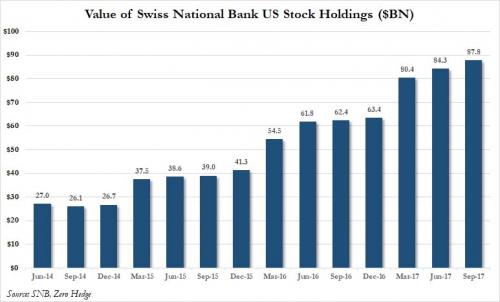

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. - Click to enlarge While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times, it is no stranger to pumping money into companies all over the world… SNB - US Stock Holdings, Q3 2017(see more posts on SNB Holdings, ). Including Apple, Alphabet, and Microsoft… But, as Reuters reports, this is its first acquisition in decades. The central bank said on Thursday it was purchasing a 90 percent stake in Landqart AG after the company –

Topics:

Tyler Durden considers the following as important: Apple, Bailout, Banking in Switzerland, Banknote, Business, Central Bank, Currency intervention, economy, Featured, Finance, Monetary Policy, Money, money creation, newslettersent, Reuters, SNB, SNB Apple Holdings, SNB Holdings, SNB US Stock Holdings, Swiss National Bank, Zerohedge on SNB

This could be interesting, too:

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

investrends.ch writes Die Zurückhaltung der SNB wird mehrheitlich begrüsst

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

investrends.ch writes SNB erzielt nach 9 Monaten einen Gewinn von 12,6 Milliarden Franken

| In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. | |

| While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times, it is no stranger to pumping money into companies all over the world… |

SNB - US Stock Holdings, Q3 2017(see more posts on SNB Holdings, ) |

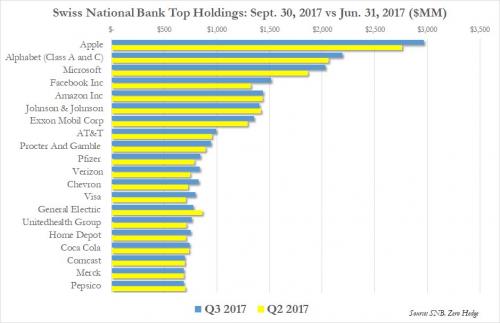

| Including Apple, Alphabet, and Microsoft…

But, as Reuters reports, this is its first acquisition in decades. The central bank said on Thursday it was purchasing a 90 percent stake in Landqart AG after the company – which makes the polymer material used in new 10-franc notes – got into financial difficulties. |

SNB Top Holdings, Q3 2017(see more posts on SNB Holdings, ) |

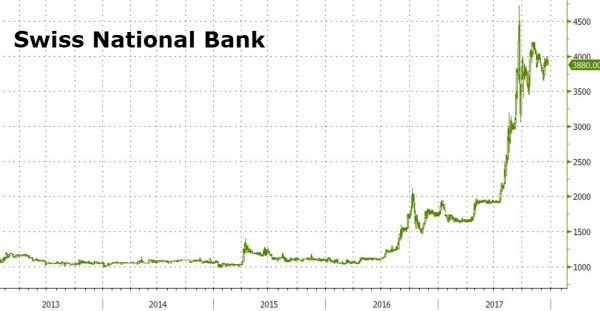

| The Swiss National Bank certainly has the ‘currency’ to do the bailout – its share price is up over 250% in the last 2 years…

Buying the company was the best solution to avoid interruptions in the production of the Durasafe paper, described by SNB Chairman Thomas Jordan as “integral” to the safety of new notes.

The deal came about after an overseas customer unexpectedly cancelled an order with Landqart, which employs 260 people, leading to a big drop in sales and cash flow problems. The company reduced workers’ hours to deal with the crisis, which the SNB said posed a “direct and existential threat” to Landqart’s survival. The SNB said Landqart would be provided with enough funds to ensure its survival, with between 5 and 15 million francs earmarked for the project.

Does anyone else see the irony that in a world that is ‘printing money’ at the fastest rate in its history, one of the biggest manipulators of markets via its balance sheet is forced to bail out it money-manufacturer… |

SNB Overview, 2013 - 2017 |

Tags: Apple,Bailout,Banking in Switzerland,Banknote,Business,Central Bank,Currency intervention,economy,Featured,Finance,Monetary Policy,money,money creation,newslettersent,Reuters,SNB Apple Holdings,SNB Holdings,SNB US Stock Holdings,Swiss National Bank