Swiss Franc The Euro has risen by 0.14% to 1.0984 EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and follow-through selling was seen in Asia Pacific and Europe. Hong Kong, South Korea, and Singapore equity markets fell more than 1% to lead today’s sell-off. However, comments from China’s chief negotiator that he was still “cautiously optimistic” that a deal will be struck lifted the markets off their

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, EUR/CHF, Featured, FX Daily, Hong Kong, liu he, newsletter, South Korea, trade, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

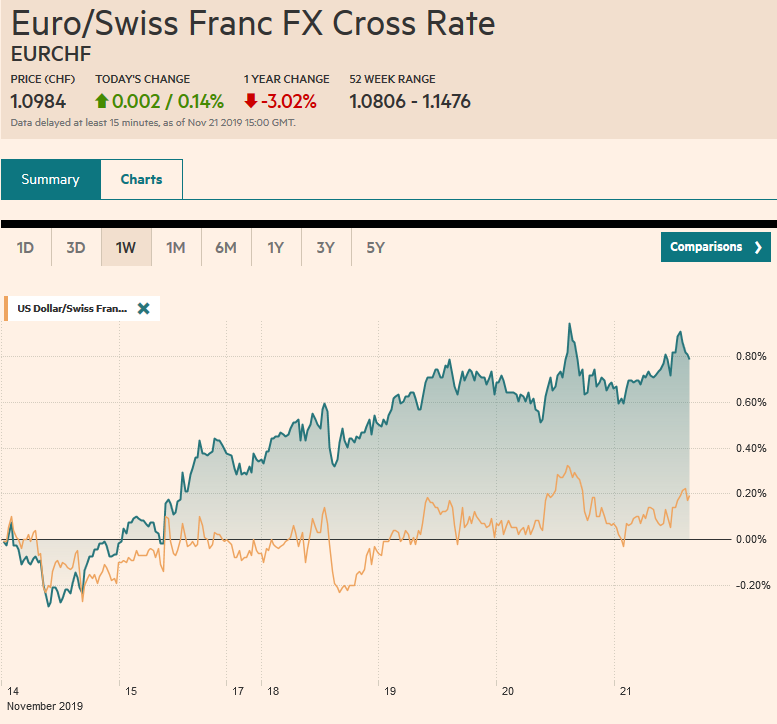

Swiss FrancThe Euro has risen by 0.14% to 1.0984 |

EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

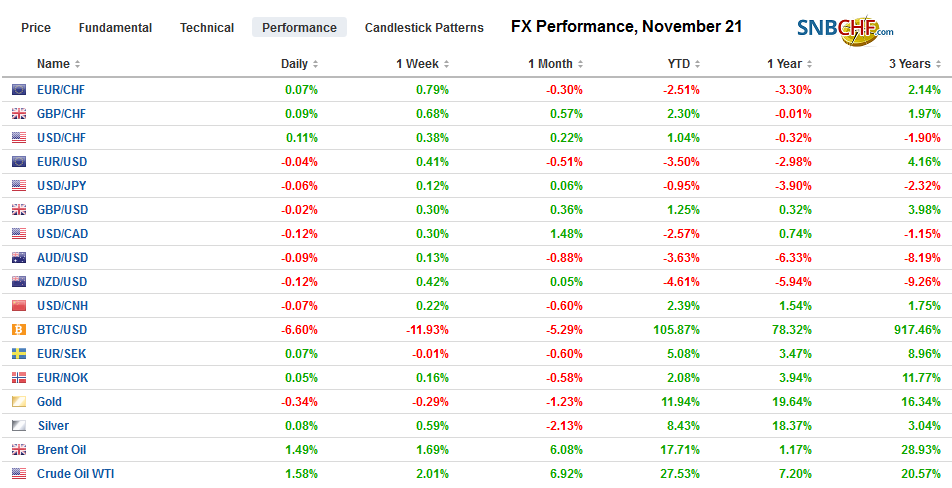

FX RatesOverview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and follow-through selling was seen in Asia Pacific and Europe. Hong Kong, South Korea, and Singapore equity markets fell more than 1% to lead today’s sell-off. However, comments from China’s chief negotiator that he was still “cautiously optimistic” that a deal will be struck lifted the markets off their intraday lows. European shares were marked lower at the opening though stabilized as the morning progressed. The Dow Jones Stoxx 600 is extending its losses for the fourth consecutive session. US shares are trading a little softer. Benchmark 10-year yields are mostly slightly lower, while the dollar is trading heavier against nearly all the major currencies and most of the freely accessible emerging market currencies. Gold and oil are little changed. |

FX Performance, November 21 |

Asia Pacific

China’s chief negotiator expressed “cautious optimism” that a trade deal between China and the US can still be struck. However, at a Bloomberg-sponsored event in China, this seemed perfunctory. What else could Liu He say? The market may have heard what it wanted to as Liu also said that China was confused about US demands. Moreover, there are different factions within the Chinese Communist Party, and the more market-oriented reform wing is being challenged apparently from a harder-line camp, which, judging from media stories, is not as optimistic as Liu. The bills approved by the US Congress regarding Hong Kong further antagonize the relationship, revealing the confrontation between the US and China transcends the Trump Administration.

Despite the sell-off of Korea’s Kospi (-1.35%) for the fourth consecutive session, and the weakness of the won (~-0.7%), the most among emerging market currencies today, the trade news suggests that the worst may be behind us. Exports in the first 20-days of November were 0ff 9.6% from a year ago after falling 19.5% in October. Imports also improved to reflect an 11.2% decline after a 20.1% fall last month.

Hong Kong’s inflation slipped to 3.1% in October from 3.2% in September. The rise in food prices (6.1% in October year-over-year vs. 6.0% in September) may conceal the disinflationary pressure of an economy that is contracting. Like in the mainland, pork is a notable culprit. Fresh pork prices in Hong Kong have risen around 83% over the past year. Clothing, rent, and utility prices eased.

The dollar tested last week’s low against the Japanese yen near JPY108.25 in early Asia before recovering to around JPY108.65 before the European session began. Nearby resistance is seen near yesterday’s high by JPY108.75. There are two sets of expiring options to note today. The first is for around $4.6 bln, and it is between JPY108.20 and JPY108.50. The second is for about $1.4 bln, and it is between JPY108.65 and JPY108.75. For a third session, the Australian dollar found bids in the $0.6785-$0.6790 area. However, it could not muster the strength to overcome nearby resistance in the $0.6830-$0.6835 area. An option for A$1.9 bln at $0.6850 that expires today may be helping to block the upside. The US dollar tested the month’s high against the Chinese yuan near CNY7.05 before returning to little changed levels.

Europe

Market-moving news from Europe remains thin. The market awaits from tomorrow’s flash PMI reading. It is expected to show a little improvement in both services and manufacturing. If so, it is still early days and downside risks, both foreign and domestic, remain. New ECB President Lagarde delivers a much-await speech tomorrow. Separately, we note that the short-term rate benchmark in the Eurosystem jumped by a few basis points (to around -51 bp from -54 bp) in an unusual move outside of quarter-end. While vaguely similar to what the US experienced, we suspect that with tiering of negative rates on reserves that the plumbing issue will not be as persistent as has been experienced in the US.

We have highlighted a political risk emanating from Germany. The SPD, which has been Merkel’s federal coalition partner in 10 of her 14 years as Chancellor, is in the middle of the leadership contest. A large faction wants the SPD to leave the government and seek to rebuild its base after turning in dreadful performances at the polls. Meanwhile, the CDU conference is going to shortly get underway, and there is a brewing leadership challenge there as well. Merkel’s handpicked successor Annegret Kramp-Karrenbauer (AKK) has committed several faux pas that has undermined her leadership as head of the CDU. Her (and Merkel’s) main rival Merz appears to be biding his time, and the party conference may not see the rivalry break into the open very much. However, the party is not as united as it has been, and the SPD withdrawing from the coalition (odds increase early next year) could spur a crisis within the CDU as well.

The euro is firm near the recent highs (~$1.1085). There is a 1.2 bln euro option expiring today that is struck at $1.1090. The $1.1105-area corresponds to a (61.8%) retracement of the euro’s decline since November 4. We anticipate a consolidative tone in the North American session today. Sterling also is posting minor gains and remains below the week’s high set on Monday, near $1.2985. There around GBP1.8 bln in options between $1.2990 and $1.3000 that expire today. There is another set of options between $1.2945 and $1.2965 for GBP1.1 bln also will be cut today.

America

Yesterday the House of Representatives approved the Senate versions of two bills. The first grants the Executive Branch’s state department to decide whether Hong Kong is sufficiently independent to allow it to have access to the US market that is not enjoyed by the rest of China. The other bill bans the sale of crowd control weapons to Hong Kong. The motions carried both chambers nearly unanimously and are one of the few truly bipartisan issues at the moment. Both measures were passed then with practically veto-proof majorities. Reports suggest that the President will likely sign the bills into law as early as today. The language China used in protesting the measures also colored the growing realization that a trade deal is unlikely and that Trump and Xi will not meet this year. Some suspect that that was the substance of why Trump summoned Powell to the White House at the start of the week.

The US President directly blamed China, saying that it is not making enough of an effort. Trump has repeatedly threatened to increase tariffs on China if no deal is struck. Pressure builds ahead of December 15 when a 15% levy on around $160 bln of Chinese goods, including consumer goods, is due. As we anticipated, the FOMC minutes indicated that although the midcourse correction was complete, and the economy was in a good place, downside risks remained elevated. Trade and the slowing of the global economy, which partly, and far from wholly, stems from the clash between the world’s two largest economies. The prospect of an escalation of the tit-for-tat tariffs could be part of the material change in the economic outlook that is necessary to get the FOMC to resume its easing.

The US reports the November Philadelphia Fed’s manufacturing index, which is notable because it is one of the first data points for this month, alongside the weekly jobless claims. October’s existing house sales will also be reported, but what will capture our attention is the Leading Economic Indicator. It is likely to have fallen for the third consecutive month, which is a warning of a potential economic contraction. No economic indicator works all the time, but it does dovetail with ideas that recessions take place when the yield curve re-steepens after an inversion. Remember, the Atlanta and NY, Fed GDP trackers, see the economy nearly stagnating in the first half of the Q4. The Fed’s Mester and Kashkari speak today.

Canada’s October CPI reported yesterday was in line with expectations and Bank of Canada Deputy Governor Wilkins, who we suspect may be the leading candidate to replace Governor Poloz, whose term ends toward the middle of next year, reinforced ideas that monetary policy continues to be on hold. Still, should the elevated global risks materialize, it is prepared to ease if necessary. Meanwhile, Trudeau indicated that Morneau will remain the Finance Minister, and Freeland, who was the Foreign Minister, will become the Deputy Prime Minister. The US dollar is consolidating yesterday’s advance against the Canadian dollar and is straddling the CAD1.33 area. Initial support is seen near CAD1.3275. The dollar jumped to almost MXN19.5525 yesterday, its best level in a little more than a month. It closed by MXN19.4635 yesterday and is hovering around there today. Stabilization of equities today could see the dollar pare its recent gains. Support is seen around MXN19.35.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,EUR/CHF,Featured,FX Daily,Hong Kong,liu he,newsletter,South Korea,Trade,USD/CHF