Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever. Here’s the default Bullish case for stocks and the economy: let’s call it Plan Zero. 1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy) 2. Higher energy costs have near-zero effect on the economy and stocks. 3. The Federal Reserve will deliver a soft landing which reduces inflation back to near-zero while the economy and stocks continue lofting higher. 4. Higher food costs and global food scarcities have near-zero effect on the economy and stocks. 5. Supply chains unraveling has near-zero effect on the economy and stocks. 6. Deglobalization has near-zero effect on the economy and stocks. 7.

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy)

2. Higher energy costs have near-zero effect on the economy and stocks.

3. The Federal Reserve will deliver a soft landing which reduces inflation back to near-zero while the economy and stocks continue lofting higher.

4. Higher food costs and global food scarcities have near-zero effect on the economy and stocks.

5. Supply chains unraveling has near-zero effect on the economy and stocks.

6. Deglobalization has near-zero effect on the economy and stocks.

7. Higher interest rates have near-zero effect on housing, the economy and stocks.

8. The continual evolution of more contagious variants of Covid-19 has near-zero effect on the economy and stocks.

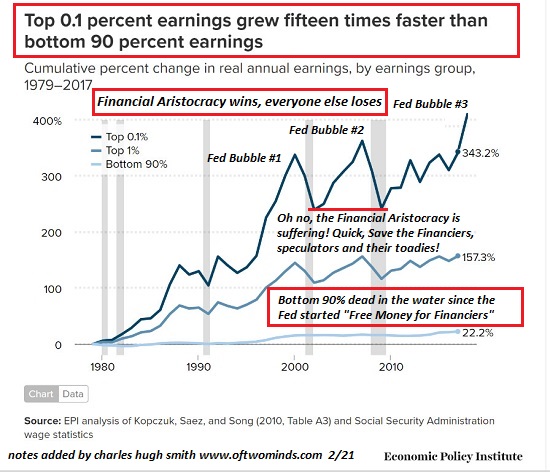

9. There are no speculative bubbles in housing, stocks or other assets.

10. Even if a speculative bubble in stocks did arise (gasp!), it will never pop because a) the Fed b) sentiment is bearish so stocks can only go higher c) stock buybacks will continue expanding forever d) the yen-quatloo pair’s correlation with bat guano futures is signaling more bullish upside e) Golden Sax issued a buy recommendation, etc. etc. etc.

We hope you enjoyed your ride through FantasyLand. As you exit the ride, please watch your step returning to reality, where extremes unravel extremely energetically and magical thinking fails to actually change the real world.

Back in the real world, it behooves us to have a Plan A, Plan B and Plan C. I have often suggested a simple formula for methodically planning a range of responses ahead of time so we’re ready when and if our circumstances change: Plans A, B and C.

Back in the real world, it behooves us to have a Plan A, Plan B and Plan C. I have often suggested a simple formula for methodically planning a range of responses ahead of time so we’re ready when and if our circumstances change: Plans A, B and C.

Plan A is our response should our circumstances change while the socio-economic system remains pretty much the same. An example might be unexpectedly losing your job due to a sudden downturn and being unable to find a replacement job in the same field at the same wage.

Plan B is our response should our circumstances change while the socio-economic system is unraveling. An example might be we no longer feel safe in our neighborhood due to rising crime and a dysfunctional, bankrupt local government.

Plan C is our response should the socio-economic system completely break down. An example might be supply chains fail and gas stations no longer have fuel and grocery store shelves are empty.

No matter how unlikely a breakdown might be, the consequences are so dire that it’s prudent to prepare a response. Making a plan ahead of time requires no money and only a modest amount of effort. Trying to figure out what to do in a chaotic crisis rarely leads to good results.

Common sense suggests preparing a plan that avoids adversity as much as possible rather than going to ground until adversity has reached maximum disruptive force and then waiting passively for others’ decisions to impact you.

Another benefit of preparing Plans A, B and C is that we may conclude that there is much to be gained by taking action before a crisis rather than waiting until the crisis washes ashore. By then, our options will have significantly narrowed.

For example, trying to leave a city when everyone else is trying to leave will only trap us in gridlock. Our planning should be designed to get us out of the city a week, month or even a year before the crisis arrives.

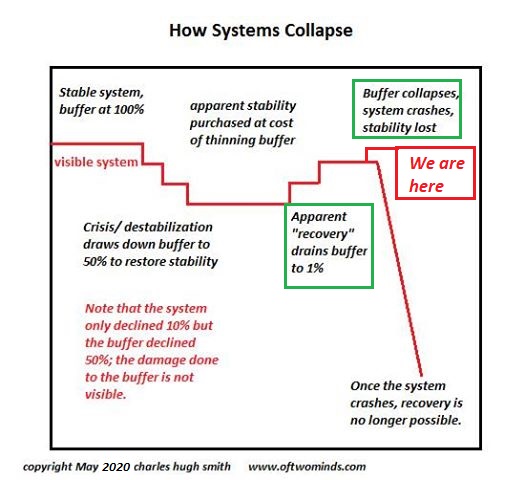

Extremes unravel unpredictably and unevenly. Some locales will remain relatively stable while others decay and others break down. Some forms of wealth may gain value while others lose value. Things we assume will always be available may become unavailable.

Living and working in a productive community that values our contributions offers advantages that cannot be matched by isolated islands of wealth which make attractive targets.

Just as money is no substitute for personal integrity, money is no substitute for people who value us for our contributions, however modest, and our willingness to share and add value however we can.

If we look at communities where people are active and productive into old age, we find life revolves around the fundamentals of human existence: growing food, raising animals, caring for children, sharing home-cooked meals and working together on common interests. This is a good life.

Much of what we’re told is essential for a good life is just relentlessly marketed consumerist excess. The limited value of these excesses will be revealed as scarcities and instability show us what’s truly valuable.

As the economy transforms from a waste is growth Landfill Economy dependent on cheap resources and credit to a degrowth economy of improved efficiency and reduced consumption, there will be many opportunities for those whose work provides truly sustainable sources of energy and other essentials by improving productivity, efficiency, recycling and durability.

Let’s recap: Plan Zero depends on speculative bubbles never popping and extremes only becoming ever more extreme, basically forever. The true believers in this fantasy also believe that their phantom wealth will protect them from anything bad happening. The Plan C view is that depending on phantom wealth to protect them from anything bad happening more or less guarantees something bad happening.

You may only get one chance to activate a plan, so choose wisely. Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever.

There’s much to be said for being a valued contributor in a productive, low-consumption, tightly-knit community: The Art of Survival, Taoism and the Warring States (June 27, 2008).

Tags: Featured,newsletter