Crude oil has been climbing a trendline for the past year. This Great Graphic depicts this trend on a weekly bar chart. Depending exactly the line is drawn, it comes in now near $65 a barrel. The technical indicators are consistent with further losses. Oil is off for a third day, alongside other industrial commodities, including copper. In addition to concerns about the economic impact from the trade tensions, the...

Read More »Monthly Macro Monitor – August 2018

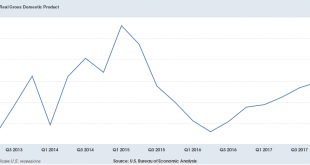

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%). The US economy is definitely accelerating out of the 2016 slowdown. The...

Read More »Who Would Invest in a Gold Bond?

Berkshire Hathaway CEO Warren Buffet famously dismissed gold. “Gold has two significant shortcomings, being neither of much use nor procreative.” I have recently written about how a government with gold mining tax revenues can use gold. The benefits of issuing gold bonds include reducing risk, and getting out of debt at a discount. Pretty useful, eh? As to his second point, one should never confuse suppressed with...

Read More »Welche Lieder darf ich noch hören? – Offener Brief an Tamara Funiciello

Liebe Tamara Ich kenne dich nur aus den Medien. Du hast sicher wie jeder Mensch herausragende Qualitäten. Auch stelle ich fest, dass sich viele Leute über dich aufregen. Ich finde, sollen sie doch, wenn sie dadurch glücklich werden. Ich habe vernommen, du magst gewisse Lieder nicht. Den...

Read More »Welche Lieder darf ich noch hören? – Offener Brief an Tamara Funiciello

Liebe Tamara Ich kenne dich nur aus den Medien. Du hast sicher wie jeder Mensch herausragende Qualitäten. Auch stelle ich fest, dass sich viele Leute über dich aufregen. Ich finde, sollen sie doch, wenn sie dadurch glücklich werden. Ich habe vernommen, du magst gewisse Lieder nicht. Den...

Read More »FX Daily, August 16: Emerging Markets Stabilize, Dollar Eases a Little

Swiss Franc The Euro has risen by 0.48% to 1.1322. EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Two developments have helped turned sentiment, or at least arrested the markets’ momentum. First, the developments in Turkey, where officials have taken a few measures that will make it somewhat more difficult to access the lira. This may...

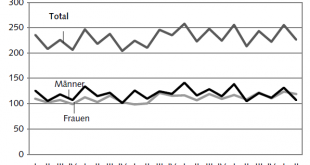

Read More »Swiss Labour Force Survey in 2nd quarter 2018: Number of persons in employment rises by 0.7 percent, unemployment rate based on ILO at 4.6 percent

Neuchâtel, 16.08.2018 (FSO) – The number of employed persons in Switzerland rose by 0.7% in the 2nd quarter 2018 compared with the same quarter of the previous year. The unemployment rate as defined by the International Labour Organisation (ILO) rose during the same period by 0.2 percentage points to 4.6%. The EU’s unemployment rate based on the ILO definition decreased from 7.6% to 6.9%. These are some of the results...

Read More »Zurich bank settles tax evasion probe with US

The Zürcher Kantonalbank agrees to pay $98.5 million as part of a settlement with US tax authorities after a seven-year investigation into the bank’s activities with US customers. The Zürcher Kantonalbank (ZKB) has agreed to pay the United States Department of Justice (DOJ) $98.5 million (CHF97.7 million) to resolve a long-running investigation into its role in tax evasion by wealthy Americans using undeclared Swiss...

Read More »Great Graphic JPY Struggles at Trendline

This Great Graphic is a weekly bar chart of the dollar-yen exchange rate. It shows a three-year downtrend line (white line). The US dollar had popped above it last month, but this proved premature and has not closed about it for a month. The trendline is found near JPY111.55 now. Connecting the 2016 dollar lows and the low from late March this year is a red line. It is found near JPY105.60. Together both lines mark a...

Read More »Wall Street – Island of the Blessed

Which Disturbance in the Farce can be Profitably Ignored Today? There has been some talk about submerging market turmoil recently and the term “contagion” has seen an unexpected revival in popularity – on Friday that is, which is an eternity ago. As we have pointed out previously, the action is no longer in line with the “synchronized global expansion” narrative, which means with respect to Wall Street that it is best...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org