The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks. Talks with Canada have apparently not progressed very far in recently, and the US insistence on a sunset clause remains a...

Read More »Swiss Trade Unions to Boycott Talks on EU Labour Negotiations

Swiss Trade Union Federation President Paul Rechsteiner, pictured, said unions would go as far as forcing a referendum to ensure that Switzerland protects wages autonomously. (Keystone) Switzerland’s largest national trade union centre has refused to participate in discussions led by Swiss Economics Minister Johann Schneider-Ammann on easing measures for wages and working conditions as part of framework negotiations...

Read More »The Fantasy of “Balanced Returns” Funding Retirement

Consider how a “balanced portfolio” yielding “balanced returns” worked out for middle class retirees in Venezuela. The fantasy that a “balanced portfolio” yielding “balanced returns” will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the...

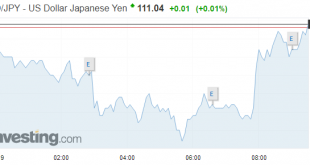

Read More »FX Daily, August 08: Sterling Can’t Get Out of Its Own Way, While Dollar and Yen Catch a Bid

Fears that the UK could leave the EU in a little over six months without an agreement continues to drag sterling lower. Recall that over the weekend, the UK’s International Trade Minister Fox suggested there was a 60% chance of a no-deal Brexit. A few days earlier BOE Carney said that although it was not the most likely scenario, the risks such a departure were “higher than comfort.” Sterling is lower for a fifth...

Read More »Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

By: Rachel Koning Beals – News Editor Marketwatch Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated...

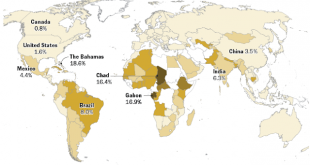

Read More »Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought. It has become fashionable to talk about reciprocity and intuitively has much...

Read More »Global Asset Allocation Update – (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet Global Asset Allocation Update: The Certainty of...

Read More »FX Daily, August 07: Turn Around Tuesday for the Greenback

Swiss Franc The Euro has risen by 0.18% to 1.1532 CHF. EUR/CHF and USD/CHF, August 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is pulling back today after yesterday’s advance. All the major currencies are higher and even the Turkish lira, which plunged nearly 5% yesterday to cap a six-day slide, is trading firmer today ([email protected]). The dollar’s...

Read More »Monetary Paradigm Reset, Report 5 August 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Explaining a new paradigm can be both simple and impossible at the same time. For example, Copernicus taught that the other planets and Sun do not revolve around the Earth. He said that all the planets revolve around the Sun, including Earth. It isn’t hard to say, and it isn’t especially hard to grasp. Indeed, one of its...

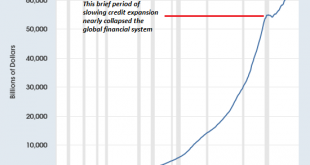

Read More »We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I’ve been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency. The funny thing about the loss of a currency’s purchasing power is that it wipes out every holder of that currency, rich...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org