The casino has become complex and there are no easy answers or predictable paths. The Wall Street herd had it easy from 2009 to 2021. Life was simple and life was good: markets were easy to predict. As long as the Federal Reserve kept interest rates near-zero and increased its balance sheet to buy Treasury bonds, the stock market rose. As long as the Fed increased its balance sheet to buy mortgage-backed securities, housing rose. If the Fed tried to reduce its balance sheet, the market would quiver and shake and throw a tantrum, and the Fed would go back to keeping interest rates near-zero and increase its balance sheet. To make money all one had to do was buy the dips. Easy-peasy. Alas, life is not so simple these days, and the herd doesn’t know quite which way

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The casino has become complex and there are no easy answers or predictable paths.

The Wall Street herd had it easy from 2009 to 2021. Life was simple and life was good: markets were easy to predict. As long as the Federal Reserve kept interest rates near-zero and increased its balance sheet to buy Treasury bonds, the stock market rose.

|

As long as the Fed increased its balance sheet to buy mortgage-backed securities, housing rose. If the Fed tried to reduce its balance sheet, the market would quiver and shake and throw a tantrum, and the Fed would go back to keeping interest rates near-zero and increase its balance sheet. To make money all one had to do was buy the dips. Easy-peasy. Alas, life is not so simple these days, and the herd doesn’t know quite which way to run. Dynamics that were relegated to the margins for 13 years have emerged from the shadows to complicate the process of making money in markets. Inflation has risen from the depths, breathing fire, stampeding the herd. The herd hears all sorts of messages and it can’t discern signal from noise: inflation in transitory, no it’s embedded, supply chain issues will go away, no they won’t, wage inflation will reverse, no it won’t, and so on. All this complexity has confused the herd mightily. Keep it simple, stupid (KISS) no longer works. Then there’s foreign exchange (FX): the relative value of currencies barely moved. Who cared what micro-moves the yen and yuan made other than currency traders? But now FX moves are big and spooky. The herd became complacent, everyone forgot that currencies mattered, and now the herd is skittish: what the heck does the yen and yuan getting crushed mean? Nobody’s sure, and that spooks the herd. |

|

| Globalization has also run off the tracks. It was all so easy for the past couple of decades: close the plant here, shift production to sweatshops overseas, drop the quality of goods to boost profit margins, and voila, nothing to do but watch corporate profits climb.

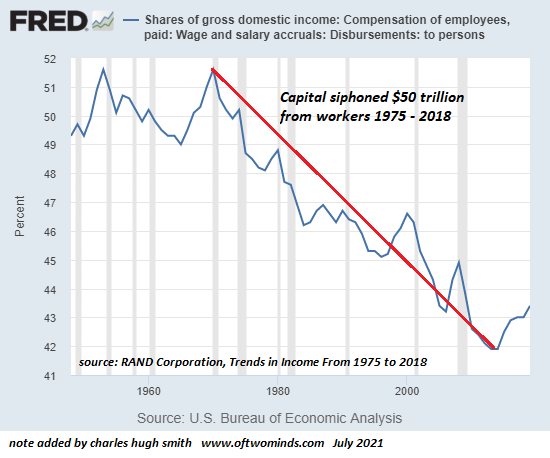

Now that globalization is reversing, the herd doesn’t know which way to run. Where will the easy, guaranteed profits come from now? Energy has been cheap for so long, the herd took it for granted. Now that it appears there are actual physical limits that might affect the financial castles in the sky, the herd is discombobulated. You mean the input costs of everything will go up? Bu-u-u-ut what about the guaranteed higher corporate profits? After decades of being compliant pack animals, the workforce has started wandering off. Millions of workers are quitting every month, dissatisfied and restive. The Wall Street herd believed the hype about robots doing all the work and so automation would force workers to accept lower wages, but a funny thing happened on the way to lower-wage-Nirvana–the workers’ pay was no longer enough to pay rent, student loan payments, food, taxes, etc. The herd has no response to Marx being right after all except a deer-in-the-headlights blank look. That labor might actually stop caving in to corporate capital is incomprehensible, and the herd is in a real spot of bother. |

|

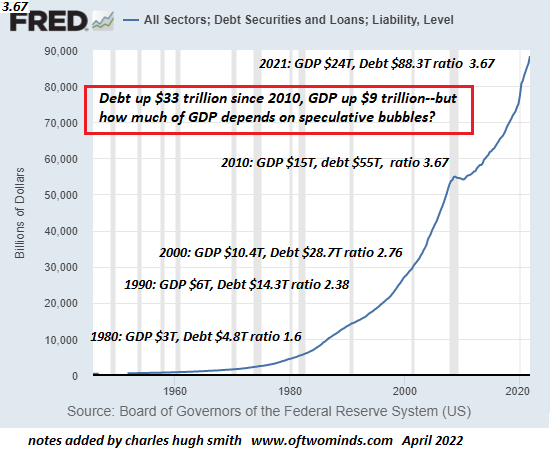

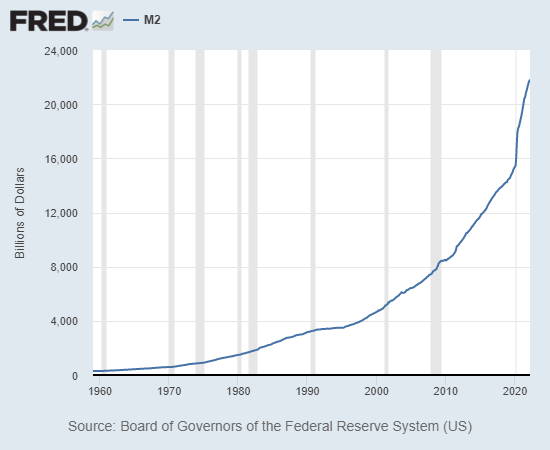

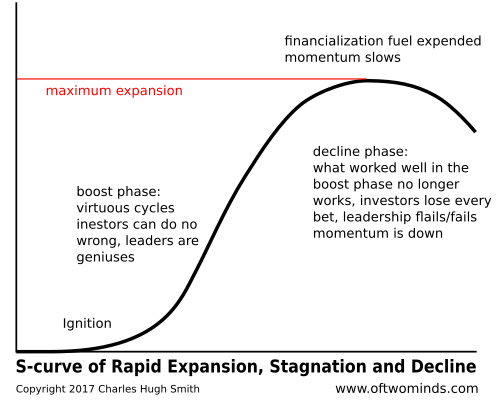

| The herd–fat, dumb and happy after years of easy money– also has no means to comprehend diminishing returns. The fuel for higher profits and markets is expanding debt: nothing could be easier. And since the Fed will keep interest rates near zero, there’s no real limit on debt, so borrow as much as you want.

But borrowing more eventually ceases to generate the desired effect. Rather than boost revenues, taxes, profits and markets, borrowing more now has a cost, and that cost is weighing on the gravy train. Then there’s global capital flows. For the past 13 years, money sloshed around the world more or less making everyone who was already rich even richer. The herd liked this, a lot, as the herd skims a percentage of all wealth and an even bigger chunk of new wealth. Governments liked this too, because governments also skim a percentage of income, profits and wealth that boosts capital gains and property taxes. But now global capital is flowing from the periphery to the core, and that complicates things. There are now big losers in the global casino, and should the flow of global capital become a raging torrent, the winners could become losers faster than they thought possible. The herd on the Street is whining, please just make it simple and easy to make money. Sorry, Herd on the Street. Now you’ll actually have to work to make money from not producing any goods and services. The casino has become complex and there are no easy answers or predictable paths. I’m hearing good things about the yen-quatloo-bat-guano-Slobovian-bond-volatility ratio. You might give that a try. Or just run with the herd and hope you don’t go off a cliff somewhere. |

Tags: Featured,newsletter