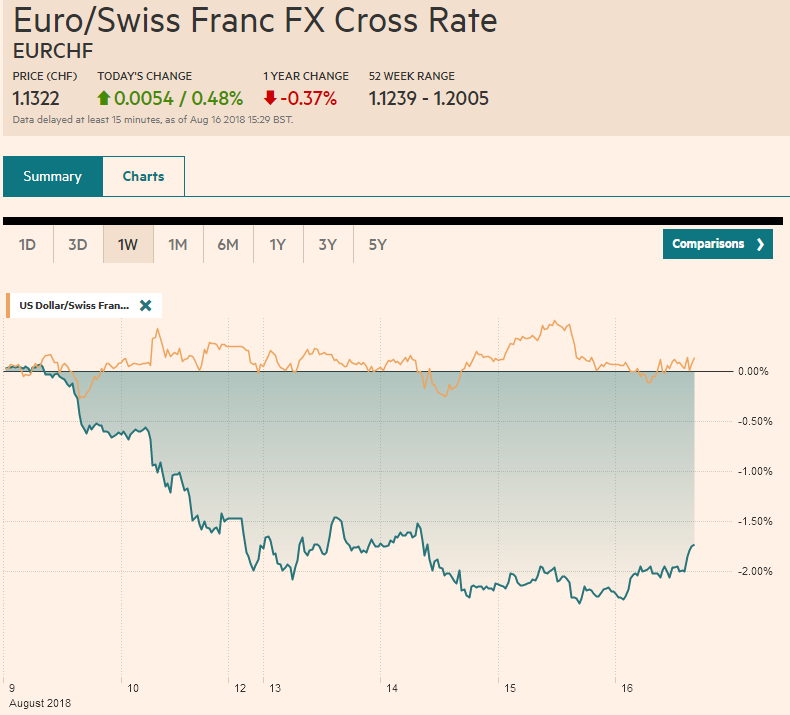

Swiss Franc The Euro has risen by 0.48% to 1.1322. EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Two developments have helped turned sentiment, or at least arrested the markets’ momentum. First, the developments in Turkey, where officials have taken a few measures that will make it somewhat more difficult to access the lira. This may have an unintended consequence of also making it more difficult for foreign investors to buy Turkey’s bonds at auctions, for example, not that this is an imminent challenge. It is also true that the dramatic depreciation of the lira and the likely compression of domestic demand will see the country’s

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, SPX

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.48% to 1.1322. |

EUR/CHF and USD/CHF, August 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesTwo developments have helped turned sentiment, or at least arrested the markets’ momentum. First, the developments in Turkey, where officials have taken a few measures that will make it somewhat more difficult to access the lira. This may have an unintended consequence of also making it more difficult for foreign investors to buy Turkey’s bonds at auctions, for example, not that this is an imminent challenge. It is also true that the dramatic depreciation of the lira and the likely compression of domestic demand will see the country’s external funding needs decline. Reports indicate that Qatar would also invest $15 bln in Turkey and this also aided sentiment. This is a short-term palliative. Given the reliance on foreign funding, Turkey owes about $16 bln before the end of the year. Still, the desire of others to help ease the pressure on Turkey also is an important reminder that while the US can use its vast political, military, and financial assets to punish countries, it depends on others too. The true kindness of strangers lies not in buying US Treasuries, which often foreign central banks have done to minimize the appreciation of their own currencies, but in not doing end-runs around US policy. Efforts to help circumvent US wishes can be punished as in sanctions announced yesterday and a Chinese company (and its Singaporean affiliate) and a Russian company for trading with North Korea (in violation of the UN as well). However, some like, Russia’s offer of 2.5 mln acres to China to grow soy, are more difficult to contain. The US embargo against Iran is not expected to be nearly as effective as the previous effort without the more active cooperations of others. The second development was the announcement that a Vice Minister from China will come to the US by the end of the month to resume trade talks after a two-month hiatus. This seemed to help ease anxiety on the margins, though expectations are fairly low as both sides appear to have dug in for a protracted conflict and a new round of US tariffs are expected to be announced before the end of the month. Keeping in line with the Trump Administration’s “maximum pressure” doctrine no relief is likely without Chinese concessions. |

FX Performance, August 16 |

The PBOC did fix the yuan lower, though not as low as some models would have suggested. The yuan, alongside most of the world’s currencies, is firmer against the dollar today. However, Chinese stocks continued to fall, for a fourth consecutive session. The Shanghai Composite is off 3.2% so far this week. Equities throughout the region were lower, following the losses on Wall Street. The MSCI Asia Pacific Index was off 0.5% to bring this week’s loss to 2.75%.

There were two data points of note in Asia-Pacific today. Australia jobs data disappointed. Employment fell 3.9k whereas economists were looking for continued jobs growth after the heady 58.2k (revised from 50.9k). Still, the loss reflected part-time positions, with full-time positions expanding by 19.3k after 43.2k in June (revised from 41.2k). The unemployment rate ticked down to 5.3%, but the participation rate fell by more 65.5% vs. 65.7%).

The Australian dollar is extending yesterday’s recovery from a test on $0.7200. Resistance is seen the $0.7300-$0.7330 area. There is an AUD1 bln option expiring today at $0.7300. Initial support now is seen near $0.7250.

Japan reported a larger than expected trade deficit for July when seasonally it tends to deteriorate from June. The cause of the miss (JPY231 bln deficit instead of JPY41 bln median expectation in the Bloomberg survey) was the weaker exports. They rose 3.9% year-over-year, down sharply from the 6.7% pace in June about three-quarters the gain expected. Imports were slightly higher than expected.

The yen is steady against the dollar, which is holding in a half yen range below JPY111.00, which we see as the middle of the immediate range. There are around $1.75 bln in options struck JPY110.50-JPY110.60 that expire today. Thee are another $655 mln at JPY111.40 which may not come into play. The yen is the weakest of the majors.

There are three developments in Europe to note. First, Italian stocks are underperforming (-1.7%) as the government begins the process to revoke a toll bridge concession from Atalantia following the tragic collapse of a bridge earlier this week. Italian banks shares are also lower. The 1% decline today is the sixth consecutive session of losses.

Second, as widely expected Norway’s central bank left rates steady and continued to signal a hike next month. The krone has not responded much to the anticipated news. Yesterday’s sharp drop in oil prices and higher beta ways to play the dollar’s pullback may be curbing demand.

Third, the UK reported much better than expected retail sales. Expectations were extremely low (flat) after being disappointed last month when it learned June retail sales fell 0.6% excluding auto fuel). Retail sales rose 0.9% by this measure in July, which lifted the year over year rate to a healthy 3.7%. It is interesting to note that spending online rose to a record 18.2% of all retailing in July, the same level as department stores.

Sterling is also trading flattish, within yesterday’s range to straddle the $1.2700-level. There is a large GBP1.7 bln option struck at $1.27 that expires today, which may help to limit its movement. The euro is trading firmly after recovering in North America yesterday. However, it has not been able to retake the $1.14-handle. The week’s high was seen Monday just shy of $1.1435. An hourly trendline from yesterday comes in now near $1.1360.

US data includes weekly jobless claims, the Philly Fed survey (August) and July housing starts and permits. While the Philly Fed is for a new month, the market may be more interested in the housing data. This is an interest rate sensitive sector that has been showing some moderation. Starts had been holding new cyclical higher but fell in tow of the past three months, and the 12.3% drop in June was a shock. It was the biggest drop since November 2016, which had been preceded by a 25% rise. Building permits, a lead indicator fell each month in Q2 and four times in the first half.

Canada reports manufacturing sales and ADP publishes its July jobs report. Neither are market-movers. The US dollar is consolidating in the upper half of the yesterday’s range against the Canadian dollar. There is a $580 mln option stuck at CAD1.31 that may turn out not to be relevant. The hourly trendline from yesterday is coming in now around CAD1.3140.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$CNY,$EUR,$JPY,Featured,newsletter,SPX