are now.

Could there be another round of borrowing to consume that will drive earnings higher, thus yields higher, thus further rise in prices / drop in yield? There could. Would we bet on it? We would not. It has been a very long boom and consequent bull market. Enormous amounts of capital have been consumed. It will have to be written off sooner or later, but right now this phantom capital commands a high valuation.

We don’t know how to account precisely for the synergistic effects falling interest rates:

- borrowing to consume

- and liquidating assets to consume

- which fuels earnings

- which spurs capital investment

- which adds to employment and spending

- which fuels earnings

- and rising asset prices

- goto 1

We just know that the effect is significant. And that it will reverse sooner or later. And when it does, people will turn to gold as the one financial asset without counterparty risk. And not subject to earnings expectations.

Gold and Silver PricesWe will look at that the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell slightly this week. |

Gold to Silver Ratio(see more posts on gold silver ratio, ) |

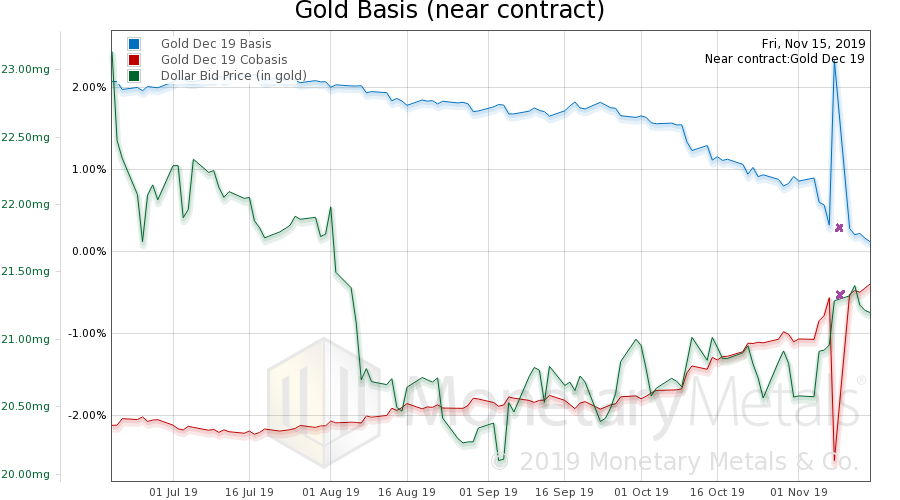

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. It rose this week. Last week, there was a great anomaly in the gold basis and cobasis. You can see the big spikes up in the blue line, and down in the red. This week, the anomaly disappeared and the normal trends for those lines continued. That is, the abundance of gold (i.e. the basis) is falling, and the scarcity (i.e. cobasis) is rising. We put little X’s where the real values for both indicators likely should have been on Friday. This, of course, is the December contract, now close to expiry. As each contract approaches this point, speculators must close their position in that contract. If they want to keep their position, they can trade the next contract month. The gold bugs believe the banks are short speculators. And they often discuss what would happen if the longs all stood for delivery. In this view, banks would have to buy the expiring contract, as they cannot deliver the metal. And the longs all have the option of paying the cash to take delivery. If all this were true, the price of the December contract would be rising right now. In fact, the banks are arbitragers. They have no urgency. But the longs are mostly naked, they have not got the cash to take delivery of the metal. So the longs are selling, which we observe as a falling basis (which is essentially Future price minus spot price). |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

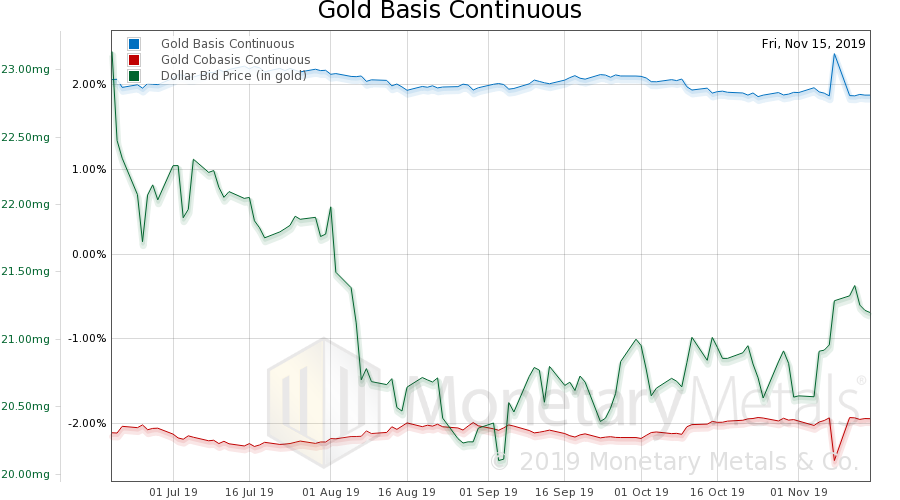

Gold Basis and Co-basis and the Dollar PriceHere is the chart of the gold basis continuous. It does not show the same apparent trend of rising scarcity since October. The Monetary Metals Gold Fundamental Price, was down $16 this week, to $1,465. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

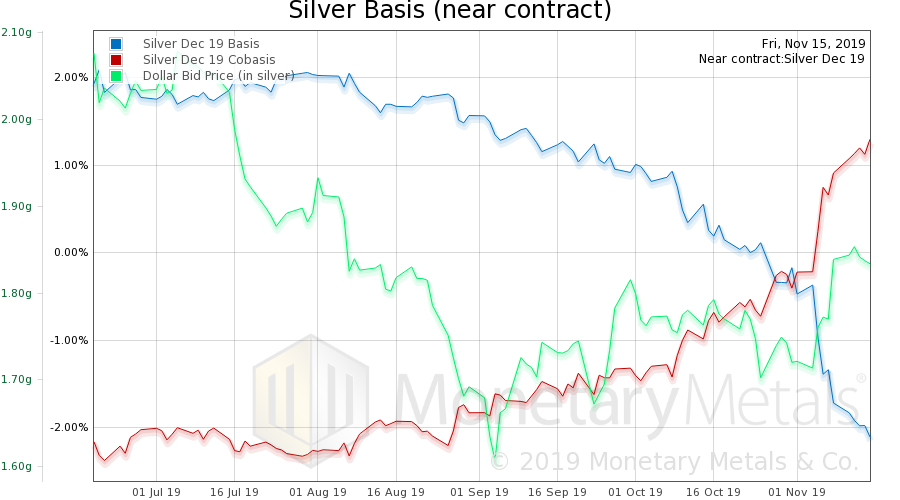

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. There is a sizeable temporary backwardation in silver. With its lesser liquidity, the forced selling of the longs drives the price of the expiring contract down. The Monetary Metals Silver Fundamental Price fell by another 15 cents, to $16.32. People have no need of gold and silver to increase their purchasing power. So far, equities are doing that job just fine. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,bubble,capital consumption,Featured,newsletter,perverse behavior,perverse incentive,perverse outcome,speculation