While the broader market for Swiss stocks has risen modestly this year, one ‘entity’ has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since...

Read More »Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial Times noted in a story about its...

Read More »Can Switzerland Survive Today’s Assault On Cash And Sound Money?

Authored by Marcia Christoff-Kurapovna via The Mises Institute, “Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

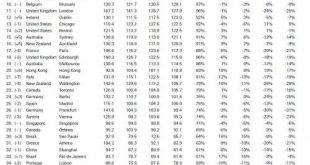

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive – and in this year’s edition, best – cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of “cheap dates” in the world’s top cities. The index consists of...

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of "cheap dates" in the world's top cities. The index consists of i) cab rides, ii) dinner/lunch for two at a pub or diner, iii) soft...

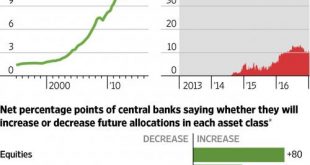

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017’s ‘known unknowns’ suggest a year of more mayhem awaits… Here’s a selection of key events in the year ahead (and links to Bloomberg’s quick-takes on each). January Donald Trump will be sworn in as U.S. president on Jan. 20.QuickTakes: Immigration Reform, Free Trade and Its Foes, Supreme Court, Oil Sands, Confronting Coal, Climate Change,...

Read More »Frontrunning: December 20

Trump wins Electoral College vote; a few electors break ranks (Reuters) European Stocks Head for a One-Year High (BBG) Japan's Central Bank Keeps Policy Unchanged, Upgrades Economic Outlook (BBG) Russia and Turkey vow to keep detente on track after murder (FT) The Political Implications of Events in Ankara and Berlin (BBG) Trump condemns Berlin attack, says things 'only getting worse' (Reuters) Merkel: "No Doubt Berlin Crash Was a Terror Attack" (BBG) Gunman in Zurich mosque shooting is dead...

Read More »Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

Submitted by Michael Shedlock via MishTalk.com, For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change. But leading experts say the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org