What if all the new consensus memes are as wrong as the ones they replaced? I have the Contrarian Curse, and I have it bad. The Contrarian Curse is: as soon as the herd adopts your previously contrarian view, you start questioning the new consensus, just as you questioned the previous consensus. Example #1: fiat currencies are doomed. After all, if creating “money” out of thin air solves all our problems, why not just let everyone print as much as they want at home? Oh, wait, only the super-wealthy and powerful get the newly created “money”? Oh, that makes it really sustainable, doesn’t it? Now the hot meme is the US dollar is expiring and gold / commodity-backed currencies will replace it atop the heap. Many of us on the fringes have pondered alternatives to fiat

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

What if all the new consensus memes are as wrong as the ones they replaced?

I have the Contrarian Curse, and I have it bad. The Contrarian Curse is: as soon as the herd adopts your previously contrarian view, you start questioning the new consensus, just as you questioned the previous consensus.

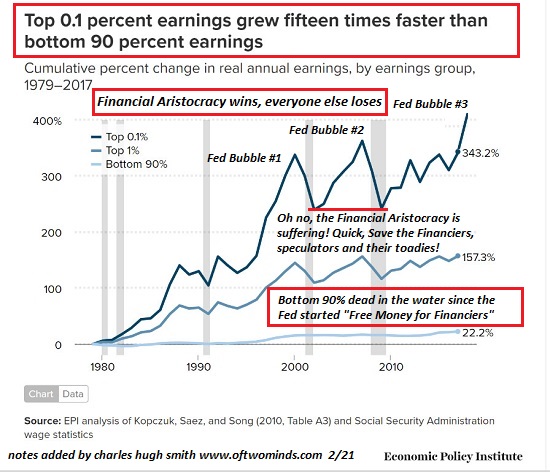

Example #1: fiat currencies are doomed. After all, if creating “money” out of thin air solves all our problems, why not just let everyone print as much as they want at home? Oh, wait, only the super-wealthy and powerful get the newly created “money”? Oh, that makes it really sustainable, doesn’t it?

Now the hot meme is the US dollar is expiring and gold / commodity-backed currencies will replace it atop the heap. Many of us on the fringes have pondered alternatives to fiat currency, and so this becoming mainstream is a real sea change.

Which immediately arouses my contrarian curse. Ok, so exactly how does a gold/commodity-backed currency work? If gold or wheat declines (as measured in purchasing power to everything else), does the quantity of currency shrink to reflect this decline in value? Can the currency supply only expand if gold/commodities rise in relative value? Can the issuing central bank just keep emitting new currency without expanding the reserves of gold/commodities?

What about private banking creating new “money” by originating new mortgages and other loans? What’s backing all this new privately-created “money”?

|

Lots of knotty questions, few if any detailed answers to how a gold-backed Can I convert my gold-backed quatloo into gold? If not, then what exactly does gold-backed mean? As for digital currencies issued by central banks or private banks, how are these different from existing fiat currencies, which are for all intents and purposes, already fully digital currencies? Even more contrarian: what if the demand for US dollars pushes the relative value higher despite the intrinsic flaws in fiat currencies? “Money” is a funny thing. You can print more, but expanding the supply tends to devalue the existing stock of “money,” reducing the value of the newly issued currency. But if demand for the “money” exceeds supply, the relative value Here’s another funny thing about “money.” Take a bunch of loans–student loans, truck loans, mortgages, lines of credit, etc., and extinguish all that debt by writing them off as uncollectible, forgiving the loan, reducing the market value of the underlying collateral (if any), and so on. All that “money” goes to Money Heaven and the supply of “money” shrinks accordingly. If demand remains steady, this reduction in the supply of “money” will push its relative value up. (Questions like this prompted me to writeMoney and Work Unchained.) |

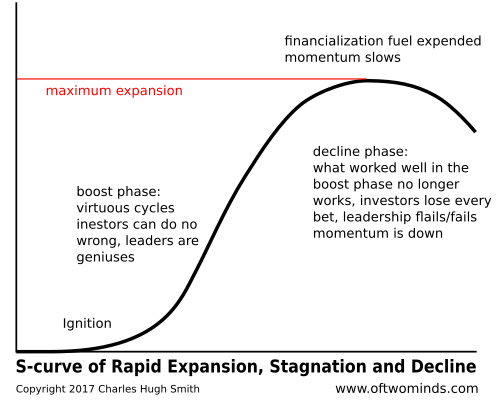

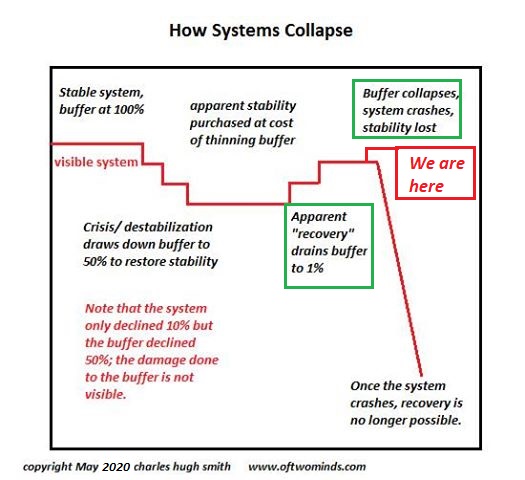

Example #2: yields and interest rates have to stay near-zero or the system implodes. Now that debt has ballooned to insane levels, there’s no way to service the debt except at near-zero rates of interest which means Treasury yields also have to be near-zero.

Now that this is the consensus, I wonder: what if rates will continue rising anyway? What would it take for the 40-year bull market in bonds–i.e. 40 years of declining yields/interest rates–to reverse into a Bear market for bonds, i.e. yields/interest rates steadily marching higher?

What if entire mountains of debt are extinguished, effectively reducing the supply of “money”? If capital becomes scarce, then perhaps there will be a premium charged to borrow it.

Geopolitically, one way to reduce the burden of higher commodity prices is to increase the value of the nation’s “money” by inducing demand while limiting supply. One way to induce demand is to treat capital fairly and transparently.

What if all the new consensus memes are as wrong as the ones they replaced? I told you it’s a curse.

Tags: Featured,newsletter