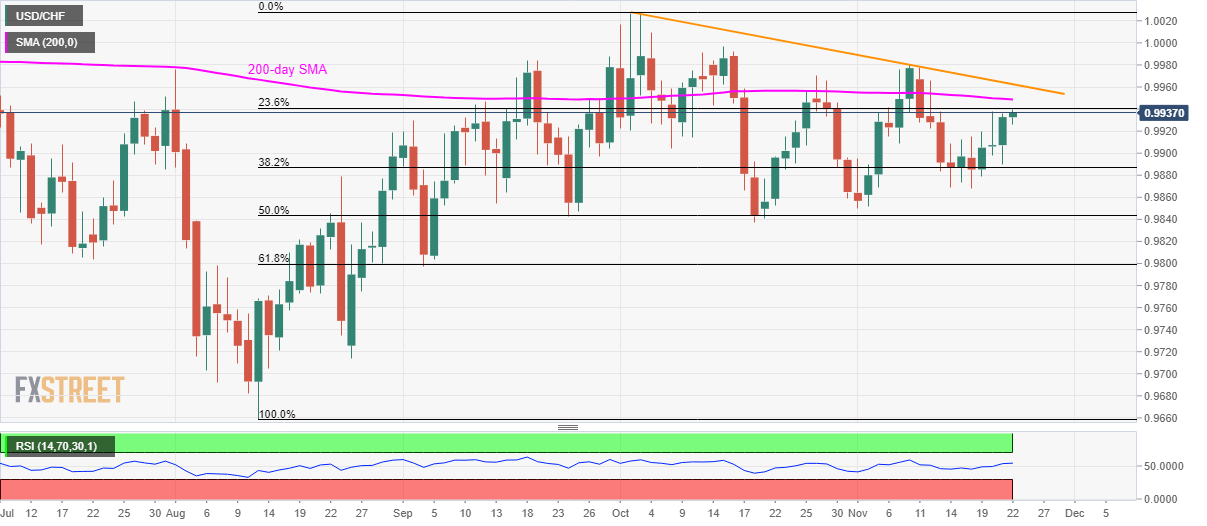

Following its latest recovery, USD/CHF rises to the highest since the previous Tuesday. 200-day SMA and multi-week-old resistance line hold the key to pair’s run-up towards 1.0000 mark. 0.9870 can entertain short-term sellers. Based on its U-turn from 0.9870, the USD/CHF pair current takes the bids to the highest in eight-day while trading around 0.9940 during early Friday. However, 200-day Simple Moving Average (SMA) and a downward sloping trend line since October-starts, around 0.9950 and 0.9965 respectively, stand tall to challenge buyers. It’s worth mentioning that the pair’s run-up beyond 0.9965 enables it to claim 1.0000 round-figure whereas the previous month high close to 1.0030 could challenge bulls then after. Should prices take a U-turn from the present

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Following its latest recovery, USD/CHF rises to the highest since the previous Tuesday.

- 200-day SMA and multi-week-old resistance line hold the key to pair’s run-up towards 1.0000 mark.

- 0.9870 can entertain short-term sellers.

| Based on its U-turn from 0.9870, the USD/CHF pair current takes the bids to the highest in eight-day while trading around 0.9940 during early Friday.

However, 200-day Simple Moving Average (SMA) and a downward sloping trend line since October-starts, around 0.9950 and 0.9965 respectively, stand tall to challenge buyers. It’s worth mentioning that the pair’s run-up beyond 0.9965 enables it to claim 1.0000 round-figure whereas the previous month high close to 1.0030 could challenge bulls then after. Should prices take a U-turn from the present levels, 0.9870 can act as nearby key support ahead of October month low near 0.9835. Additionally, the pair’s extended downpour beneath 0.9835 emphasizes on 0.9800/0.9795 area including September bottom and 61.8% Fibonacci retracement of August-October upside. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Pullback expected

Tags: Featured,newsletter,USD/CHF