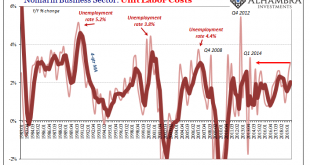

There’s a couple of different ways that Unit Labor Costs can rise. Or even surge. The first is the good way, the one we all want to see because it is consistent with the idea of an economy that is actually booming. If workers have become truly scarce as macro forces sustain actual growth such that all labor market slack is absorbed, then businesses have to compete for them bidding up the price of marginal labor. This is, of course, the exact scenario we’ve been...

Read More »The Real Boom Potential

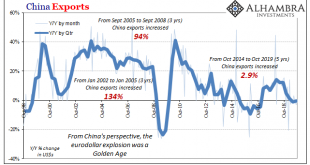

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving. For many of them, it is the typical broken windows stuff. The war devastated Europe and much of the...

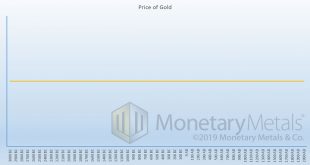

Read More »What’s the Price of Gold in the Gold Standard, Report 10 Nov

Let’s revisit a point that came up in passing, in the Silver Doctors’ interview of Keith. At around 35:45, he begins a question about weights and measures, and references the Coinage Act of 1792. This raises an interesting set of issues, and we have encountered much confusion (including from one PhD economist whose dissertation committee was headed by Milton Friedman himself). Gold, Paper, and Redeemability Back in the 18th century, three facts were obvious and not...

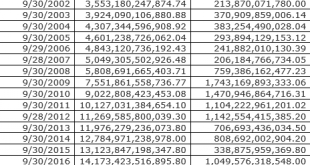

Read More »The Feds Spend More on National-Debt Interest Than You Think

Recently, the Treasury Department reported a 26% increase in the federal budget deficit with a 2019 deficit of $984 billion. The reported data on the budget can be misleading. You might think that a budget deficit is the amount of spending that exceeds budget revenue, in other words, the amount of borrowing needed to make up for this shortfall. However, in the world of Washington D.C., not all spending is counted as spending and it’s possible for the government to...

Read More »FX Daily, November 11: Dollar Consolidates and Equities Follow Asia Lower

Swiss Franc The Euro has fallen by 0.23% to 1.0964 EUR/CHF and USD/CHF, November 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Escalating violence in Hong Kong and the continued fall in Chinese producer prices weighed on equities in Asia Pacific trading. The MSCI Asia Pacific Index has risen nearly 7% during the five-week rally and is off to a weak start this week. Hong Kong’s Hang Seng fell around 2.6%,...

Read More »USD/CHF Technical Analysis: Positive beyond 200-day SMA, 50 percent Fibo.

USD/CHF fails to cross mid-October high, 61.8% Fibonacci retracement. A downside break of 0.9948 could recall 0.9900 on the chart Bullish MACD keeps buyers hopeful. The USD/CHF pair’s failure to rise beyond mid-October highs can’t be considered as it’s weakness unless the quote traders above 200-day SMA, 50% Fibonacci retracement of April-August downpour. The prices seesaw around 0.9970 during early Monday. Also favoring the buyers are the bullish signals from 12-bar...

Read More »Billionaire Boom “Has Now Undergone A Natural Correction”

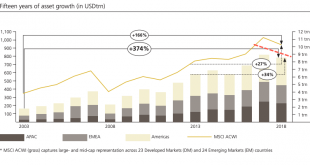

Over the last five years ending in 2018, the billionaire boom created more billionaires than the world has ever seen. These financial elites saw their wealth increase by more than a third over the same period, but as soon as 2018 rolled around, the billionaire boom deflated, according to a new UBS/PwC Billionaires Report. Global central banks pumped trillions of dollars into global financial markets and helped produced nearly 589 billionaires during the period,...

Read More »French-speaking cantons biggest winners from next year’s fiscal transfers

© Swisshippo | Dreamstime.com The amount of money paid by “rich” cantons to “poor” ones will rise by CHF 61 million to CHF 5.3 billion in 2020, according to a recent government press release. The only French-speaking canton paying will be Geneva. All of the rest will see the sums they receive rise compared to 2019. In 2020, Geneva will pay CHF 275 million, down slightly from the CHF 300 million it paid in 2019. In 2020, the canton of Fribourg will receive CHF 387...

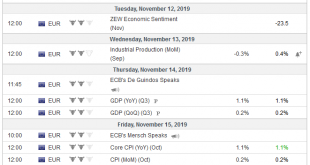

Read More »FX Weekly Preview: Caution: Prices Diverging from Macro Drivers

Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world’s two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce. The Federal Reserve, the European Central Bank, the People’s Bank of...

Read More »EM Preview for the Week Ahead

EM was mostly lower last week, as doubts crept in about the recent trade optimism. Some events also served as reminders of idiosyncratic EM risk that can’t be overlooked, such as downgrade risks (South Africa), failed oil auctions (Brazil), and violent protests (CLP). EM may remain on its back foot until we get further clarity on the US-China talks, but we remain confident in our call that a deal will be struck soon that lower existing tariffs. AMERICAS Mexico...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org