Summary Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%. Stock Markets In the EM equity space as measured by MSCI, Poland (+4.0%), UAE (+3.3%), and Peru (+3.1%) have outperformed this week, while Russia (-2.2%), Colombia (-1.8%), and Turkey (-1.4%) have underperformed. To put this in better context, MSCI EM rose 1.1% this week while MSCI DM rose 0.4%. In the EM local currency bond space, Brazil (10-year yield -17 bp), Indonesia (-6 bp), and Colombia (-5 bp) have outperformed this week, while India (10-year yield +39 bp), Turkey (+10 bp), and Poland (+8 bp) have underperformed. To put this in better context, the 10-year UST yield fell 6 bp this week to 2.41%. In the EM FX space, EGP (+5.1% vs. USD), RUB (+0.8% vs. USD), and INR (+0.6% vs. USD) have outperformed this week, while ZAR (-0.9% vs. USD), CNH (-0.9% vs. USD), and SGD (-0.8% vs. USD) have underperformed. Stock Markets Emerging Markets February 06 Source: economist.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

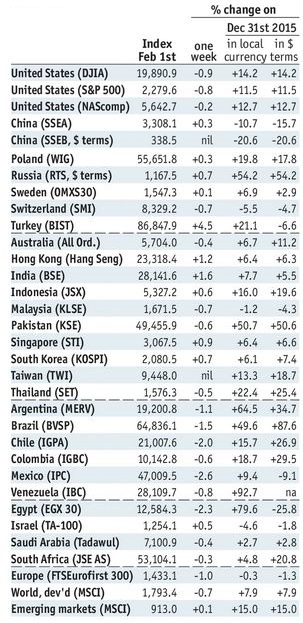

Stock MarketsIn the EM equity space as measured by MSCI, Poland (+4.0%), UAE (+3.3%), and Peru (+3.1%) have outperformed this week, while Russia (-2.2%), Colombia (-1.8%), and Turkey (-1.4%) have underperformed. To put this in better context, MSCI EM rose 1.1% this week while MSCI DM rose 0.4%. In the EM local currency bond space, Brazil (10-year yield -17 bp), Indonesia (-6 bp), and Colombia (-5 bp) have outperformed this week, while India (10-year yield +39 bp), Turkey (+10 bp), and Poland (+8 bp) have underperformed. To put this in better context, the 10-year UST yield fell 6 bp this week to 2.41%. In the EM FX space, EGP (+5.1% vs. USD), RUB (+0.8% vs. USD), and INR (+0.6% vs. USD) have outperformed this week, while ZAR (-0.9% vs. USD), CNH (-0.9% vs. USD), and SGD (-0.8% vs. USD) have underperformed. |

Stock Markets Emerging Markets February 06 Source: economist.com - Click to enlarge |

IndiaReserve Bank of India signaled an end to the easing cycle. Besides unexpectedly keeping rates steady, the bank moved its stance from accommodative to neutral. Most were looking for the bank to cut rates 25 bp. The RBI reiterated that it wants to get a clearer picture of the economic impact of the November demonetization. Price pressures are expected to pick up this year. IndonesiaS&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The agency noted that the change in outlook reflects signs of reduced structural constraints on the rating. It added that Indonesia’s vulnerability to external shocks is falling somewhat and is expected to continue. Indonesia’s implied rating was steady at BBB/Baa2/BBB. PolandThe ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Party leader Jaroslaw Kaczynski implied as much in a radio interview, but a senior parliamentary official said work was still being done on a workable solution. This was one of the party’s signature promises during the campaign, but Kaczynski’s comments suggest that the government’s stance may be softening. RomaniaRomanian Justice Minister Iordache resigned. He was seen as the architect of the controversial measures that was seen as weakening anti-corruption efforts. Protests have continued even after the government reversed course on those measures. The cabinet survived a no confidence motion in parliament this week after lawmakers from the ruling Social Democrats boycotted the vote. BrazilLocal press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%. The target has been kept steady since 2005, though the tolerance band was narrowed this year from +/- 2 percentage points to +/- 1.5 (this was announced back in 2015). |

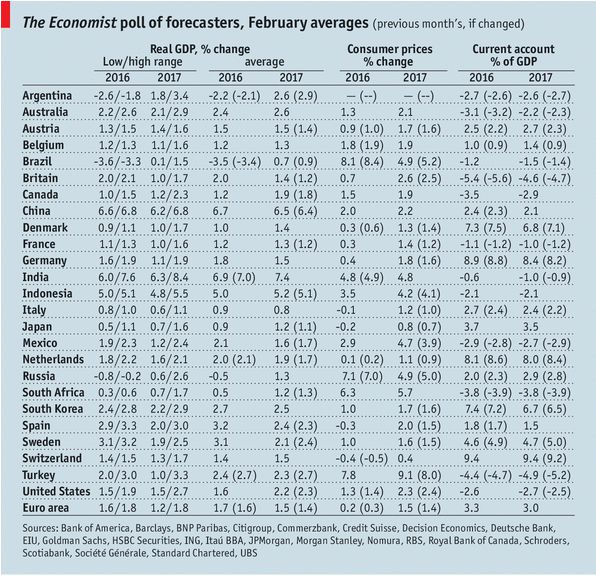

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter