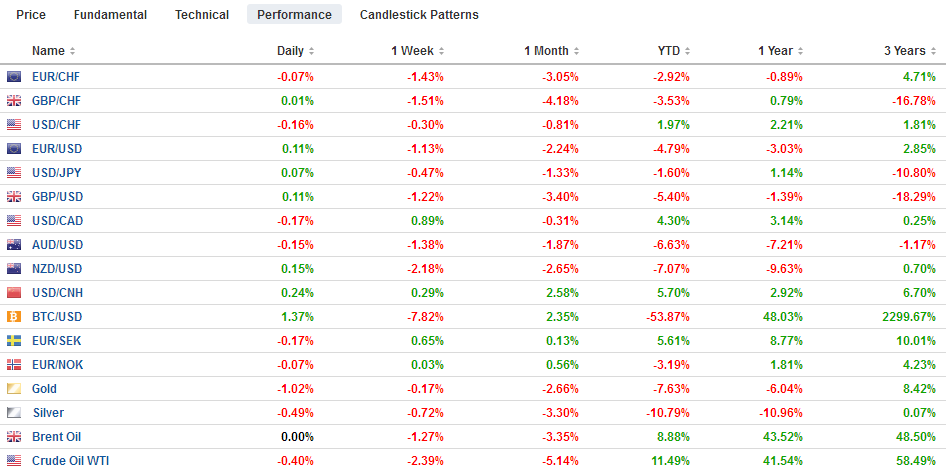

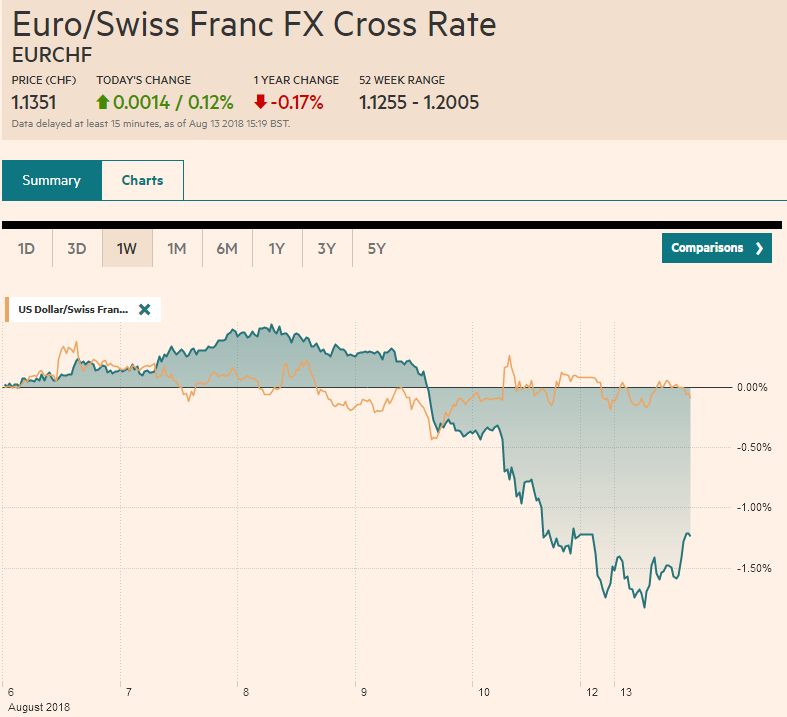

Swiss Franc The Euro has risen by 0.12% to 1.1351. EUR/CHF and USD/CHF, August 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest currency this year, and which has been partially protected by prospects of a new NAFTA agreement has suffered as well. The dollar finished last week near MXN18.91, having advanced by more than 1% for the second sessions, surged above MXN19.37 today. The risk-off moment is evident in the European

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, EUR, Featured, GBP, JPY, MXN, newsletter, SPX, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.12% to 1.1351. |

EUR/CHF and USD/CHF, August 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest currency this year, and which has been partially protected by prospects of a new NAFTA agreement has suffered as well. The dollar finished last week near MXN18.91, having advanced by more than 1% for the second sessions, surged above MXN19.37 today. The risk-off moment is evident in the European periphery, where Italy’s 10-year benchmark has been lifted above 3%. Spanish, Portugal and nearly all European yields are rising, but Germany. The US benchmark yield is a basis point lower. The MSCI Emerging Markets index gapped lower and is off 1.75%. It has come within a quarter of a percentage point of the June low which was the lowest level since July 2017. The gap in the MSCI Asia Pacific Index was a little larger, and the stability seems more fragile. The low for the year was set in early July is less than 0.5% away. Of note, Chinese and India markets have fared among the best, with their major indices losing less than 0.5%. The dollar rose to almost CNY6.8850 today. The year’s high was set on August 3 just shy of CNY6.90. |

FX Performance, August 13 |

The measures announced by the Turkish government seem woefully inadequate. Required reserves were cut, which may have freed up around TRY10 bln and eased some collateral rules and boost the among of lira that can be borrowed against euro and dollars. There appear to be some de facto capital controls, such as restrictions on fx swaps, but broad capital controls were rejected. Efforts to crack down on social media seems little more than a distraction.

Even the triple-A rated Australia was not immune to the pressures, though bonds were firm. The local equity market lost about 0.4%, though saw gains in utilities, information technology, and energy. The Australian dollar is the weakest of the major currencies, nursing a 0.5% loss (~$0.7265). The yen is the strongest of the majors, rising almost 0.4% against the greenback. The dollar approached the JPY110 area, where 1 $1 bln expiring option is struck, before recovering in the European morning toward JPY110.50.

European equities are lower, but the pace is modest. The 0.5% loss in the Dow Jone Stoxx 600 is half the drop seen before the weekend. Energy and information technology are posting small gains. Healthcare and financials are leading the way lower. Note that Bayer responded strongly negatively to the damages levied against Monsanto by a court in the US ahead of the weekend. Bayers bought Monsanto in a couple of months ago (~$66 bln).

The euro’s recent losses were extended to $1.1365 in Asia, about a quarter of a cent below the pre-weekend low. The euro finished last week below the 50% retracement of last year’s rally (~$1.1450), and the 61.8% retracement objective is found a little below $1.12. To appreciate the magnitude of the euro’s slide, consider that it has approached three standard deviations from the 20-day moving average (~$1.1350). Although we know that the returns (changes) in exchange rates are not normally distributed, this is a rare phenomenon. A close below the two standard deviation band uncommon, but unless the euro rallies half a cent in North American session, it will close for a below its lower Bollinger Band for a second consecutive session.

Sterling is threatening to extend its losing streak into an eighth consecutive session. It has held just above the pre-weekend loss and has mostly straddled little-changed levels. It is confined to a narrow $1.2720-$1.2780 trading range. Perhaps helping sterling are reports suggest that Prime Minister May is composing a new plan that would keep UK rules for longer after Brexit, but what might be acceptable to the UK may not be acceptable to the wing of the Tories that seek a cleaner exit. The transition period is already slated to extend to end the end of 2020. Talks with the EC resumes on August 16.

The economic calendar is light in North America today, giving investors little to distract from the spike in volatility that may ruin more than one summer vacation. We remain concerned that the price action is exaggerating the systemic risk that posed by Turkey. Of course, the wave of volatility emanating can be sufficient to trigger secondary crises in other fragile markets. However, the technical readings for the US dollar are stretched, and we advise caution in chasing it.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CNY,$EUR,$JPY,Featured,MXN,newsletter,SPX