It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever. Economists and experts have long argued that technological advances drive U.S. economic...

Read More »Risks Facing Bullish Investors As September Begins

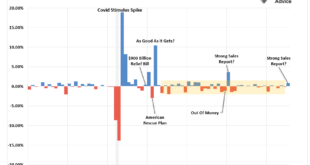

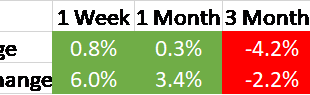

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story. It is true that “a rising tide lifts all boats,” meaning that as the market rises, investors begin to chase higher stock prices, leading to a virtual buying spiral. Such leads to an improvement in...

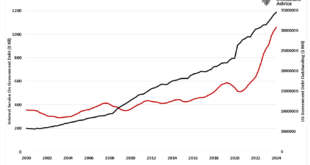

Read More »Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically. Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to fund itself, given...

Read More »Red Flags In The Latest Retail Sales Report

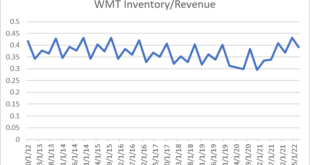

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and auto loans suggest...

Read More »Dollar Mixed as Markets Digest US Political Developments

Overview: News that President Biden will not seek re-election has left investors unsure of the next step, but PredictIt.org still points to a Trump advantage of slightly better than 60-40. It is not clear yet whether Vice-President Harris will be challenged for the nomination. The dollar is mixed against the G10 currencies, with the dollar bloc and Norway weaker. The yen is up around 0.45% to lead the others higher. The Swiss franc, euro and sterling are slightly...

Read More »Macro: GDP Q3 — Inflationary BOOM!

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years. It was the best real growth quarter since Q2 and Q3 of 2014. The last 12 months has been mostly about services, here are the biggest contributors to YoY GDP: Consumption of Services Consumption of Goods Lower imports Government Non-residential investment in structures Intellectual property Q2 to Q3, we saw an acceleration in goods...

Read More »Markets Becalmed Ahead of Key Data and BOJ Meeting Outcome

Overview: Some regional bank earnings were weighing on investor sentiment but reports that the FDIC is running out of patience with First Republic Bank to strike a private deal and could decide to downgrade its assessment. This could lead to limits on its ability to use the Fed's emergency facilities. Other reports said that the bank's advisers are securing commitments to buy a new stock as part of a broader restructuring. Still, while the KBW bank index of large...

Read More »Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS...

Read More »Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

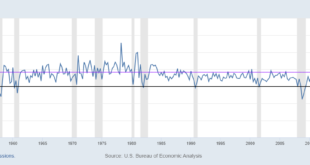

Read More »Goldilocks Calling

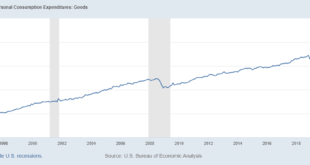

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org