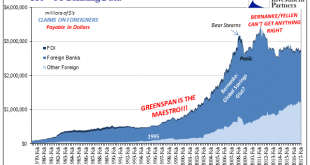

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

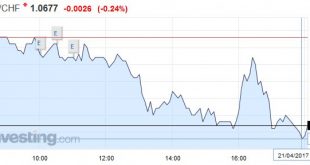

Swiss Franc EUR/CHF - Euro Swiss Franc, April 21(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen’s hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has...

Read More »Assessing China’s Economic Risks

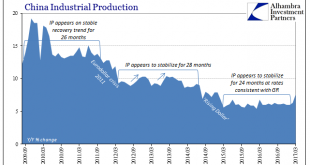

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful. Due to unanswered...

Read More »What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency. There are, of course, various economic areas where estimates are going to...

Read More »Trade Notes: China and Prospects for a New Executive Order

Summary: China’s trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive. Last week’s meeting between the US and China’s Presidents did not produce much fireworks or headlines. The...

Read More »FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

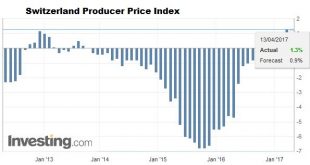

Swiss Franc Switzerland Producer Price Index (PPI) YoY March 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended...

Read More »Saxo Warns Reflation Trade Ends In Q2 With “Healthy Correction”

The reflation trade that started before Donald Trump’s victory in the US presidential elections accelerated in Q1 as global economic data improved and surprised against expectations. Global equities are up 6.5% in dollar terms with markets such as Hong Kong, emerging markets, and Brazil the clear outperformers. In its Q2 2017 Outlook report, Saxo Bank warns that the reflation trade will end in Q2 with a healthy correction in global equities. The biggest perception-versus-reality...

Read More »Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

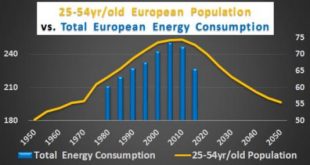

Authored by Chris Hamilton via Econimica, The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives...

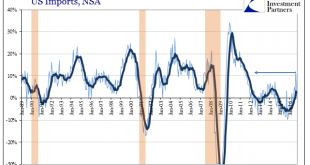

Read More »February US Trade Disappoints

The oversized base effects of oil prices could not in February 2017 push up overall US imports. The United States purchased, according to the Census Bureau, 71% more crude oil from global markets this February than in February 2016. In raw dollar terms, it was an increase of $7.3 billion year-over-year. Total imports, however, only gained $8.4 billion, meaning that nearly all the improvement was due to nothing more...

Read More »FX Daily, April 05: Dialing it Up on Hump Day

Swiss Franc EUR/CHF - Euro Swiss Franc, April 05(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc may come under pressure tomorrow after Consumer Price Index inflation numbers are released. Inflation is expected to fall from 0.6% to 0.5% for the month of March and any weakening in the numbers could see the Swiss Franc weaken. Fridays unemployment data from Switzerland could also give a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org