In the first tentative step toward the final option available for Erdogan to halt the Lira’s accelerating collapse – which crashed as low as 7.2362 earlier after the Wellington FX open following the the Turkish president’s latest belligerent comments – namely capital controls, the Turkish Banking Regulation and Supervision Agency imposed a limit on the amount of foreign currency and lira swap and swap-like transactions,...

Read More »Monetary Consequence of Tariffs, Report 12 August 2018

Last week in Monetary Paradigm Reset, we talked about the challenge of explaining a new paradigm. We said: “The hard part of accepting this paradigm shift, was that people had to rethink their entire view of cosmology, theology, and philosophy. In the best case, people take time to grapple with these challenges to their idea of man’s place in the universe. Some never accept the new idea.” We were talking about the fact...

Read More »FX Daily, August 13: Turkey Drives Risk-Off, but Pressure Abating

Swiss Franc The Euro has risen by 0.12% to 1.1351. EUR/CHF and USD/CHF, August 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest...

Read More »FX Weekly Preview: Testing the Dollar’s Breakout

The US dollar surged last week, with the Dollar Index rising 1.25%, the most since April. The dollar is being boosted by two drivers. The first is the policy mix and interest rate divergence. The other is the intensification of pressure on emerging market. Turkey has a disastrous combination of more fundamentals, large short-term foreign currency debt obligations, unorthodox policies, and the lack of credibility. On top...

Read More »Robot-built pergola showcases Swiss digital fabrication skills

Istituto Svizzero, the Swiss cultural centre in Rome, gets some welcome shade thanks to a computer-designed, robot-built pergola. The four-metre tall construction was inaugurated in June and was the handiwork of 17 architecture students at the Swiss Federal Institute of Technology in Zurich (ETHZ). The pergola was put together without using nails, glue or screws. The structure is made completely of timber and is held...

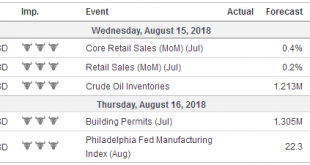

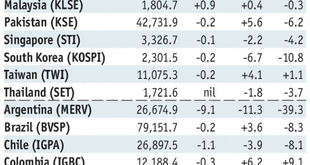

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.Yet it’s worth noting that the five best...

Read More »Two In-Depth Interviews

Keith had two more in-depth, ideaful interviews. Keith was interviewed on the Jason Stapleton Program. Keith had a lively discussion with Peter Bell and Mickey Fulp, the Mercenary Geologist. Related posts: Gold to Enter New Bull Market – Charles Nenner An Inquiry into Austrian Investing: Profits, Protection and Pitfalls The Great Gold Upgrade, Report...

Read More »Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the...

Read More »Wann stoppt dieser Zentralschweizer Rassismus? – Offener Brief an Fritz Erni, Direktor Hotel Montana

Von Lucien Looser- Nichts ist in der Innerschweiz so verhasst und sie scheinen das grösste Problem der Region überhaupt zu sein, die asiatischen Reisegruppen. Fritz Erni vom Hotel Montana und zahlreiche Journalisten fachen das Rassismus-Feuer erneut an. Sehr geehrter Herr Erni Ich kenne...

Read More »Wann stoppt dieser Zentralschweizer Rassismus? – Offener Brief an Fritz Erni, Direktor Hotel Montana

Von Lucien Looser- Nichts ist in der Innerschweiz so verhasst und sie scheinen das grösste Problem der Region überhaupt zu sein, die asiatischen Reisegruppen. Fritz Erni vom Hotel Montana und zahlreiche Journalisten fachen das Rassismus-Feuer erneut an. Sehr geehrter Herr Erni Ich kenne...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org