Global equity markets continue to trend higher; the dollar remains under pressure The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed Fitch cut Italy by a notch to BBB- with stable outlook; Germany reports April CPI Reports suggest that governors in Japan will ask the national government to extend the state of emergency; Australia reported higher than expected Q1 CPI The dollar is mostly weaker against the majors as risk-on sentiment persists. Kiwi and Loonie are outperforming, while Nokkie and sterling are underperforming.

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Global equity markets continue to trend higher; the dollar remains under pressure

- The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out

- France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread

- Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed

- Fitch cut Italy by a notch to BBB- with stable outlook; Germany reports April CPI

- Reports suggest that governors in Japan will ask the national government to extend the state of emergency; Australia reported higher than expected Q1 CPI

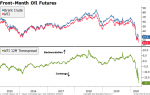

The dollar is mostly weaker against the majors as risk-on sentiment persists. Kiwi and Loonie are outperforming, while Nokkie and sterling are underperforming. EM currencies are mostly firmer. IDR and HUF are outperforming, while TRY and CNY are underperforming. MSCI Asia Pacific ex-Japan was up 1.0% on the day, with Japan closed for holiday. MSCI EM is up 1.0% so far today, with the Shanghai Composite rising 0.4%. Euro Stoxx 600 is flat near midday, while US futures are pointing to a higher open. 10-year UST yields are down 2 bp at 0.59%, while the 3-month to 10-year spread is down 2 bp to stand at +51 bp. Commodity prices are mostly higher, with Brent oil up 5.1%, WTI oil up 15.2%, copper up 0.4%, and gold down 0.1%.

The dollar is mostly weaker against the majors as risk-on sentiment persists. Kiwi and Loonie are outperforming, while Nokkie and sterling are underperforming. EM currencies are mostly firmer. IDR and HUF are outperforming, while TRY and CNY are underperforming. MSCI Asia Pacific ex-Japan was up 1.0% on the day, with Japan closed for holiday. MSCI EM is up 1.0% so far today, with the Shanghai Composite rising 0.4%. Euro Stoxx 600 is flat near midday, while US futures are pointing to a higher open. 10-year UST yields are down 2 bp at 0.59%, while the 3-month to 10-year spread is down 2 bp to stand at +51 bp. Commodity prices are mostly higher, with Brent oil up 5.1%, WTI oil up 15.2%, copper up 0.4%, and gold down 0.1%.

Despite a small decline yesterday in the US, global equity markets continue to trend higher. The MSCI world is now up over 25% from the lows and 16% away from the February highs. Year to date, the S&P 500 is down 11% and the Nasdaq down only 4%; futures are up after mostly stronger earnings reports. Europe remains far behind, however, with the EuroStoxx 600 down 18% this year and the UK FTSE 100 down over 20%, about the same as MSCI EM.

The dollar remains under some pressure. DXY is down four straight days but is finding support near the 99.60 area. A clean break below that would set up a test of the April 15 low near 98.817. The euro is edging higher after support held near $1.08 area, while sterling is lagging and remains stuck near the $1.24 area. USD/JPY remains heavy and is trading at the lowest level since March 17 near 106.45. Break below the 105.20 area would set up a test of the March 9 low near 101.20. We remain constructive on the dollar but acknowledge room for near-term losses during this current bout of risk-on sentiment.

AMERICAS

The two-day FOMC meeting ends today. After the recent flurry of both monetary and fiscal stimulus in the US, we expect the Fed will now take a wait and see approach. Chair Powell will lay out the Fed’s latest thinking at his pos-decision press conference. Its efforts to “normalize” market segments that came under stress appear to be working. All of the major measures taken this year have come at emergency meetings. To wit, the Fed expanded its Municipal Liquidity Facility (MLF) this Monday, a day before the FOMC meeting began. If anything else changes between this meeting and the next scheduled one June 10, rest assured that the Fed will take quick action as needed. There is simply no reason for the Fed to be limited by the calendar any more.

The first look at Q1 US GDP comes out. While it is old news, it will give markets a taste of what’s to come in Q2. Consensus sees a contraction of -3.9% SAAR and compares to a -1.0% reading from the Atlanta Fed’s GDPNow model and -0.4% from the New York Fed’s Nowcast model. Looking ahead, the Nowcast model is currently estimating Q2 growth at -7.8% SAAR. It’s also worth noting that the New York Fed recently unveiled its Weekly Economic Index (WEI) to better capture the current state of the economy by using high frequency data. For the week ending April 25, WEI suggests the economy is contracting -11.6%. Other US data today include weekly mortgage applications and March pending home sales, which are expected to plunge -13.6% m/m.

EUROPE/MIDDLE EAST/AFRICA

France’s re-opening plan is out. Shops will begin operating on May 11, but restaurants and cafes will start later on June 2. There will be strict rules governing school re-openings, but some will start on May 11. Large public events will remain banned until September. Beaches will remain closed until June 1 and park openings will depend on conditions.

Spain is looking at a two-month path that will lead the country to a “new normal,” according to PM Pedro Sanchez. Provinces will have the authority to ease restrictions according to conditions on the ground. Schools will only re-open in September. The comments followed measures already announced, including allowing for outdoor exercise from May 2.

The UK is focusing on a technological solution, a “test, track and trace” system. It will involve launching a mobile app and recruiting some 18K contact tracers to identify those exposed. The estimated release time is three weeks, after which we can expect see some restrictions relaxed.

Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed. Yesterday, EU regulators relaxed the so-called leverage ratio for commercial banks. This will allow banks to hold less capital for funds that they keep at their respective central banks as well as funding for infrastructure and small- to medium-sized businesses. All told, an EU official said the measures may free up an estimated EUR450 bln that can be used for increased lending.

The ECB’s April bank lending survey helps explain these moves. It showed that banks tightened lending conditions to both businesses and households in Q1. The report noted that ““Banks referred to the deterioration of the general economic outlook, increased credit risk of borrowers and a lower risk tolerance as relevant factors for the tightening of their credit standards” but added that “For the second quarter of 2020, banks expect credit standards to ease considerably for firms, probably on account of the support measures introduced by governments.”

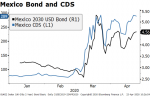

Yesterday, Fitch cut Italy by a notch to BBB- with stable outlook. The agency said the downgrade “reflects the significant impact of the global COVID-19 pandemic on Italy’s economy and the sovereign’s fiscal position ” and now matches Moody’s Baa3 rating. Stable outlook? That’s being generous. Speaking of generous, S&P inexplicably left its rating at BBB with negative outlook last Friday. Moody’s review is scheduled for May 8 and our own sovereign ratings model shows Italy at BB+/Ba1 and so a downgrade is warranted. However, the timing is always tricky to guess and it’s possible Moody’s gives Italy a temporary reprieve. But make no mistake, Italy will eventually go to sub-investment grade.

Germany reports April CPI, which is expected to halve to 0.7% y/y from 1.4% in March. Ahead of that, some states have already reported and point to slight upside risks to the national reading. Retail sales and unemployment will be reported tomorrow and expected to show considerable weakness.

Oil prices remain extremely volatile. WTI is up nearly $2 to over $14 per barrel, while the second month contract is up over $1.0 to just under $19. Brent is up $1 to trade above $21. However, the underlying near-term tension here is still storage capacity for landlocked oil in the US. Cushing storage rose by 2.5 mln barrels last week and could reach its max capacity in the next few weeks. Until the demand-supply imbalance has been addressed, we are skeptical that oil can build on these recent gains.

ASIA

Reports suggest that governors in Japan will ask the national government to extend the state of emergency beyond May 6. Tokyo Governor Koike reportedly said that the extension is needed as the situation remain severe in the capital. Elsewhere, talk is emerging that the Tokyo Summer Olympics that were postponed until next year may be cancelled altogether if the virus is not brought under control in time.

Australia reported higher than expected Q1 CPI data. Headline rose 2.2% y/y vs. 1.9% expected, while trimmed mean rose 1.8% y/y vs. 1.6% expected. Inflation is the highest since Q3 2014 and back within the 2-3% target range. The acceleration was largely due to a drought- and brushfire-related spike in food prices, which are likely to reverse sharply in Q2. Yet this is old news and the focus is no longer on inflation. Risk-on sentiment has boosted AUD to the highest level since March 10 near .6545 and is on track to test the March high near .6685. That high currently coincides with the 200-day moving average and will likely prove tough to break above.

Tags: Articles,Daily News,Featured,newsletter