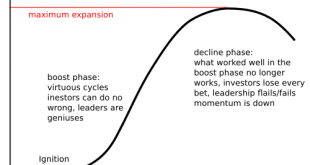

The decline phase of the S-Curve is just beginning. Globalization and Imperial Pretensions have been decaying for years; now the tide has turned definitively against them. The Covid-19 pandemic didn’t cause the demise of globalization and Imperial Pretensions; it merely pushed the rickety structures over the edge. It’s human nature to reckon the current trend will continue running more or less forever, and that temporal, contingent structures are...

Read More »Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill Fed easing expectations are intensifying The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them Reports suggest the Bank of Japan is “likely to strengthen stimulus” next week; Australia announced details of its AUD17.6 bln stimulus plan The dollar is broadly firmer...

Read More »And Then Came the Lawsuits: Pandemic in a Litigious Society

This is the upside of hyper-litigiousness: prevention is prioritized as the most effective means of limiting future liability. Never mind prevention or vaccines; the big question is “who can we sue after this blows over to rake in millions of dollars?” Yes, this is pathetic, tragic, perverse and evil, but that’s reality in a hyper-litigious society like the U.S. Many people are struck by the apparent over-reaction of Corporate America to the Covid-19 threat, but this...

Read More »Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data RBA Deputy Governor Debelle laid out the likely path for unconventional policy; China reported disappointing money and...

Read More »ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week. POLICY OUTLOOK It’s worth noting that even with the complicated voting rights system, a formal vote is not always needed to act. For instance, at the September 2019...

Read More »Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs Italy announced that it is extending travel curbs beyond just the north to the entire nation; further fiscal measures there will be seen Japan reported February...

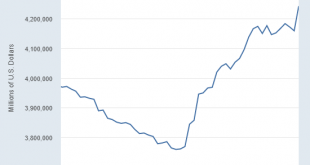

Read More »What the Fed Can Do: Print and Buy, Buy, Buy

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon. Much has been written about what the Federal Reserve cannot do: it can’t stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic. But let’s not overlook what the Fed can do: create U.S. dollars out of thin air and use these dollars to buy assets either directly or through proxies. Let’s also not overlook how much the Fed...

Read More »Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day Japan has a fairly heavy data week; the yen continues to benefit from risk-off sentiment...

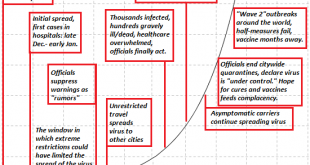

Read More »The Gathering Storm: Could Covid-19 Overwhelm Us in the Months Ahead?

Either the science is wrong and the complacent will be proven correct, or the science is correct and the complacent will be wrong. The present disconnect between the science of Covid-19 and the status quo’s complacency is truly crazy-making, as we face a binary situation: either the science is correct and all the complacent are wrong, or the science is false and all the complacent are correct that the virus is no big deal and nothing to fret about. Complacency is...

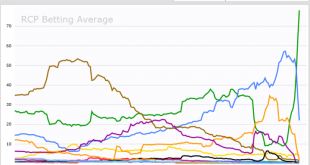

Read More »Updated Democratic Primary Timeline

Super Tuesday has come and gone. Bloomberg has suspended his campaign after an extremely poor showing, and Warren is expected to follow suit soon. Here is our updated take on the likely Democratic candidate. RECENT DEVELOPMENTS Biden exceeded expectations on Super Tuesday. He won Alabama, Arkansas, Massachusetts, Minnesota, North Carolina, Oklahoma, Tennessee, Texas, and Virginia and leads in Maine. Sander won Colorado, Utah, and Vermont and leads in California. As...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org