There’s been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump’s support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%. It seems that policy rates in the US are too high — and will likely conform to the rest of the world, which is near zero to negative territory. This has undoubtedly alarmed UBS CEO Sergio Ermotti, who said banks have “no choice” but to pass on the negative rate pain to customers. Ermotti said UBS “will not pass negative rates to smaller clients, the personal banking clients,” that’s because if UBS and other EU banks actually passed along negative rates to poor and

Topics:

Tyler Durden considers the following as important: 3.) Swiss Banks, Donald J. Trump, Featured, newsletter, Sergio Ermotti

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| There’s been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump’s support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%.

It seems that policy rates in the US are too high — and will likely conform to the rest of the world, which is near zero to negative territory. This has undoubtedly alarmed UBS CEO Sergio Ermotti, who said banks have “no choice” but to pass on the negative rate pain to customers. Ermotti said UBS “will not pass negative rates to smaller clients, the personal banking clients,” that’s because if UBS and other EU banks actually passed along negative rates to poor and middle-class families — that would quickly spark unwanted social unrest that could crash the entire system.

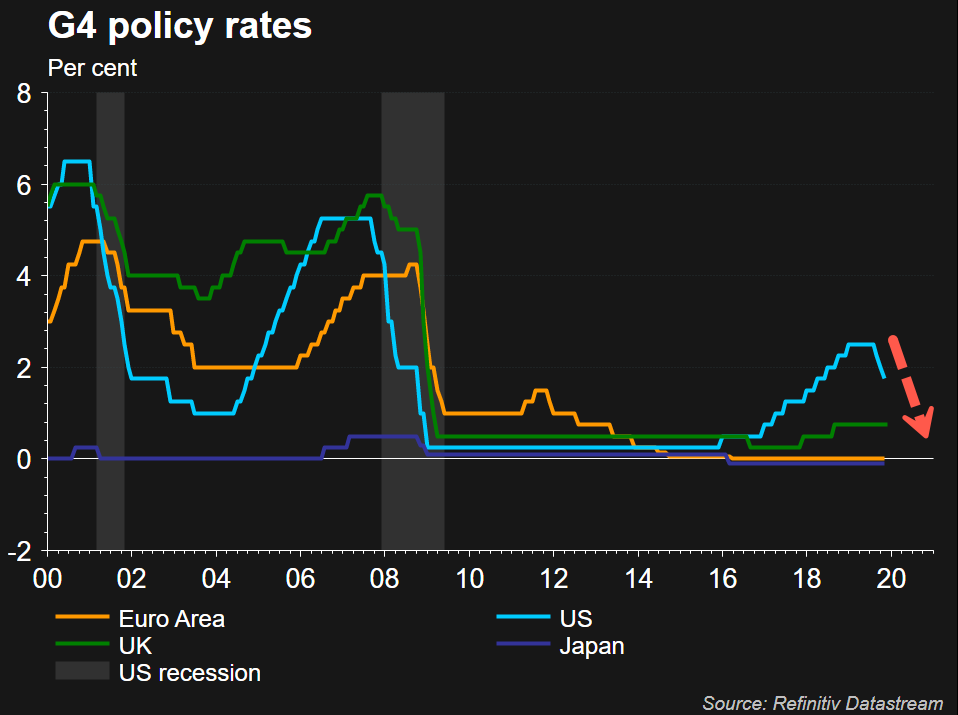

“It’s difficult to make a prediction right now, but we are quite convinced it’s not going to go down to smaller investors.” And of course, banking elites are smart enough not to pass on negative rates to poor people, but as per the Bloomberg interview, Ermotti will be targeting high-net-worth investors with more than 500,000 euros or 2 million Swiss francs. G4 policy rates are near zero, with the exclusion of the US. But with the Federal Reserve embarking on a new interest rate cut cycle in response to collapsing global growth, it seems that policy rates across the world could go deeper into the negative territory through 2020. |

G4 policy rates, 2000-2020 |

The ECB and SNB have slammed rates into negative territory in recent years in hopes to stimulate domestic and regional growth by charging banks to deposit funds, rather than lending to consumers or businesses, Bloomberg noted.

Negative interest rates have been in an absolute disaster in Europe, with Germany teetering on the edge of a recession.

Though Trump on Twitter has been begging for negative rates for the last several months as the US economy grinds to halt in Q4. Trump could see negative rates, but it will be for all the wrong reasons, and then US banks will have to make the decision that European banks are currently going through, which is how to pass along negative rates to customers.

The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. We have the great currency, power, and balance sheet…..

— Donald J. Trump (@realDonaldTrump) September 11, 2019

The failure of monetary policy in Europe has pushed the region to a near recession with EU banking stocks down 13% on the year.

And as UBS’s Ermotti said in the interview, he has no other choice to pass through negative rates to clients, but at the moment, his bank will charge only wealthy clients. This means wealthy depositors will have to pay UBS to store their money in the bank.

Tags: Donald J. Trump,Featured,newsletter,Sergio Ermotti