Submitted by Michael Shedlock via MishTalk.com, For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change. But leading experts say the...

Read More »We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

Submitted by John Rubino via DollarCollapse.com, At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable: SNB’s U.S. Stock Holdings Hit $62.4 Billion...

Read More »L’argent des banques centrales finit dans les paradis fiscaux!

Nous savions que la crise avait laminé les finances des Etats, de l’économie publique et des familles. Jusque là rien de nouveau.Mais en finance, quand quelqu’un perd, il y a en général quelqu’un d’autre qui gagne la même somme et peut-être plus. A moins qu’il ne s’agisse de billets physiques que l’on flambe, c’est comme ça. Nous allons donc nous intéresser aux grands gagnants de la crise financière. S’il y en a...

Read More »Something Strange Is Going On In Switzerland: “Is Someone Trying To Buy The Swiss National Bank”

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank… Value of Swiss National Bank US Stocks Holdings(see more posts on Swiss National Bank, )Value of Swiss National Bank US Stocks Holdings - Click to enlarge … which has shown a particular appetite for AAPL stock: Swiss National Bank Top Holdings(see...

Read More »Is Someone Trying To Buy The Swiss National Bank?

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank… Value of Swiss National Bank US Stocks Holdings(see more posts on SNB Holdings, )Value of Swiss National Bank US Stocks Holdings - Click to enlarge … which has shown a particular appetite for AAPL stock: Swiss National Bank Top Holdings(see more...

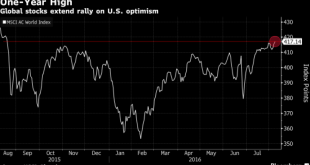

Read More »S&P To Open At New Record High As Commodities Rise, China Trade Disappoints

The meltup continues with the S&P500 set to open at new all time highs as futures rise 0.2% overnight, with European, Asian stocks higher, as job data pushed MSCI Asia Pacific Index towards highest close since Aug. 2015. Germany, U.K. economic data seen positive, with dollar, oil rising, and gold declining. Global equities advanced with commodities and emerging markets on speculation the U.S. economy is strong enough to sustain growth while only triggering a gradual increase in interest...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More »Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. There was some confusion as to why the jump and then it was revealed that none other than that “other” billionaire, Warren Buffett, has decided to start building a stake in the world’s biggest cell phone company to the tune of 9.8 million shares or about $1.07 billion as of March 31. Making some more sense of the transaction, CNBC adds this...

Read More »BNS en mode d’autodestruction. Liliane Held-Khawam

Une autodestruction qui se déroule au vu et au su de tous! Carl Icahn est un investisseur américain qui a aussi été ces dernières années un des principaux actionnaires de Apple. Alors que C Icahn visait les 200$ pour l’action, il s’est soudainement mis à douter du titre et à vendre ces derniers temps son stock. TOUT son stock selon Zerohedge! Cela a eu pour vertu de faire dégringoler la valeur du titre. Mais voilà qu’au même moment une entité cherchait à acheter chaque titre disponible...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org