Fundamental Developments – The Gap Keeps Widening Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price? They done whacked our lighthouse! [PT] Image credit: Skip Willits - Click to enlarge Gold and Silver...

Read More »Cool Video: Bloomberg TV Clip-Dollar Developments

- Click to enlarge The US dollar was sliding as I joined Vonnie Quinn and Shery Ahn on the Bloomberg Markets show. I tried making the case, as I have in recent posts, that the dollar’s rally in the first half of the month had left it over-extended. Most of the major currencies were outside of their Bollinger Bands a week ago and had begun correcting since August 15. Reports of President Trump’s criticism of the...

Read More »Great Graphic: Head and Shoulders Top in Dollar Index

This Great Graphic depicts what appears to be a head and shoulders top in the hourly bar chart of the Dollar Index. The neckline is found near 96.00 and rotating the pattern along it produces a measuring objective near 95.00. The bearish pattern was formed in the last few days, and the Dollar Index was resting near the neckline before Trump’s comments gave it the push. The low today is near 95.45, which corresponds to...

Read More »FX Daily, August 21: Trump Comments Hit Dollar, Little Impact on Rates

Swiss Franc The Euro has risen by 0.02% to 1.1378. EUR/CHF and USD/CHF, August 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly lower following President Trump’s comments yesterday, criticising Fed policy and reiterating his previously made claim that China and the EU are manipulating their currencies. We suggested that last week’s...

Read More »A trying time for euro

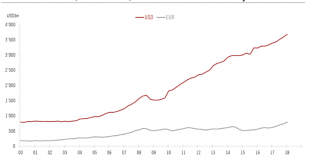

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months. The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the...

Read More »A third of Swiss companies have difficulty filling vacancies

A shortage of skilled labour continues to affect the Swiss job market, according to the latest surveyexternal link by employment agency Manpower. Among reasons given for difficulties in finding the right candidates, 30% of employers surveyed cited a lack of technical skills, 29% a lack of candidates, 17% blamed a lack of professional experience and 14% cited missing interpersonal skills. Among the most sought-after...

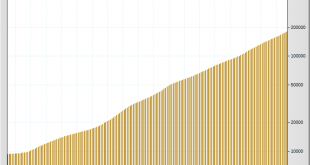

Read More »Annual Mine Supply of Gold: Does it Matter?

The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and...

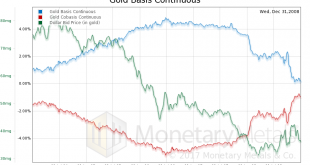

Read More »In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018

Last week, we discussed the tension between forces pushing the dollar up and down (measured in gold—you cannot measure the dollar in terms of its derivatives such as euro, pound, yen, and yuan). And we gave short shrift to the forces pushing the dollar down. We said only that to own a dollar is to be a creditor. And if the debtors seem in imminent danger of default, then creditors should want to escape this risk. The...

Read More »FX Daily, August 20: Greenback Consolidates Pre-Weekend Pullback in Quiet Turnover

Swiss Franc The Euro has risen by 0.11% to 1.1348. EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is slightly firmer against most of the major currencies, as the light participation and lack of fresh news see a consolidative tone emerge after the pullback at the end of last week. Although markets in Turkey are closed for a...

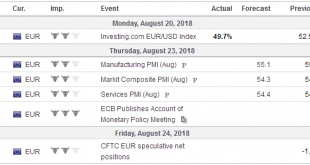

Read More »FX Weekly Preview: Five Traps in the Week Ahead

Turkey Officials have taken steps to make it more difficult and more expensive to short the lira, but that did not prevent a 5% slide ahead of the weekend. There is no interest rate, within reason, that can compensate for such currency risk. When S&P cut its sovereign credit rating to B+ from BB- and retained a stable outlook, it did not cite the dispute over the pastor. Moody’s cut Turkey’s rating to Ba3 from Ba2...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org