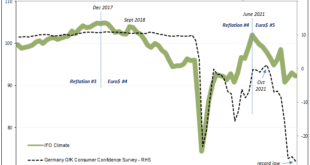

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation. From GfK back then: The growing consumer optimism signals that consumers here consider the German...

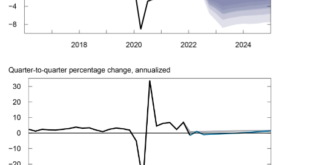

Read More »Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

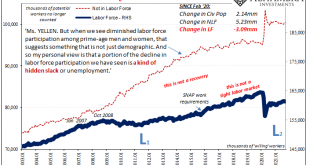

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament. From there, to try to get the...

Read More »Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4...

Read More »Consumer Prices And The Historical Pain(s)

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history. Then, suddenly, consumer prices skyrocketed and it left many Americans wondering if there would ever be an end to the massive volatility. At its peak in March 1947, the US CPI had gained 19.67%...

Read More »The Red Warning

Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried? There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right...

Read More »The Historical Monetary Chinese Checklist You Didn’t Know You Needed For Christmas (or the Chinese New Year)

If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source. And the timing is equally as festive;...

Read More »This Is A Big One (no, it’s not clickbait)

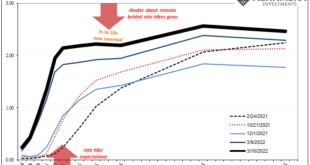

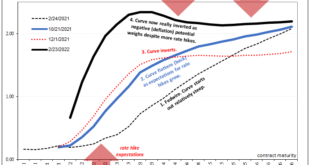

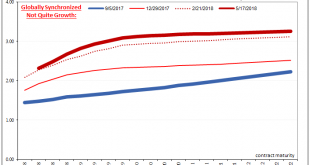

Stop me if you’ve heard this before: dollar up for reasons no one can explain; yield curve flattening dramatically resisting the BOND ROUT!!! everyone has said is inevitable; a very hawkish Fed increasingly certain about inflation risks; then, the eurodollar curve inverts which blasts Jay Powell’s dreamland in favor of the proper interpretation, deflation, of those first two. Twenty-eighteen, right? Yes. And also today. Quirky and kinky, it doesn’t seem like a lot,...

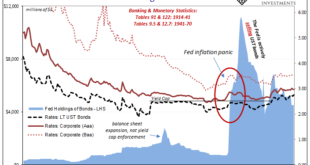

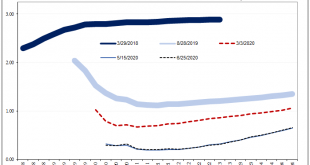

Read More »What Does Taper Look Like From The Inside? Not At All What You’d Think

Why always round numbers? Monetary policy targets in the post-Volcker era are changed on even terms. Alan Greenspan had his quarter-point fed funds moves. Ben Bernanke faced with crisis would auction $25 billion via TAF. QE’s are done in even numbers, either total purchases or their monthly pace. This is a messy and dynamic environment, in which the economy operates out of seeming randomness at times. Yet, here we have something that is “quantitatively” determined...

Read More »Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board. And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute. That’s the part which caused so...

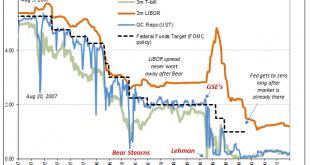

Read More »Banks Or (euro)Dollars? That Is The (only) Question

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes. Total financial resilience otherwise. Yesterday was,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org