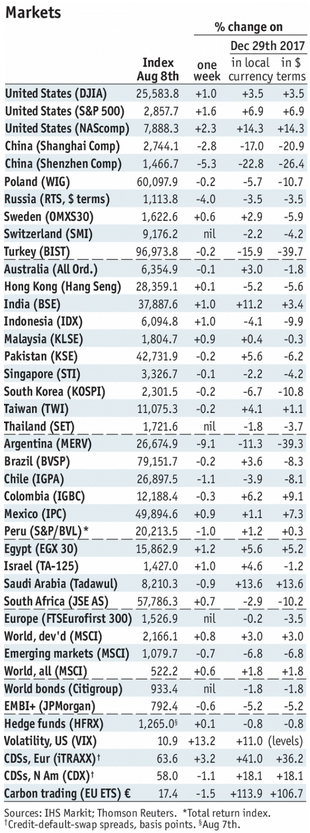

Stock Markets EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.Yet it’s worth noting that the five best are MXN (+4%), COP (+1.5%), MYR (-1%), PEN (-1.5%), and THB (-2%). Yes, we are in a broad-based EM bear market but investors are not selling indiscriminately. Stock Markets Emerging Markets, August 08 - Click to enlarge China China reports July retail sales and IP will be reported Tuesday. IP is

Topics:

Win Thin considers the following as important: 5) Global Macro, Argentina, China, Colombia, Czech Republic, emerging markets, Featured, Hungary, India, Indonesia, Israel, Malaysia, newsletter, Poland, Singapore, South Africa, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.Yet it’s worth noting that the five best are MXN (+4%), COP (+1.5%), MYR (-1%), PEN (-1.5%), and THB (-2%). Yes, we are in a broad-based EM bear market but investors are not selling indiscriminately. |

Stock Markets Emerging Markets, August 08 |

ChinaChina reports July retail sales and IP will be reported Tuesday. IP is expected to rise 6.3% y/y while sales are expected to rise 9.1% y/y. For now, policymakers are likely to wait several months to gauge the impact of recent stimulus measures. IsraelIsrael reports June trade Monday. It reports July CPI Wednesday, which is expected to rise 1.6% y/y vs. 1.3% in June. If so, it would be the highest rate since December 2013. Next central bank policy meeting is August 29. No change is expected then but we think the bank will start the tightening cycle in Q4. Q2 GDP will be reported Thursday, which is expected to grow 2.4% SAAR vs. 4.7% in Q1. PolandPoland reports June trade and current account data Monday. Q2 GDP will be reported Tuesday, which is expected to grow 5.1% y/y vs. 5.2% in Q1. This would be a disappointing reading given the low base effect from 2017. This would support the stance of the central bank doves, though we think rising inflation warrants tightening. Next policy meeting is September 5, no change expected then. IndiaIndia reports July CPI Monday, which is expected to rise 4.47% y/y vs. 5.0% in June. July WPI will be reported Tuesday, which is expected to rise 5.24% y/y vs. 5.77% in June. We believe this is a temporary drop in inflation, and the central bank will retain its hawkish bias. Next policy meeting is October 4. It’s too early to make a call now as the decision will be data-dependent. Czech RepublicCzech Republic reports Q2 GDP Tuesday, which is expected to grow 2.7% y/y vs. 4.2% in Q1. If so, this would be the slowest rate since Q1 2017. Yet the central bank appears ready to continue hiking rates. September 26 may be too soon after back-to-back hikes, but another 25 bp hike November 1 or December 20 seems likely. |

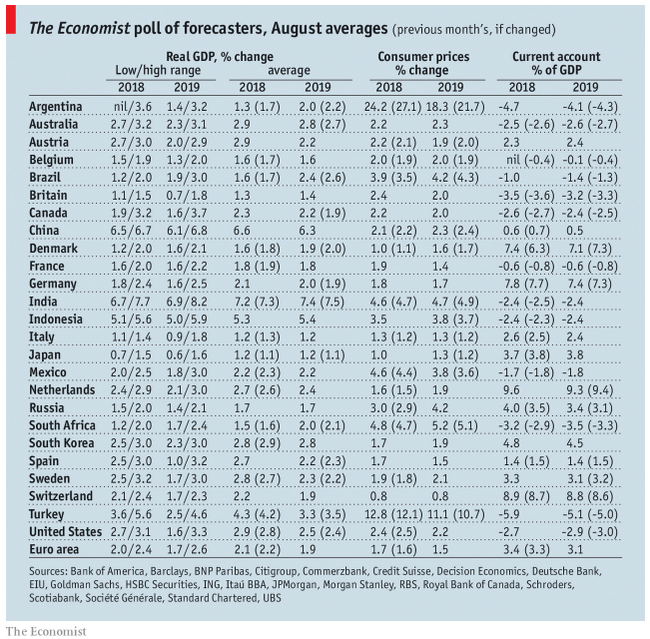

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2018 Source: economist.com - Click to enlarge |

Hungary

Hungary reports Q2 GDP Tuesday, which is expected to grow 4.1% y/y vs. 4.4% in Q1. This would be a disappointing reading given the low base effect from 2017. This would support the stance of the central bank doves, though like Poland, we think rising inflation warrants tightening here. Next policy meeting is August 21, no change expected then.

Colombia

Colombia reports June IP, retail sales, and trade Tuesday. IP is expected to rise 1.6% y/y and sales by 4.6% y/y, both slowing from May. Q2 GDP will be reported Wednesday, which is expected to grow 2.6% y/y vs. 2.2% in Q1. Growth remains a bit sluggish, but we think the easing cycle has ended. Next policy meeting is September 28, no change expected then.

Indonesia

Bank Indonesia meets Wednesday and is expected keep rates steady at 5.25%. After it left rates steady at its July meeting, we see some risk of a hawkish surprise this week as the rupiah remains under pressure. July trade will also be reported that day, where a -$688 mln deficit is expected.

South Africa

South Africa reports June retail sales Wednesday. The rand has gotten caught up in the EM sell-off, which suggests upside risks to inflation ahead. While the economy remains sluggish, we think SARB will retain a hawkish bias. Next policy is September 20. While no move is likely then, much will depend on external conditions and the rand.

Argentina

Argentina reports July CPI Wednesday, which is expected to rise 31.2% y/y vs. 29.5% in June. With a 40% nominal policy rate, such a reading would yield a real rate of 8.8%. While still relatively high, further acceleration of peso weakness may require further tightening. Recent ARS losses are disappointing in light of the orthodox policy response already seen.

Malaysia

Malaysia reports Q2 GDP Thursday, and growth is expected to remain steady at 5.4% y/y. Q2 current account data will also be reported that day. CPI rose only 0.8% y/y in June. While Bank Negara does not have an explicit inflation target, we believe low price pressures and downside risks to growth for the region will keep Bank Negara on hold for the foreseeable future. Next policy meeting is September 5, no change is seen then.

Turkey

Turkey reports June IP Thursday, which is expected to rise 5.0% y/y vs. 6.4% in May. The way things are going, we expect a hard landing for the economy in the coming months. Markets await some sort of policy response, but the longer Turkey waits, the worst things will ultimately get. Next central bank policy meeting is September 13 but an intra-meeting move will likely be forced by the markets. As of this writing, there have been no weekend developments from Turkey.

Singapore

Singapore reports July trade Friday. NODX is expected to rise 7.9% y/y vs. 1.1% in June. CPI rose only 0.6% y/y in June. While the MAS does not have an explicit inflation target, we believe low price pressures and downside risks to growth for the region will allow it to keep policy steady at its semiannual meeting in October.

Tags: Argentina,China,Colombia,Czech Republic,Emerging Markets,Featured,Hungary,India,Indonesia,Israel,Malaysia,newsletter,Poland,Singapore,South Africa,Turkey,win-thin