How much gold will you trade for a few eggs? It depends on how hungry you are. Two ideas will help us understand the rest of this tumultuous decade: core-periphery and the revaluation of what’s truly important: systemic adaptability, transparency, accountability, risk, capital and resources. I recently discussed the core-periphery model in a blog post, Crash Is King: “Crashes reveal what’s core and what’s periphery because the core controls the destiny of the...

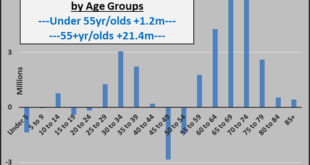

Read More »Why the Labor Shortage Isn’t Going Away

It’s getting hard to fill toxic low-pay jobs, and that’s not going to change. The nature of work and the labor market are changing in ways few discern or perhaps are willing to discern because these changes are disrupting the exploitive system they want to remain unchanged. But refusing to discern change doesn’t stop change. It just leaves us unprepared to deal with fast-changing realities. There are multiple systemic reasons why work and the labor force are...

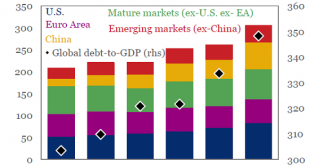

Read More »The Real Policy Error Is Expanding Debt and Calling It “Growth”

Waste is not growth, and neither are the unlimited expansion of debt and speculative bubbles. The financial punditry is whipping itself into a frenzy about a Federal Reserve “policy error,” which is code for “if the music finally stops, we’re doomed!” In other words, any policy which reduces the flow of juice sluicing through the sewage pipes of the financial system (credit, leverage and liquidity–the essential mechanisms of financialization and globalization)...

Read More »The Only Real Solution Is Default

The destruction of ‘phantom wealth’ via default has always been the only way to clear the financial system of unpayable debt burdens and extremes of rentier / wealth dominance. The notion that the world could always borrow more money as long as interest rates were near-zero was never sustainable. It was always an unsustainable artifice that we could keep borrowing ever larger sums from the future as long as the interest payments kept dropping. The only real solution...

Read More »US Dollar Strength: “Unintended Consequences” Or “The Empire Strikes Back”?

How unintended can these consequences be? My guess: not very. A great many people got the U.S. dollar trade wrong. The conventional view held that “printing money”, i.e. expanding the supply of money, would automatically devalue the currency. It isn’t quite so simple, it seems. It depends on where the newly issued money ends up, whether the economy is expanding along with the money supply, the relative perception of the currency’s stability / safety, the returns...

Read More »Calm Before the Tempest?

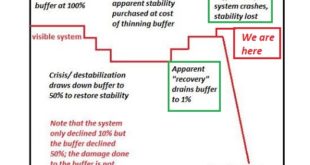

Is it beyond conception that the core actually strengthens for a length of time before the unraveling reaches it? Let’s start by stipulating the obvious: no one knows the future, and most of the guesses–oops, I mean forecasts–will be wrong. Arguing about the forecasts now won’t make any difference as to which ones are correct and which ones are wrong. Time alone will tell. That said, here’s a scenario that fits the dynamics I see as most consequential: Core-Periphery...

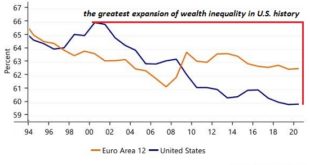

Read More »Why Nations Fail

The irony is that the suppression of dissent is the suppression of competing ideas that generate systemic stability via rapid adaptation. Nations that appear stable may fail once they’re under pressure.What do I mean by “under pressure”? Pressure can come from many sources: invasion, civil war, prolonged scarcities of essentials, natural disasters, financial crises, droughts, pandemics and social disorder triggered by inequality and corruption. Pressure diminishes...

Read More »You Know What Would Be Really Irritating? A Crazy Rally to New Highs

It would be very irritating to have a rally suck in all the bears salivating for a crash from a bear-market rally peak and then decimate the shorts with a rally that soars rather than collapses to new lows. As a contrarian, I’m always squinting at the consensus and wondering if it is really that easy to be right.Now that everyone is bearish for reasons we all know–global recession, a hot war, energy scarcities and stagflation– I’m thinking, you know what would be...

Read More »The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or “global markets,” maximizing greed / corporate profits. Sorry about the clickbait title. We all know there isn’t “one solution” to anything as complex as a socio-economic-cultural-political system. But this is based on looking at all the problems from one very shaky perspective: that the foundations of any solutions are rock-solid and all we need to do is...

Read More »The Most Valuable Form of Money Nobody’s Seen–Yet

What is “money”? “Money” is a claim on the essentials of life. Ration cards are claims on essentials. Many people expect “money” will soon be tied to commodities. Agreed. It’s called a ration cardthat grants the holder the right to buy a specific quantity of essential goods at a specified price. This right is a form of “money” directly tied to the value of commodities. Ration cards are the only fair way to distribute essentials in times of chronic scarcity. Markets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org