Once the contagion starts spreading, loose money won’t put the fires out. As the nation’s political and economic leaders struggled to contain the 2008 financial meltdown, President George W. Bush famously summed the situation up: “If money doesn’t loosen up, this sucker will go down.” Eleven years into the loose money recovery, this sucker is finally going down for reasons that have little to do with tight money and everything to do with the inconvenient fact...

Read More »The Taxonomy of Collapse

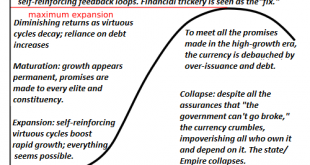

The higher up the wealth-power pyramid the observer is, the more prone they are to a magical-thinking belief that the empire is forever, even as it is crumbling around them. How great nations and empires arise, mature, decay and collapse has long been of interest for a self-evident reason: if we can discern a template or process, we can predict when the great nations and empires of today will slide into the dustbin of history. One of the justly famous attempts to...

Read More »EM Preview for the Week Ahead

EM has had a good month so far as market optimism on a Phase One trade deal remains high.Yet November trade data due out this week should show that until that deal is finalized, the outlook for EM remains weak. Deadline for the next round of US tariffs is December 15 and so talks this week are crucial. Lastly, three major EM central banks are expected to cut rates this week, underscoring the downside risks to growth. AMERICAS Mexico reports November CPI Monday,...

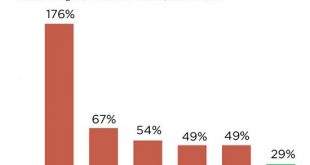

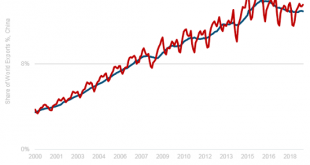

Read More »Costs Are Spiraling Out of Control

And how do we pay for these spiraling out of control costs? By borrowing more, of course. If we had to choose one “big picture” reason why the vast majority of households are losing ground, it would be: the costs of essentials are spiraling out of control. I’ve often covered the dynamics of stagnating income for the bottom 90%, and real-world inflation, i.e. a decline in purchasing power. But neither of these dynamics fully describes the relentless upward spiral...

Read More »Crunchtime: When Events Outrun Plan B

Not only will events outrun Plan B, they’ll also outrun Plans C and D. We all know what Plan B is: our pre-planned response to the emergence of risk. Plan B is for risks that can be anticipated, regular but unpredictable events such tornadoes, earthquakes, hurricanes, etc. In the human sphere, risks that can be anticipated include temporary loss of a job, stock market down turns, recession, disruption of energy supplies, etc. Hidden in most Plan B’s are a host of...

Read More »Dollar Soft on Weak Data and the Return of Tariff Man

The dollar has taken a hit from the weaker than expected data Monday Tariff man is back The US economy remains solid in Q4 but there are some worrying signs for the November jobs data Friday The political pressure on Turkey from the US could increase soon; South Africa’s Q3 GDP came in well below expectations at -0.6% q/q and 0.1% y/y Japan JGB auction went poorly on supply concerns ahead of planned fiscal stimulus; RBA kept rates steady at 0.75% but the outlook was...

Read More »EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress. Until a deal is wrapped up, we remain cautious on EM. AMERICAS Chile...

Read More »Could America Survive a Truth Commission?

A nation that’s no longer capable of naming names and reporting what actually happened richly deserves an economic and political collapse to match its moral collapse. You’ve probably heard of the Truth Commissions held in disastrously corrupt and oppressive regimes after the sociopath/kleptocrat Oligarchs are deposed. The goal is not revenge, as well-deserved as that might be; the goal is national reconciliation via the only possible path to healing: name names and...

Read More »A China Trade Deal Just Finalizes the Divorce

Each party will continue to extract whatever benefits they can from the other, but the leaving is already well underway. Beneath the euphoric hoopla of a trade deal with China is the cold reality that the divorce has already happened and any trade deal just signs the decree. The divorce of China and the U.S. was mutual; each had used up whatever benefits the tense marriage had offered, and each is looking forward to no longer being dependent on the other. Any trade...

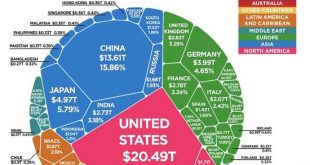

Read More »We Can Only Choose One: Our National Economy or Globalization

The servitude of society to a globalized economy is generating extremes of insecurity, powerlessness and inequality. Does our economy serve our society, or does our society serve our economy, and by extension, those few who extract most of the economic benefits? It’s a question worth asking, as beneath the political churn around the globe, the issues raised by this question are driving the frustration and anger that’s manifesting in social and political disorder. A...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org