Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. When finances tighten, there are two choices: cut expenses or increase revenues. Monopolies, cartels and governments can increase revenues by increasing taxes or the price of goods and services because users / customers / taxpayers have no alternative. The rest of us have to cut expenses. Making lasting cuts in expenses generally requires reducing sources of expense, and within institutions and enterprises, complexity is one systemic source of expense. But reducing complexity is difficult, so it’s rarely pursued unless the only remaining choice is bankruptcy / collapse. The problem is there are many

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

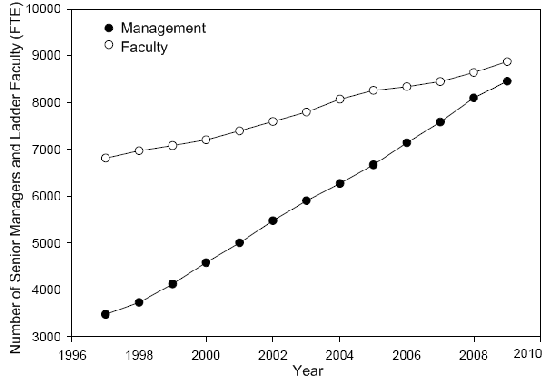

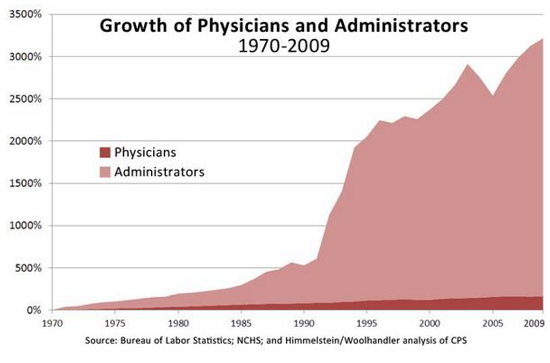

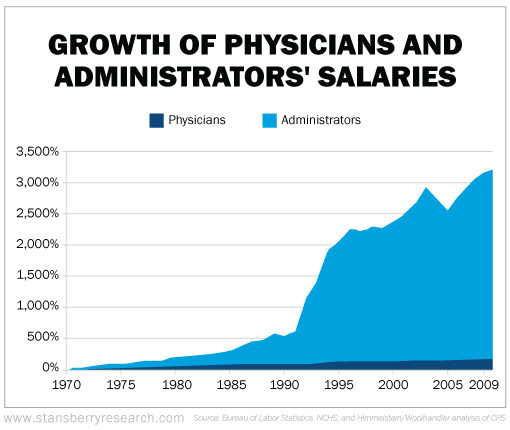

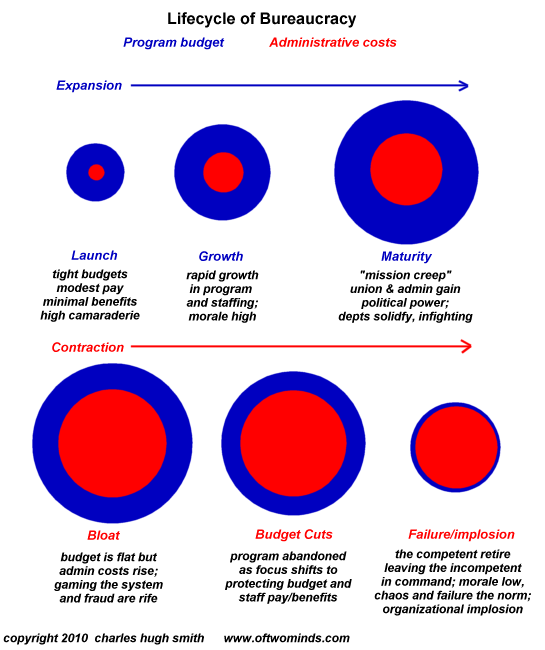

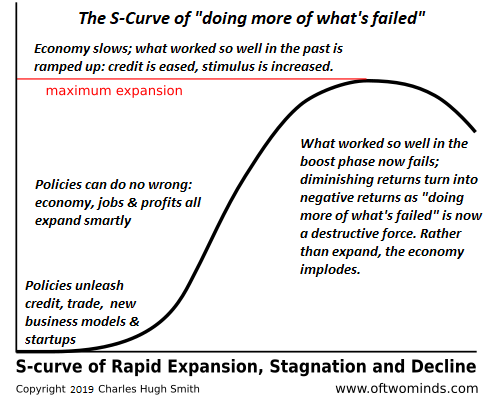

Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. When finances tighten, there are two choices: cut expenses or increase revenues. Monopolies, cartels and governments can increase revenues by increasing taxes or the price of goods and services because users / customers / taxpayers have no alternative. The rest of us have to cut expenses. Making lasting cuts in expenses generally requires reducing sources of expense, and within institutions and enterprises, complexity is one systemic source of expense. But reducing complexity is difficult, so it’s rarely pursued unless the only remaining choice is bankruptcy / collapse. The problem is there are many constituencies defending complexity and none favoring slash-and-burn reductions of complexity. As a result, complexity is defended and the core functions of the institution are sacrificed instead. I’ve posted the charts below reflecting the extraordinary expansion of administrators in higher education and healthcare in the context of the Ratchet Effect and bureaucratic bloat. |

|

| The Ratchet Effect is: costs and complexity only increase, they never decrease because organizations are optimized to expand, not shrink, and so there are no institutionalized pathways to reducing complexity and costs.

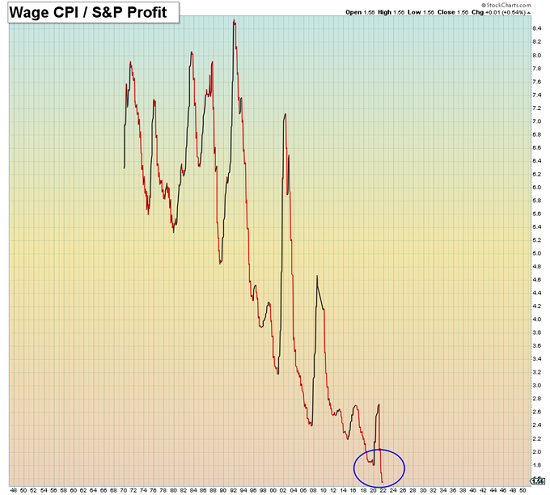

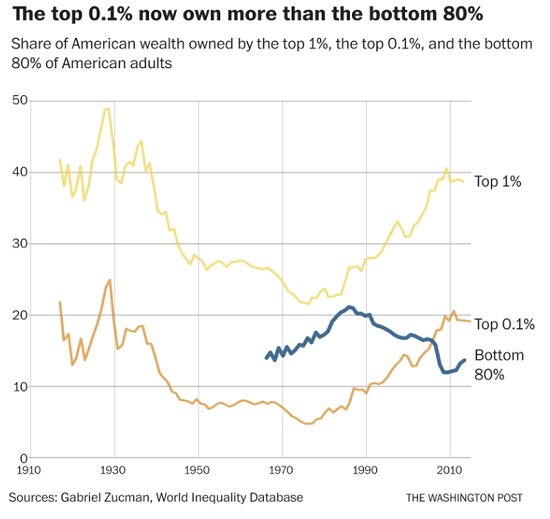

Everybody clamors for a larger budget and another assistant. Nobody clamors for a radically reduced budget and staff. This raises a question few seem to ask: what happens when complexity unravels? Why will complexity unravel? The answer is simple: it costs too much, and supply-side and labor costs are rising. Something’s gotta give, and that something will be complexity. Complexity serves us well when it radically increases productivity. But this type of complexity is rare. Most complexity is self-serving waste and friction that reduces the productivity of labor and capital. Labor has been suppressed for 45 years, and now labor costs must rise so workers can afford a higher cost of living. Costs will rise inexorably for another reason: supply chains have been optimized for a perfect world of endless expansion. Barry Lynn, executive director of the Open Markets Institute, summarized the dynamic nicely: “Corporations have built the most efficient system of production the world has ever seen, perfectly calibrated to a world in which nothing bad ever happens.” Recalibrating every corporate supply chain for all the bad things that are happening will cost a fortune. |

|

| These costs will be passed on to consumers, but as the purchasing power of wages declines, there will be limits on how much consumers will be able to pay.

These higher costs will depress profits which will depress employment and tax revenues. Corporations have two pathways: one is to cling to the old model and go bankrupt (or decay to irrelevance) or radically reduce costs by reducing unproductive complexity. Corporations have been able to borrow vast sums to mask their insolvency but now that the cost of credit is soaring, that door to zombie-corporate-Nirvana has closed. Stripped of the option of cheap borrowing, corporations will have to adapt or perish. Yes, it really will be that simple. Enterprises that burn through their capital run out of money and vanish. Public organizations have long been optimized to increase their revenues and complexity because an expanding economy also expands tax revenues. Nothing boosts local tax revenues like a real estate bubble, and nothing boosts state income taxes like a speculative bubble in stocks, cryptocurrencies, etc. But all bubbles pop, and public agencies are incapable of reducing their budgets, staff and complexity, because one politically influential constituency or another favors every program. So there’s no way to trim anything without igniting a political firestorm as whatever sacred-cow program that gets trimmed arouses the constituency committed to preserving that sacred-cow. |

|

| But beneath the surface, the administrators protect their fiefdom by slashing staff that actually does the real work.

So universities cut tenured teaching positions in order to maintain administrator positions. Healthcare cut physicians and nurses to maintain administrator positions. Building departments cut onsite building inspectors to maintain administrator positions. And so on. Lifeguards will be cut, library hours slashed, etc., while administrative positions remain (behind the screen of public-relations) largely untouched because all the complexity and political battles must be managed. The net result is critical systems will be hollowed out and cease functioning. Those of us who depend on these systems will have to find workarounds. When it takes six months to get a building inspection before you can pour a foundation slab, the workaround will be to just build the house: forget getting permission, just ask for forgiveness. That process will probably take years. |

|

| When there’s a six month wait to see a physician, the workaround will be to pay cash.

In other words, all the complexity will remain firmly in place because somebody somewhere will wage ruthless political warfare to keep it, making it impossible to resize the system to fit available resources. Those with the power to protect their jobs will make the unstated choice to throw everyone without the power to protect their income overboard to save themselves. Meanwhile, the solution is obvious to administrators: raise taxes and fees to get more money out of all those rich folks, i.e. anyone who owns a house, has a good job, etc. You’re welcome, Tax Donkeys. We had to double your property, sales and income taxes to fund essential programs. Things will fall apart behind the screen of normalcy. Cities double their business license fees, raise other fees (for trash collection. etc.) by 20% a year, year after year. The real budget crises are still ahead. The tax donkeys who’ve had enough will vote with their feet, moving away, forcing cities and counties to raise taxes and fees on the remaining tax donkeys. This is how complexity unravels. Agencies’ ability to manage their budgets and employees decays, hiding the reality they lack the structure or the will to downsize their complexity and costs to protect the agency’s core functions. All the compliance and reporting will be cobbled together to maintain the desired appearance, i.e. the illusion of precision in two-inch thick financial statements. The appearances of fulfilling all the requirements of complexity will be maintained. The constituencies defending each sacred-cow will be placated, even as the system supporting all the sacred-cow programs collapses behind the PR screen. Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. |

Tags: Featured,newsletter