While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~ trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky Way galaxy is Japan, which now owns 40% of all JGBs in its ongoing attempt to pressure the Yen lower and explains why Abe was trembling when he met with Trump, terrified the US president would tell him to stop, one place where Trump may want to look is Europe’s famously “neutral” country, which however continues to be quite bellicose when it comes to currency warfare. Overnight, the SNB announced that in 2016 it spent 67.1 billion Swiss francs, or .6 billion, to purchase foreign currencies in an effort to weaken its currency. The amount, published in the central bank’s annual report on Thursday, was roughly CHF20 billion lower than the 2015 total of 86.1 billion francs and a record of 188 billion spent in 2012. What is notable is that in 2015, the Swiss National Bank ended its 1.20 EURCHF peg, which ended up costing the SNB tens of billions in FX losses.

Topics:

Tyler Durden considers the following as important: Business, Central Banks, China, currency, Currency intervention, currency war, Donald Trump, economy, Featured, Finance, fixed, Flight to Safety, Foreign exchange market, foreign exchange reserves, Japan, Market Crash, Monetary hegemony, Money, newsletter, Swiss Franc, Swiss National Bank, UBS, Yen, Yuan, Zerohedge on CHF

This could be interesting, too:

investrends.ch writes Parlamentariergruppe legt Kompromiss zu UBS-Kapitalregeln vor

investrends.ch writes Schweizer Pensionskassen erzielen im November solide Performance

investrends.ch writes Starke Zunahme von Selfmade-Milliardären

investrends.ch writes Bundesanwaltschaft klagt Credit-Suisse und UBS an

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky Way galaxy is Japan, which now owns 40% of all JGBs in its ongoing attempt to pressure the Yen lower and explains why Abe was trembling when he met with Trump, terrified the US president would tell him to stop, one place where Trump may want to look is Europe’s famously “neutral” country, which however continues to be quite bellicose when it comes to currency warfare. Overnight, the SNB announced that in 2016 it spent 67.1 billion Swiss francs, or $67.6 billion, to purchase foreign currencies in an effort to weaken its currency.

| The amount, published in the central bank’s annual report on Thursday, was roughly CHF20 billion lower than the 2015 total of 86.1 billion francs and a record of 188 billion spent in 2012. What is notable is that in 2015, the Swiss National Bank ended its 1.20 EURCHF peg, which ended up costing the SNB tens of billions in FX losses.

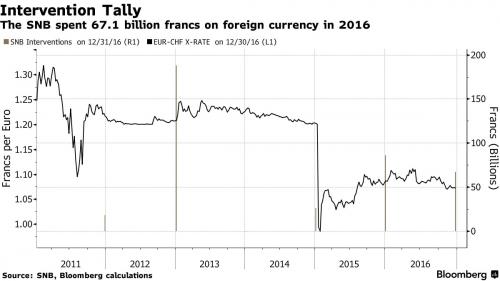

As shown in the chart below, the SNB has used interventions for the better part of a decade to keep the franc, Europe’s preeminent flight to safety currency, in check and lessen the risk of deflation. After it gave up its currency cap in early 2015, the SNB has also relied on a negative deposit rate to counter appreciation pressure. It reaffirmed that two-pillar policy stance last week. |

SNB Intervention, 2010 - 2017 |

| Additionally, as part of its annual report, the SNB reported that at the end of 2016, the SNB’s assets hit a record CHF 747 billion, compared to CHF 641 billion the previous year, higher than the country’s total GDP. The central bank’s assets consisted almost exclusively of currency reserves, that is gold and foreign currency investments. Currency reserves were up by CHF 89 billion year-on-year to CHF 692 billion, principally due to inflows from foreign currency purchases and valuation gains.

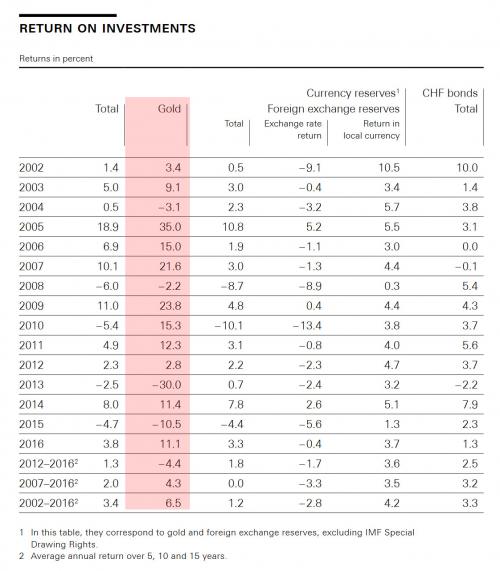

And since the SNB is the only central banks which admits it is an aggressive hedge fund, it also reports both the composition of its balance sheet and the return on assets, and in 2016 it generated a profit on currency reserves of 3.8%. Meanwhile, returns on gold and foreign exchange reserves were 11.1% and 3.3% respectively. |

Return on Investments |

| What is paradoxical is that despite gold generating the SNB’s highest return not only in 2016 (11.1%) and over the entire 2002-2016 period, at 6.5%, the central bank has been aggressively reducing the relative size of its gold-denominated assets over the past 7 years, mostly as a result of purchases of USD-denominated stocks and bonds. |

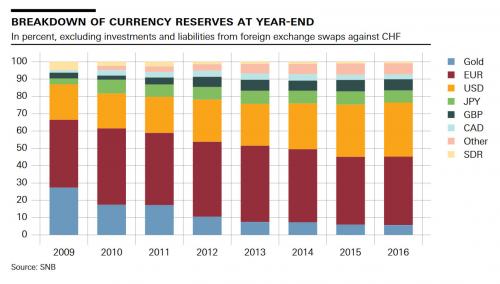

Currency Reserves Year-End, 2009 - 2017 |

| In 2016, both fixed income investments and equities contributed to the SNB’s bottom line. On the other hand, the slight appreciation of the Swiss franc reduced the return.

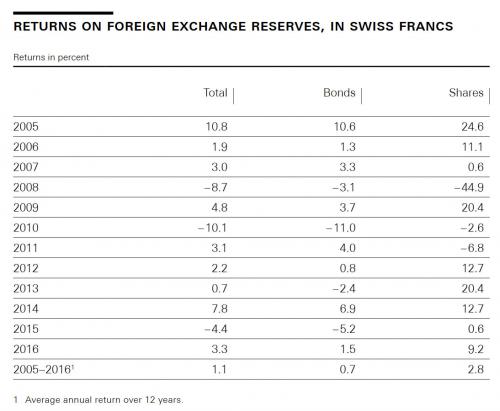

The SNB also revealed that in 2016, the SNB held 20% of its foreign exchange reserves in the form of equity investments. Measured in Swiss francs, the average annual return on equities since their introduction in 2005 has been 2.8%; the return on bonds has averaged 0.7%. Finally, for those confused that the SNB is so open about its purchases and holdings of mostly US stocks, this is how the central bank justifies its policy of active stock management:

We look forward to how this boilerplate language will change after the next equity market crash which will wipe out tens of billions in “value” from the SNB’s balance sheet. |

Foreign Exchange Reserves - Swiss Franc |

Tags: Business,central banks,China,Currency,Currency intervention,currency war,Donald Trump,economy,Featured,Finance,fixed,Flight to Safety,Foreign exchange market,Foreign Exchange Reserves,Japan,Market Crash,Monetary hegemony,money,newsletter,Swiss Franc,Swiss National Bank,UBS,Yen,yuan