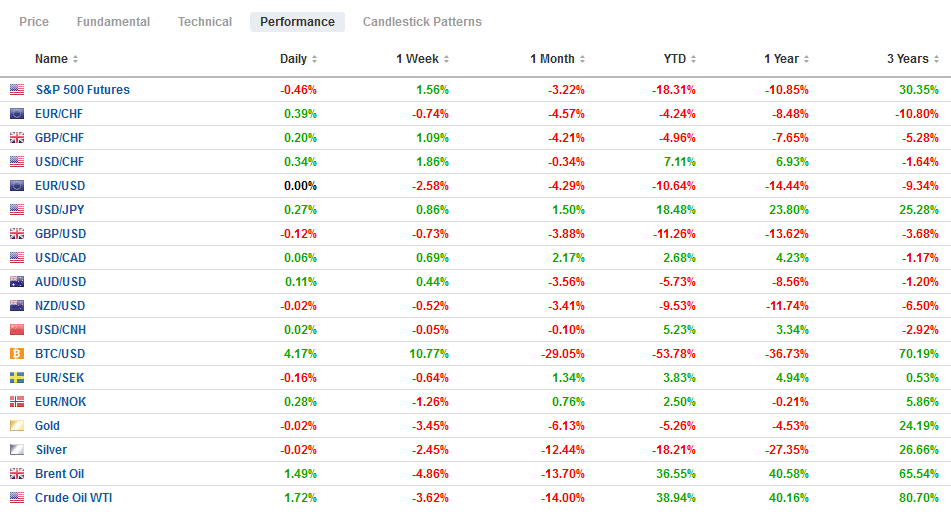

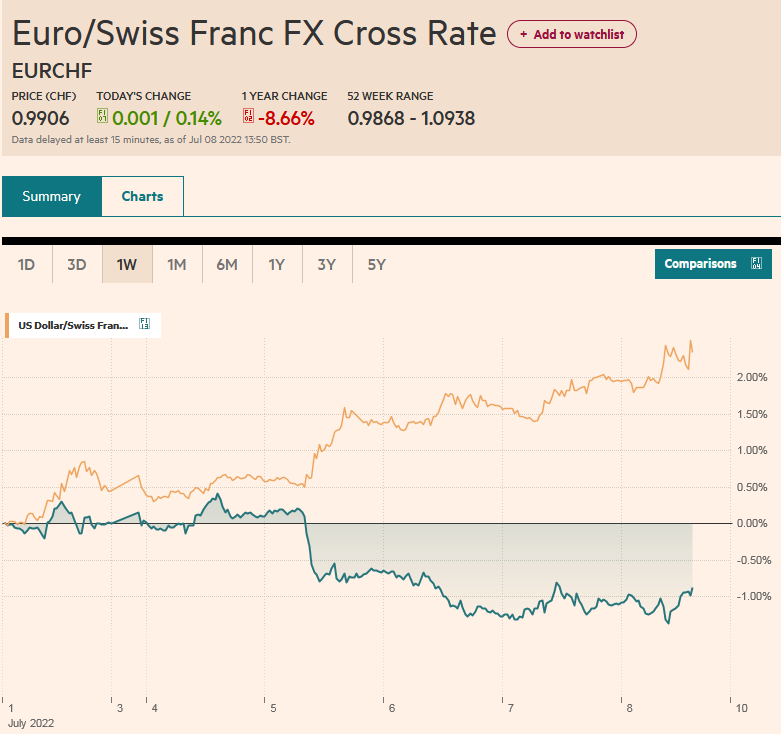

Swiss Franc The Euro has risen by 0.14% to 0.9906 CHF. EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Overview: News that former Prime Minister Abe was assassinated while campaigning in Japan ahead of the weekend election shocked the nation and world. The immediate market impact looks minimal. Asia Pacific equities mostly advanced. Chinese stocks were the main exception and generally underperformed the other large regional markets this week. After rising by about 3.5% over the past two sessions, Europe’s Stoxx 600 is off by around 0.3% near midday in Europe. US futures are also softer ahead of the jobs report. Bonds are firm, with the US 10-year yield almost two basis points lower (~2.98%), while

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Canada, China, EUR/CHF, Euro, Featured, Federal Reserve, Japan, jobs, newsletter, U.K., USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.14% to 0.9906 CHF. |

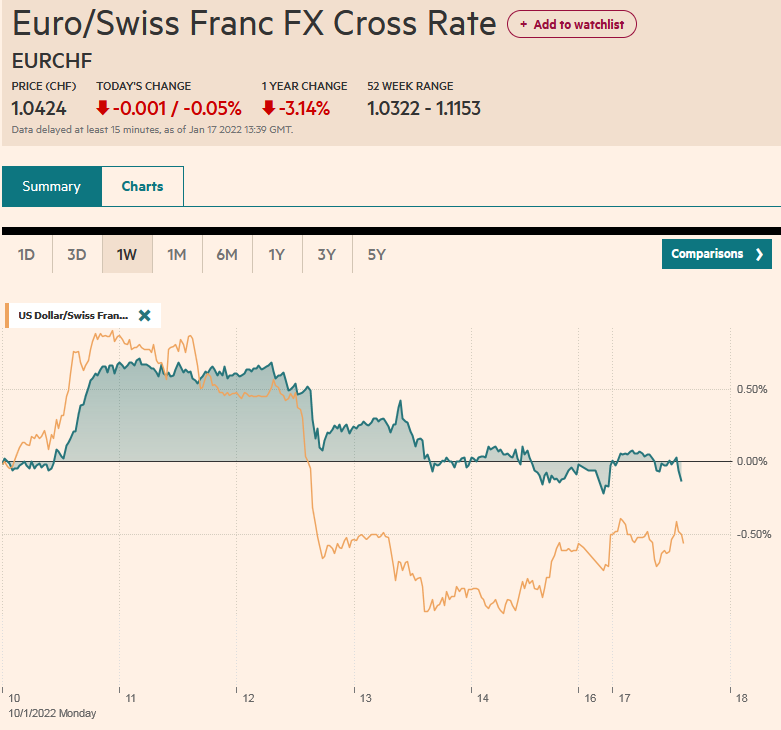

EUR/CHF and USD/CHF, July 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

| Overview: News that former Prime Minister Abe was assassinated while campaigning in Japan ahead of the weekend election shocked the nation and world. The immediate market impact looks minimal. Asia Pacific equities mostly advanced. Chinese stocks were the main exception and generally underperformed the other large regional markets this week. After rising by about 3.5% over the past two sessions, Europe’s Stoxx 600 is off by around 0.3% near midday in Europe. US futures are also softer ahead of the jobs report. Bonds are firm, with the US 10-year yield almost two basis points lower (~2.98%), while Europe’s benchmark yields are 5-7 bp lower. The US dollar is firm against all the majors but is straddling unchanged levels against the Japanese yen. Emerging market currencies are also mostly lower, led by central Europe and the South African rand. Gold is consolidating near its lows, having fallen by more than 4% this week, its fourth consecutive weekly drop and the most in a year. After closing below $100 a barrel on Tuesday and Wednesday, August WTI rebounded to almost $104.50 yesterday and is consolidating in a narrow range between $101.50 and $103.80 today. US natgas is off 2% to pare this week’s gain to about 7.4%, to recoup last week’s decline. Europe’s benchmark is off 4.7% but still up over 20% on the week. Iron ore is a little heavy and is off about 1.5% this week. September copper is off nearly 2.2% to give back nearly half of yesterday’s gain. It is off 3% this week, the fifth weekly loss, and off nearly a quarter over this stretch. September wheat snapped a five-day drop yesterday, rising by about 4.0% and is up another 2.5% today. |

FX Daily Rates, July 8 |

Asia Pacific

Japan’s economic data pales in importance to the murder of Abe. The chief take away is that household spending was considerably weaker than expected in May, falling 1.9% month-over-month, and suggesting the recovery in Q2 (from -0.5% annualized contraction in Q1) is lackluster. More aid to households, such as extending the fuel subsidy and perhaps introducing a new program for wheat, may be introduced after the election. Separately, Japan reported a smaller than expected current account surplus as the trade deficit on the balance-of-payments basis nearly tripled to JPY1.95 trillion amid rising import prices. The report also showed that Japanese investors continue to liquidate foreign bond holdings. It owns mostly US Treasuries and it sold them for the seventh consecutive month (~$2.4 bln). Japanese investors sold amount of Canadian bonds. They sold the most Australian bonds since last June and the most German Bunds since last July. Small amounts of UK and Danish bonds were bought.

Japan holds elections for the upper house on Sunday. It is usually not said in polite circles, but Japan remains a one-party state under the LDP for all practical purposes. Its preference to rule with a coalition partner (Komeito) for the past decade does not really change the fact. The coalition is expected to keep its majority in the upper house. After the election, we expected Prime Minister Kishida will be strong enough to push for more defense spending and facilitate greater reliance on nuclear power.

Sometimes it helps to reason backward. We begin with the idea that ahead of the 20th People’s Congress later this year in China, which is expected to see Xi coronated for a third term, ideally, the economy would not threaten to tarnish the moment. To that end, we have expected that Beijing will take more stimulative measures. However, monetary policy is not the lever of choice and may be too blunt of an instrument for economic planners. Reportedly under consideration is to permit local governments to begin tapping into next year’s debt quota. The idea is to allow the issuance of as much as CNY1.5 trillion (~$220 bln) of special bonds in H2 22 to accelerate infrastructure projects. Separately, CNY1.1 trillion of new infrastructure support was announced at the of beginning last month. China reports CPI and PPI figures over the weekend and Q2 GDP next week (July 14). A contraction is widely expected and sufficient to offset the 1.3% expansion recorded in Q1.

The dollar again found support near the 20-day moving average against the Japanese yen, found near JPY135.35 today. It has not closed below it since the end of May. The week’s low is around JPY134.80. Japanese officials have complained about the volatility and benchmark three-month implied vol settled below 12% yesterday for the first time in nearly a month. It peaked near 14% in the middle of June after settling May a little above 9%. The Australian dollar extended yesterday’s gains to reach $0.6860 earlier today, before drawing in sellers who drove it back toward $0.6800. A move above $0.6900, this week’s high and the 20-day moving average to improve the technical tone. The Chinese yuan is broadly steady. The greenback remains in Tuesday’s range (~CNY6.6845-CNY6.7235 range). Three-month implied yield has eased to almost 5%, its lowest level since late April. The PBOC set the dollar’s reference rate at CNY6.7098 today, slightly firmer than the CNY6.7093 expected by the median projection in Bloomberg’s survey.

Europe

The euro is struggling to sustain even the most modest of upticks. It is off about 2.9% this week, the most since March and the second-largest weekly loss since March 2020. We see it being dragged lower by three considerations. First, on the interest rate channel, the US premium over Germany, which recorded a four-month low in mid-June, slightly below 2.0%, jumped to a new three-year high this week of almost 265 bp. In part, this reflects the more aggressive path of the Fed vs. ECB. Second, the idea of a robust anti-fragmentation tool seemed to have helped keep the euro bears at bay. The Bundesbank president cast aspersions over the talk. The record of last month’s ECB meeting also showed the hawks had moved into ascendancy in the face of soaring inflation. Third, the eurozone is experiencing an energy shock of historic proportions. Even the end Norwegian strike failed to remove the pressure on European natural gas prices. The Dutch benchmark rose by more than 20% this week, its fourth weekly advance, and over this run, it has surged from 82.85 euros to 177 euros currently. The surge in energy prices strengthens both element of stagflation.

The high drama of UK politics reached a tipping point this week. Prime Minister Johnson resigned but hoped to stay on through the Conservative Party conference in October. However, this is unrealistic and more of Johnson’s preference. Instead, the party officials want to reduce the time and have the field down to two candidates by July 21 when Parliament’s summer recess begins. However, it would still not be until September before a new Tory Prime Minister is in place. Given the state of foreign affairs and the domestic economy, it seems an awkward time to have the vacuum of leadership. There still may be an attempt to have an acting premier.

The euro drew closer to parity, slipping below $1.0075 in late Asian turnover. It steadied a touch in the European morning but has been unable move above $1.0120. Recall, yesterday’s low was $1.0150. The single currency settled last week near $1.0415. It is off for the fourth consecutive session and the fifth week in the past six. Three-month implied volatility reached 11% this week, its highest since March 2020, and is near 10.5% now. Thus far, official comments about the exchange rate are notable for their absence. Sterling has mostly shrugged off the local political drama. It rose to a three-day high today near $1.2055 before sellers reemerged and pushed it to new session lows by $1.1920. The euro fell by about 1% against sterling yesterday. and edged lower today to briefly trade below the 200-day moving average (~GBP0.8445) before finding a bid that lifted it to almost $0.8480 where it was greeted by fresh sellers. Its roughly 1.8% decline this week, if sustained, will be one of the largest weekly losses for cross since March 2020.

America

In the monthly cycle of high-frequency US economic releases, the monthly jobs report has typically held a special place. In Volcker’s day, the money supply figures were tracked closely and released while markets were open. Later, the trade figures were the focus. With an advanced merchandise report, the trade balance has lost its sting. The labor market and the nonfarm payroll report had moved to top billing. However, with the Fed’s hawkish pivot, the CPI, though the central bank targets the headline PCE deflator, and inflation expectations, both explicitly cited by Fed Chair Powell, have become the most salient. Moreover, the Fed seems more determined to get inflation back toward its target even if it means deterioration of the labor market and possibly a recession. The recent FOMC minutes, according to some calculations, cited “inflation” around 90 times but did not mention recession at all. By definition, surprises often come from where one is not looking.

The June jobs report poses headline risk but is unlikely to alter the market views on the trajectory of Fed policy. In the middle of next week, the US reports the June CPI, and it is likely to have accelerated and moved closer to 9.0% from 8.6% in May, even though the core rate is expected to have slowed for the third consecutive month. The Fed funds futures imply almost an 85% chance of a 75 bp hike later this month. The median forecast for nonfarm payrolls has slipped a bit in recent days to stand at 265k. If accurate, it would be the lowest since April 2021. So what? From the Fed’s vantage point, the labor market is still strong (Powell has said “too strong”). If the median estimate is correct, leaving aside revisions, the six-month average would be about 450k, which is a robust number even if less than the 536k average in H1 21. Consider that it means that the US would have created more jobs in H1 22 (~2.7 mln) than in all of 2019 (~1.97 mln).

The unemployment rate is in its trough of 3.6%. It has been steady there since the March report. Sahm’s rule (heuristic device) says that when the three-month average of unemployment rises 0.5% above the 12-month low, the US is either in a recession or soon to be in one. The weekly jobless and continuing claims and the PMI and ISM show some weakening of the labor market, but the JOLTS report, which Powell has also cited, surprised on the upside. The idea that higher wages would draw people back into the labor force might be happening but at glacial speeds. The participation rate is expected to tick up to 62.4%, last seen in March. On the eve of the pandemic, it was at 63.3%, never having fully recovered to the pre-financial crisis levels of 66%. And wage growth appears to have crested. Consistent with core CPI and core PCE turning lower, we note that the year-over-year pace of average hourly earnings is also expected to slow for the third consecutive month. Lastly, the Fed’s leading hawks, St. Louis President Bullard and Governor Waller talk a good game but their views, a 75 bp hike this month, 50 bp in September and a year-end rate around 3.5% is already fully reflected in the Fed funds futures strip.

Canada also reports June jobs data today. Canada created 135.4k full-time positions in May, which is unlikely to have been repeated last month. An average of 47k full-time jobs have been created this year. Depending on which measure one uses, Canada is around 10%-11% the size of the US. Canada’s participation rate stood at 65.3% in May. It was 65.5% on the eve of the pandemic. The Bank of Canada meets next week (July 13), and a 75 bp hike is nearly fully discounted in the swaps market. Only four of the 16 forecasts in the Bloomberg survey have been updated since mid-June. Three look for a 75 bp, and one expects a half-point move.

The US dollar rallied Monday from around CAD1.2840 to about CAD1.3085 on Tuesday a marginal new high for the year. With the pullback yesterday and earlier today, it saw half of the gains pared (~CAD1.2960). It has bounced back toward CAD1.3025. The recent price action looks corrective (flag or pennant) and warns of the risk of another attempt higher. The next interesting chart area is in the CAD1.3180-CAD1.3200 area. That said a break of CAD1.2900-CAD1.2930 would negate bullish technical tone for the greenback. The price action still looks constructive, and the greenback could retest the four-month high set in the middle of the week near MXN20.7860. A break, and ideally a close below MXN20.4285 would weaken the dollar’s technical tone going into next week. Coming into today, the Brazilian real is the best performing Latam currency this week, off about 0.2%. The Colombian peso is the worst, off 4.5%.

Tags: #USD,Canada,China,EUR/CHF,Euro,Featured,federal-reserve,Japan,jobs,newsletter,U.K.,USD/CHF