When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure...

Read More »Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?” Sherlock Holmes: “To the curious incident of the dog in the night-time.” Gregory: “The dog did nothing in the night-time.” Sherlock Holmes: “That was the curious incident.” From Silver Blaze by Arthur Conan Doyle, 1892 It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason”...

Read More »FX Daily, April 28: Biden and Powell are Center Stage

Swiss Franc The Euro has fallen by 0.02% to 1.104 EUR/CHF and USD/CHF, April 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It appears that the backing up of US yields is giving the dollar a better tone and challenging the Eurosystem, which has stepped up its bond purchases. The US 10-year yield is around 1.65%, roughly a two-week high and back above the 20-day moving average. European yields are mostly 2-4...

Read More »Alte Welt wird abgehängt

Smartphone im Einsatz: Apple verdient dank dem iPhone mehr als alle anderen Konzerne weltweit. (Bild: Pixabay) US-Konzerne sind bezüglich Umsatz- und Gewinnwachstum führend. Das ist das Fazit einer Analyse von EY der weltweit 1000 umsatzstärksten Unternehmen. Europäische Firmen verlieren den Anschluss. Die Schweizer Konzerne behaupten sich gut.US-Konzerne sind in punkto Umsatz- und Gewinnwachstum weltweit führend: Während die grössten nordamerikanischen Unternehmen ihren Umsatz im...

Read More »Ungebremste Machtzunahme

Der Apfel glänzt platinfarben: Ein Ende des Höhenflugs der grossen Tech-Unternehmen ist nicht abzusehen. Foto: Bodo Marks Auf mehr als eine Billion Dollar – 1’000’000’000’000 Dollar – ist letzte Woche der Börsenwert des Unternehmens Apple angestiegen. Diese Summe ist um rund die Hälfte grösser als die Gesamtleistung der Schweizer Volkswirtschaft im letzten Jahr (das Bruttoinlandprodukt für 2017 wird auf 680 Milliarden Dollar geschätzt). Die Entwicklung zu solchen Werten ist wie diejenige...

Read More »iGen

In the FT, Leslie Hook reports that activist investors want Apple to address concerns over smartphone addiction and the mental health effects of phone use among children. They refer to psychologist Jean Twenge according to whom teenagers today (“the iGen”) … are more vulnerable than Millennials were: Rates of teen depression and suicide have skyrocketed since 2011. It’s not an exaggeration to describe iGen as being on the brink of the worst mental-health crisis in decades. Much of this...

Read More »In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. - Click to enlarge While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times, it is no stranger to pumping money into companies...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

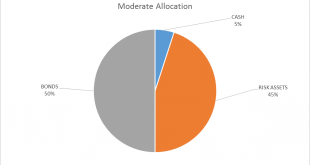

Read More »Global Asset Allocation Update

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org