If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source. And the timing is equally as festive; holidays in America and Europe soon to be followed by a big one in China. To begin, the real big stuff; as we know, another RRR cut came in close succession to the eurodollar futures inversion at the beginning of December. . Those being related, as to the former the PBOC balance sheet update for

Topics:

Jeffrey P. Snider considers the following as important: $CNY, 5.) Alhambra Investments, balance sheet, bonds, China, currencies, Deflation, deflation potential, Dollar, economy, EuroDollar, eurodollar futures, Featured, Federal Reserve/Monetary Policy, inflation, Markets, newsletter, PBOC, Yield Curve, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source.

And the timing is equally as festive; holidays in America and Europe soon to be followed by a big one in China. To begin, the real big stuff; as we know, another RRR cut came in close succession to the eurodollar futures inversion at the beginning of December. |

|

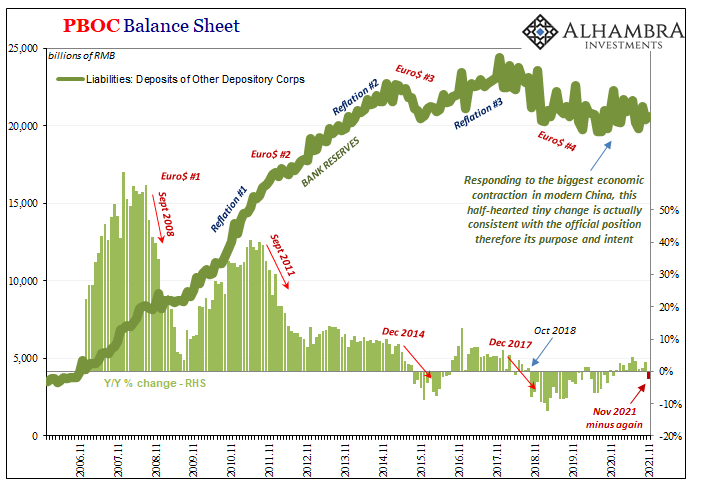

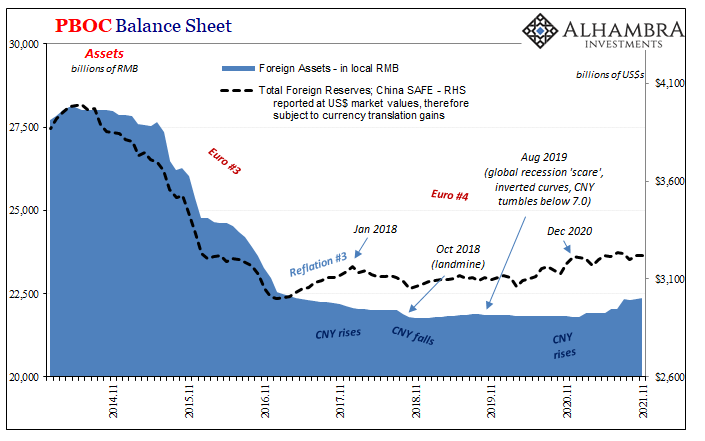

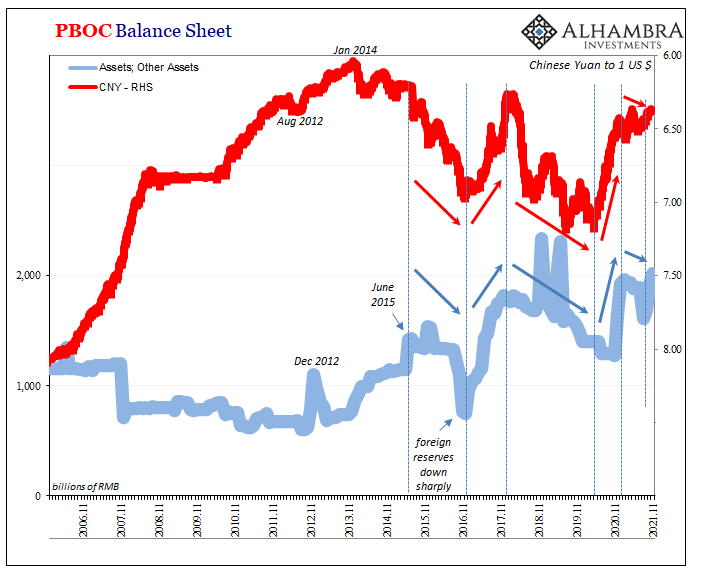

| Those being related, as to the former the PBOC balance sheet update for November 2021 describes the basis for the reserve change.

Total bank reserves fell on a year-over-year basis last month, thus the desire from authorities for China’s banking system to be able to “unlock” more of their bank reserves given overall bank reserves (set by monetary policy) are on the decline once more. Compared to November 2020, total reserves were 2.2% less in November 2021. |

|

| And all this during the Evergrande/property sector setback!

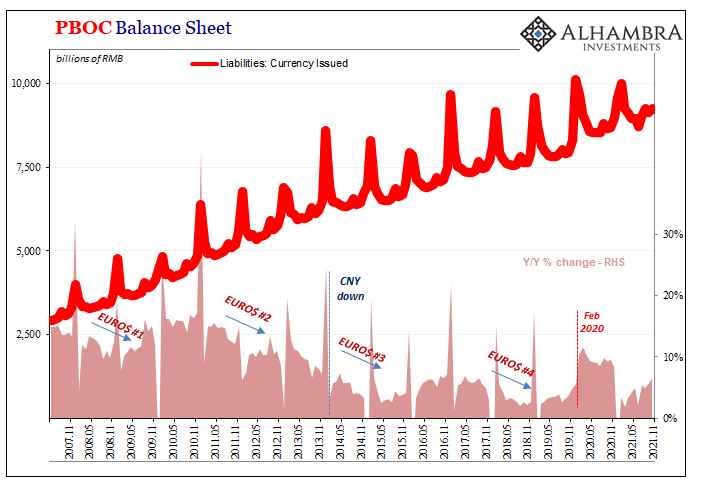

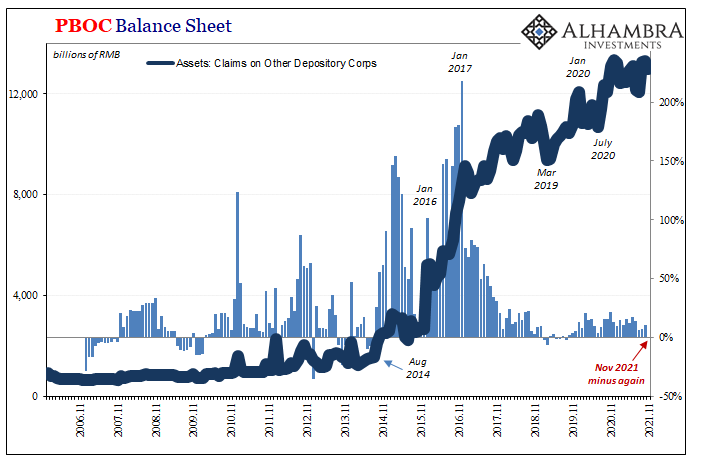

Thus, by word and now deed, the Chinese Communists are unequivocally showing you what they think about lower growth prospects; they are, in fact, taking away even more official support as uncertainty and outright problems grow larger, meaning that officials are clearly intent on China’s economy going forward without the same level of real estate and property boost as had been gained since 2009’s grand Keynesian introduction. The level of central bank balance sheet space for bank reserves and currency issued (which continues to grow at a slow pace; above) is carved out mostly by foreign assets but also through monetary policy programs such as the PBOC’s MLF facility (below). Like bank reserves on the money side, the same policy intent is spelled out here in the assets: Claims on Depository Corporations also declined (year-over-year) in November. |

|

| Despite Evergrande’s spreading woes, authorities are actively choking off liquidity aid to any and all internal financial institutions via this main domestic RMB channel in favor of, again, only the RRR method which historically has been underwhelming – to put it kindly.

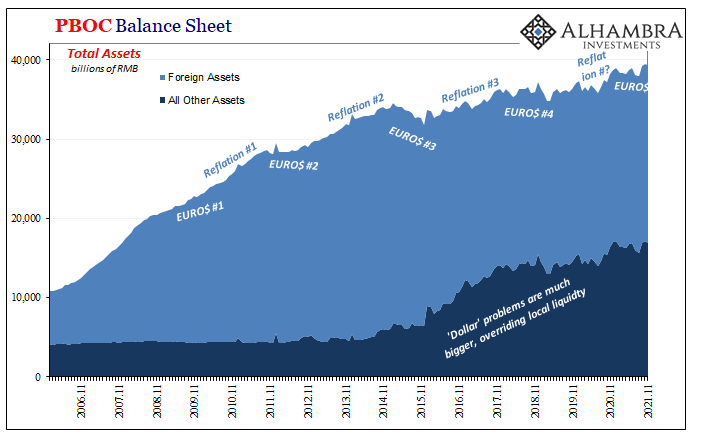

To the Evergrandes of China, the government has said: you’re on your own. You begin to see why global markets have traded more and more on edge, tilting deflationary given both these developments as well as the more global situation responsible for them. What the Chinese have left is what continues to be absent from the overall monetary therefore economic picture; still no foreign assets. |

|

| Where are they? The only reason the PBOC had turned to programs like the MLF back in 2014 is simply because the (euro)dollars suddenly disappeared. | |

| Now, with the MLF appearing to be off the table, the internal RMB option rolled back by the central bank, with no apparent dollar inflows the whole official monetary equation is left without either channel (internal nor external) for official monetary expansion.

Foreign exchange balances are the tiniest bit higher, though practically unchanged rather than anything close to the “too much” money, flood of Jay Powell dollar liquidity everyone still talks about over here in the West. |

|

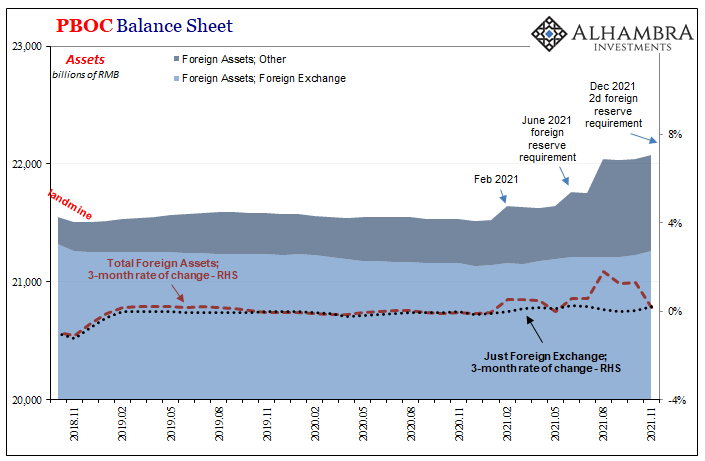

This has left the PBOC’s balance sheet exposed, which is, in my view, why Chinese authorities first demanded higher foreign exchange reserves from China’s banks beginning in June (with a detectible uptick beginning February; above). Unfortunately, because Economics has done such an awful job of educating the public and analysts alike, something like this change to foreign reserve requirements is confused for some kind of currency exchange value moderator.

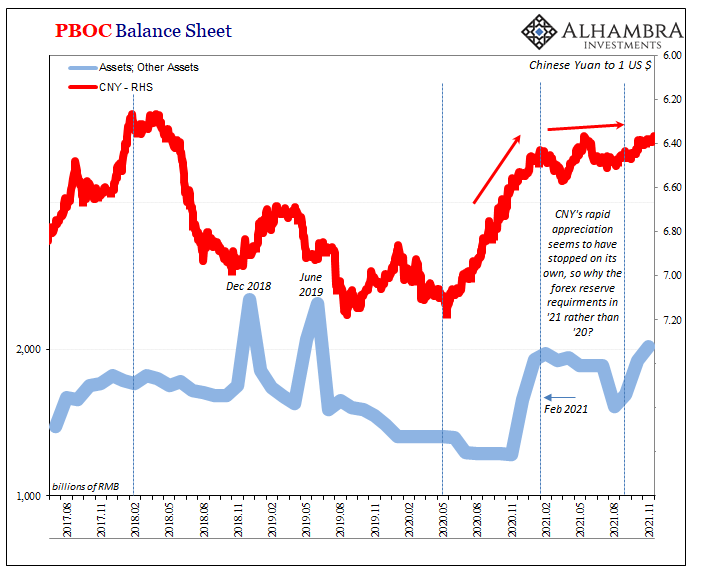

Analysts said the rise would force banks to freeze more of those dollars, slowing the yuan’s pace of appreciation by deterring dollar inflows in the longer term. Nowhere is it noted that the pace of yuan’s appreciation had abruptly changed already in February (below). And now, mandated at the same time as the RRR cut earlier this month, China’s authorities added another increase to foreign reserve requirements begun last week. Why? According to “widely believed” mainstream sources, the same “rapid appreciation” as June:

Huh? CNY’s rapid appreciation was 2020, not 2021, and last year no one was in any hurry to stop it let alone introduce these reserve requirements. Maybe instead the Chinese are more concerned about the persistent lack of dollar inflows (to the point they’ve clearly had to hide it), and in lieu of the dollar inflows to its balance sheet which really should have happened long before now, those authorities are attempting to “borrow” some of those unofficial reserves in anticipation of the same thing which has led them to already cut the RRR also twice this year. |

|

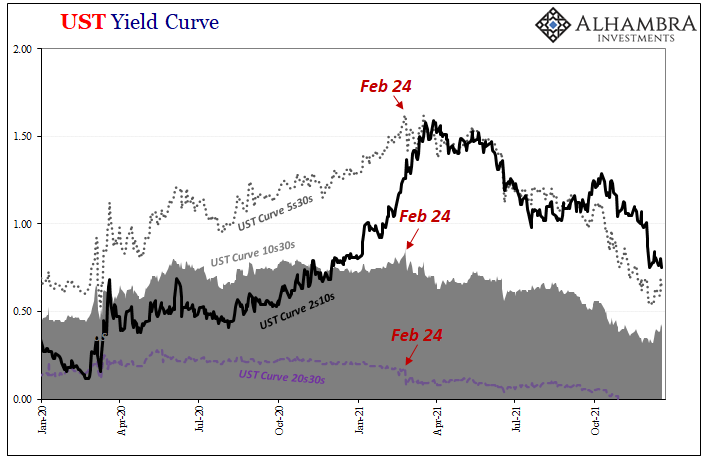

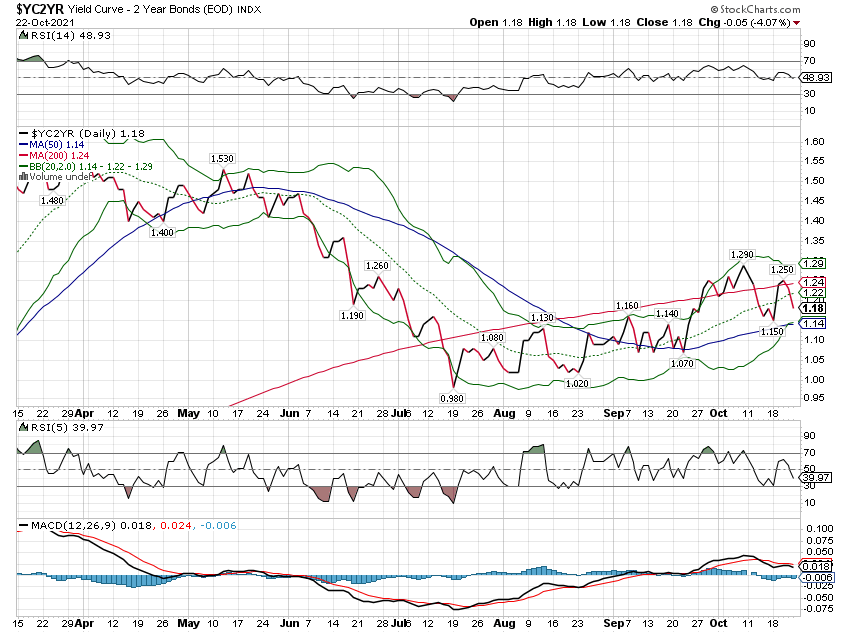

| And that thing would be the same what’s weighing on the eurodollar futures market along with the longer ends of the US Treasury yield curve especially since all these things date back to around the exact same time.

Deflationary money potential. Those foreign exchange reserve requirements end up flowing onto the PBOC’s balance sheet in the form of Other Foreign Assets; which, as noted before, have been rising since the same month the US Treasury yield curve’s long end began to flatten. But that’s not the only “other” to consider from PBOC line items. In addition to those Other Foreign Assets, China’s central bank also reports just plain Other Assets which bears a reasonable correlation to CNY’s movements, too (above and below). Just what’s going on here, that I’ll have to save for another day (and even then it’ll be speculative). What will have to suffice for now, the word which seems operative for Other Assets is: intervention. |

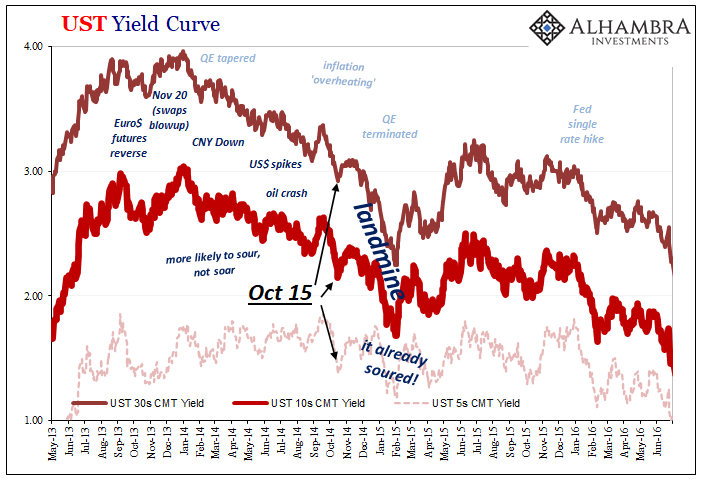

To sum up, I’ll reprint what I wrote in October 2018 just prior to Euro$ #4’s landmine. It could just as well have been written for today:

In other words, “stepped up support” for currency means reducing the reserve assets on the PBOC’s balance sheet (or, if you like, selling UST’s). Simple accounting requires either the PBOC to offset those losses with RMB program lending (which tends to be CNY negative), or to further shrink its liability side to match. Guess which one the central bank has chosen the past two years.

The RRR cut signals that the reserve problem therefore dollar problem is anticipated to grow worse. The PBOC is actually telling us that they expect in the months ahead the same or perhaps bigger commitment to “stepped up support.” CNY doesn’t need support if there is no worsening “capital outflow” situation of retreating eurodollar funding.

Even the line items we can’t completely undress are consistent with those past findings:

Asset side not growing; check.

Liability side, particularly bank reserves shrinking as a consequence; check.

RRR cuts to (fingers crossed) address the shrinking; you bet.

Signs officials are preparing for more possible eurodollar retreating; other and other.

Tags: $CNY,balance sheet,Bonds,China,currencies,Deflation,deflation potential,dollar,economy,EuroDollar,eurodollar futures,Featured,Federal Reserve/Monetary Policy,inflation,Markets,newsletter,PBOC,Yield Curve,yuan