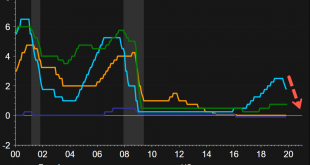

There’s been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump’s support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%. It seems that policy rates in the US are too high — and will likely conform to the rest of the world, which is near zero to negative territory. This has undoubtedly...

Read More »USD/CHF Technical Analysis: 200-day SMA, 7-week-old trendline cap rise to 8-day high

Following its latest recovery, USD/CHF rises to the highest since the previous Tuesday. 200-day SMA and multi-week-old resistance line hold the key to pair’s run-up towards 1.0000 mark. 0.9870 can entertain short-term sellers. Based on its U-turn from 0.9870, the USD/CHF pair current takes the bids to the highest in eight-day while trading around 0.9940 during early Friday. However, 200-day Simple Moving Average (SMA) and a downward sloping trend line since...

Read More »The Deep State: The Headless Fourth Branch of Government

School children learn that there are three branches of government: the legislative, executive, and judicial. In actual practice, however, there are four branches of government. The fourth is what for decades now has been called a “headless fourth branch of government,” the administrative state. As early as 1937, in a ” Report of the President’s Committee on Administrative Management ,” the authors write: Without plan or intent, there has grown up a headless “fourth...

Read More »Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue South Africa is expected to cut rates by 25 bp to 6.25% Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected The dollar is mostly weaker against the majors in very narrow ranges as markets...

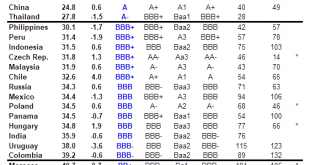

Read More »EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance. These scores...

Read More »Freedom Means a Right to Discriminate

Should employers have the right to discriminate in hiring on the basis of obesity? The Washington State Supreme Court recently ruled that “it is illegal for employers in Washington to refuse to hire qualified potential employees because the employer perceives them to be obese.” That follows guidelines released by the New York City Commission on Human Rights stating that discrimination against people based on their hairstyle will now be considered a form of racial...

Read More »FX Daily, November 21: Markets Hear What it Wants from China’s Chief Negotiator, but HK maybe New Obstacle

Swiss Franc The Euro has risen by 0.14% to 1.0984 EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and...

Read More »OECD rechnet für 2020 mit höherem Wachstum in der Schweiz

Vor allem der Einfluss internationaler Sportereignisse wird das Wachstum des Bruttoinlandprodukts (BIP) im kommenden Jahr ankurbeln, erklärte die OECD. Entsprechend werde es 2021 wieder auf 1,0 Prozent zurückfallen. Für das laufende Jahr erwartet die OECD eine Zunahme des BIP um 0,8 Prozent. Das Wachstum werde in Summe also moderat bleiben, resümierte die Organisation. Denn das düstere globale Umfeld und anhaltende Handelsstreitigkeiten würden den Export und die...

Read More »USD/CHF Technical Analysis: 5-week-old triangle can limit declines below 200-bar SMA

USD/CHF fails to extend uptick beyond 200-bar SMA, 50% Fibonacci retracement. The symmetrical triangle continues to favor sideways momentum. While failure to break 200-bar SMA and 50% Fibonacci retracement speaks loudly of the USD/CHF pair’s weakness, a month-old symmetrical triangle could restrict pair’s near-term moves. The quote takes the rounds to 0.9910 by the press time of the pre-European session on Thursday. Given the quote’s latest slip beneath key technical...

Read More »Factory lays off workers amid gloomy manufacturing outlook

Mikron’s factory in Agno, canton Ticino, has been hit by reduced demand from the automotive industry. (© Keystone / Christian Beutler) Swiss precision machine maker Mikron has laid off 25 workers, citing weak demand for its products from the global car industry. The news reflects pessimistic sentiment from Swiss manufacturers and the wider economy. Mikron announced on Tuesday that it would have to reduce headcount at a plant in southern Switzerland from its present...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org