The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it...

Read More »Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.) But let’s just suppose that, when the European leaders sat down for lunch at the Quirinal Palace, some of them had a little too...

Read More »Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist

Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist - Gold coin called ‘Million Dollar Gold Coin’ or ‘Big Maple Leaf’ stolen from Berlin museum early on Monday- World's purest gold coin and in the Guinness Book of Records for its purity of 99999 fine gold- Gold coin was legal tender, investment grade, bullion coin and only 5 other coins were minted- The other 'Million Dollar Gold Coin' is still available for sale by GoldCore safely stored in vaults in...

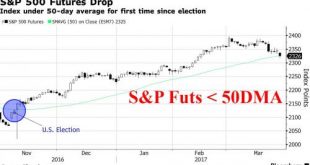

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

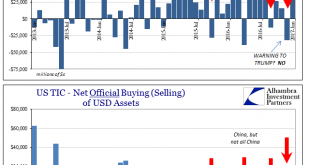

Read More »TIC Analysis of Selling

[unable to retrieve full-text content]When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of banana...

Read More »TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke...

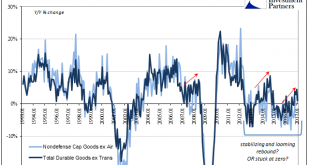

Read More »Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version. That would suggest that orders as well as shipments were somewhat better than they appear at least in in terms of...

Read More »Durable Goods After Leap Year

[unable to retrieve full-text content]New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

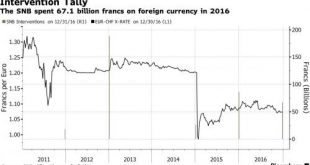

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been –...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org