The death toll from the virus continues to trend lower in Europe and the US; the dollar remains under some pressure The Fed announced an expansion of its Municipal Liquidity Facility (MLF); regional Fed manufacturing surveys for April continue to roll out; other data will be reported Sweden kept rates and QE steady, as expected; Hungary is expected to stand pat too Oil prices are tumbling again Japan reported soft March jobs data; HKMA stepped up its intervention today The dollar is broadly weaker against the majors as risk-on sentiment persists. The Scandies are outperforming, while Swissie and Kiwi are underperforming. EM currencies are mostly firmer. ZAR and MXN are outperforming, while IDR and MYR are underperforming. MSCI Asia Pacific was up 0.7% on the day,

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The death toll from the virus continues to trend lower in Europe and the US; the dollar remains under some pressure

- The Fed announced an expansion of its Municipal Liquidity Facility (MLF); regional Fed manufacturing surveys for April continue to roll out; other data will be reported

- Sweden kept rates and QE steady, as expected; Hungary is expected to stand pat too

- Oil prices are tumbling again

- Japan reported soft March jobs data; HKMA stepped up its intervention today

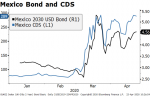

The dollar is broadly weaker against the majors as risk-on sentiment persists. The Scandies are outperforming, while Swissie and Kiwi are underperforming. EM currencies are mostly firmer. ZAR and MXN are outperforming, while IDR and MYR are underperforming. MSCI Asia Pacific was up 0.7% on the day, with the Nikkei falling 0.1%. MSCI EM is up 0.9% so far today, with the Shanghai Composite falling 0.2%. Euro Stoxx 600 is up 1.6% near midday, while US futures are pointing to a higher open. 10-year UST yields are flat at 0.66%, while the 3-month to 10-year spread is flat to stand at +57 bp. Commodity prices are mixed, with Brent oil up 1.7%, WTI oil down 7.1%, copper up 0.2%, and gold down 0.3%.

The death toll from the virus continues to trend lower in most countries in Europe and the US. This means that plans to tentatively open up the economy will be going ahead. UK seems to be lagging behind with the government yet to announce concrete re-opening plans. Also of note, there has been a second wave of infections in some Southeast Asia countries relating to migrant workers. Singapore and Thailand seem to be especially affected, in part due to crowded living conditions for these workers, which leads to faster spread of the contagion.

The dollar remains under some pressure. After DXY traded Friday at the highest level since April 6, it reversed lower ahead of the weekend and now trading back below the 100 area. The euro is nearing a test of the $1.09 area, while sterling is nearing the $1.25 area this week. USD/JPY remains heavy after trading below the 107 area for the first time since April 15. We remain constructive on the dollar but acknowledge room for near-term losses during this current bout of risk-on sentiment.

AMERICAS

Just two days ahead of the FOMC meeting, the Fed announced an expansion of its Municipal Liquidity Facility (MLF). The Fed lowered the population thresholds to 500,000 for counties and 250,000 for cities, making smaller municipal borrowers eligible for the $500 bln program. The termination date for the program was also extended to December 31.

This move is just another reminder why the two-day FOMC meeting that starts today is likely to be a non-event. All of the major measures taken this year have come at emergency meetings. If anything else changes between this meeting and the next scheduled one June 10, rest assured that the Fed will take quick action as needed. There is simply no reason for the Fed to be limited by the calendar.

The regional Fed manufacturing surveys for April continue to roll out this week. Richmond Fed reports today and is expected at -42 vs. +2 in March. Yesterday, Dallas Fed came in at -73.7 vs. -75 expected and -70 in March. Last week, Kansas City Fed came in at -30 vs. -34 expected and -17 in March, the Empire survey came in at -78.2 vs. -35.0 expected and -21.5 in March, and the Philly Fed survey came in at -56.6 vs. -32.0 expected and -12.7 in March.

There are other US data reports today. These include February S&P CoreLogic house prices, April Conference Board consumer confidence (87.9 expected), March advance goods trade (-$55 bln expected), and wholesale and retail inventories (-0.4% m/m and +0.5% m/m expected, respectively).

EUROPE/MIDDLE EAST/AFRICA

Sweden’s Riksbank kept rates and QE steady, as expected. The bank’s central rate forecast shows rates remaining at these levels until February 2021, reinforcing their resistance toward moving rates back to negative, but of course they won’t hesitate to act if necessary. Further easing is likely to come in the form of increased asset purchases. Officials slashed their growth forecast to -6.9% for 2020. Recall that Sweden took a relatively light-handed approach towards containing the virus, which is likely to pay off in terms of economic performance if they can remain on course. March trade and retail sales were also reported and came in at SEK4.1 bln and -1.7% m/m, respectively. The Swedish krona is outperforming on the day, but the sales data show that even countries that did not introduce aggressive lockdowns are still suffering.

National Bank of Hungary is expected to stand pat. In early April, the bank sent a mixed message by introducing QE to boost the economy whilst raising some rates to help support the forint. The bank is expected to reveal details today of that QE program, as Governor Matolcsy has said that asset purchases are likely to begin the first week of May. Until the impact can be better gauged, we think the bank would be right to stand pat this week. Finance Minister Varga warned that the economy is likely to contract more than the -3% previously forecast.

Oil prices are tumbling again. The trigger for this latest leg down was reports that the largest oil ETF said it would liquidate its June WTI futures position and move into July contracts. WTI June contract extended its slide to near $10 a barrel before recovering modestly. With the second (July) contract for WTI trading around $19, this leaves a $7 spread between the two contracts. The underlying problem here is the supply-demand imbalance along with an extreme shortage of storage capacity, which means that nobody wants to take delivery of crude.

ASIA

Japan reported soft March jobs data. Unemployment rose a tick as expected to 2.5%, while the jobs-to-applicant ratio dropped to 1.39 vs. 1.40 expected and 1.45 in February. That ratio is the lowest since September 2016 and is only going to get worse now that the Abe government introduced the lockdown. Indeed, with that lockdown in place, the upcoming Golden Week holiday early next month will be a subdued affair with limited travel and spending.

USD/JPY is trading at the lowest level since March 17 near 106.60. The 106.45 area represents the 50% retracement objective of the March rise. However, the key 62% area lies around 105.20 and a break below that would set up a test of the March 9 low near 101.20.

The HKMA stepped up its intervention today. With HKD still trading at the strong end of the trading band, it bought $1.7 bln today and brings the total since it started intervening last week up to around $2.7 bln. We note again that the HKMA has unlimited resources (HKD) to defend the strong end of the band. HIBOR rates should eventually adjust lower as HKD liquidity is boosted, thereby narrowing its interest rate advantage over USD and reversing the inflows. Elsewhere, Chief Executive Lam announced plans to reopen government offices and some public facilities May 4, but added that they have yet to decide about extending social distancing measures beyond May 7.

Tags: Articles,Daily News,Featured,newsletter